Rul HEDGE

- Asesores Expertos

- Vladimir Khlystov

- Versión: 1.63

- Actualizado: 1 diciembre 2020

- Activaciones: 5

Description of strategy:

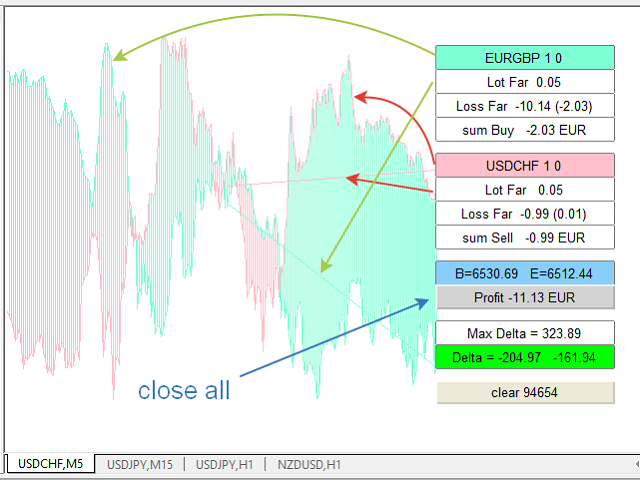

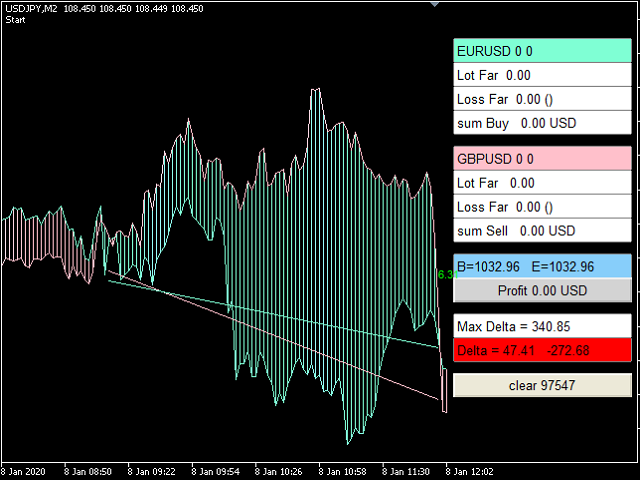

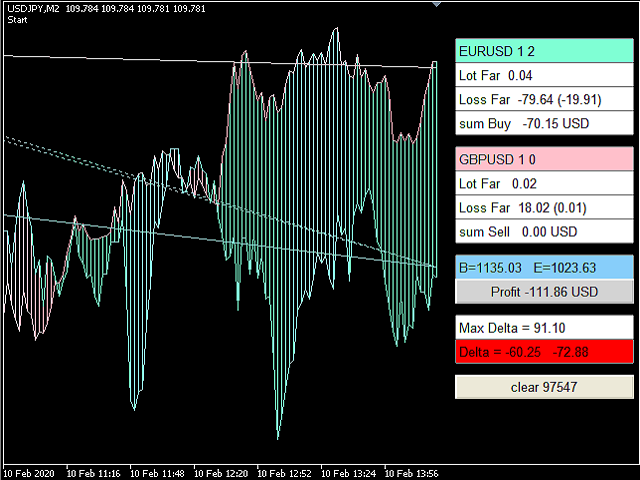

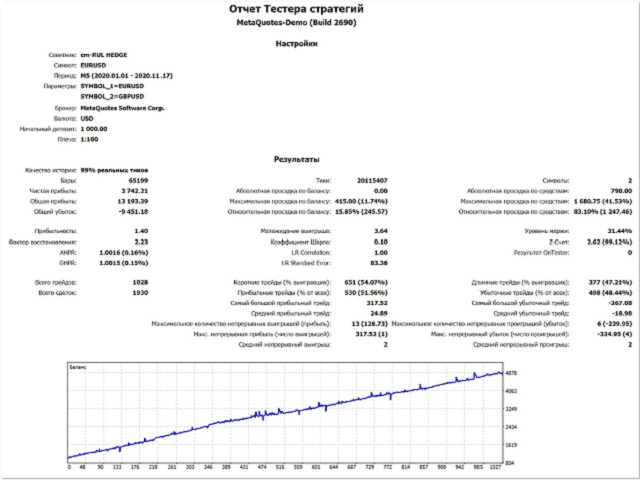

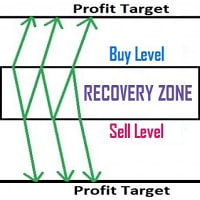

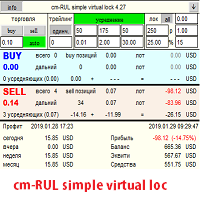

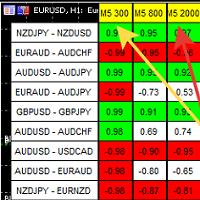

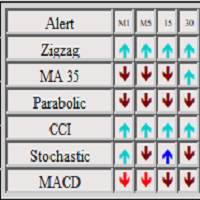

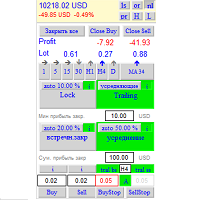

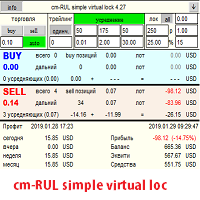

The EA trades on 2 pairs with a positive correlation. On one, he trades only for buying, on the second only for selling. If the position goes to a loss, the adviser begins to resolve it by opening deals much smaller in volume than the original one and biting off small pieces on price rollbacks. The opposite trade, which is in the black, will not be closed until the unprofitable one is resolved or until they reach the specified profit in total.

Clearing (averaging) trades are opened using a virtual trawl at a distance of LevelAverag from the current price and no closer than Step from the previous open position

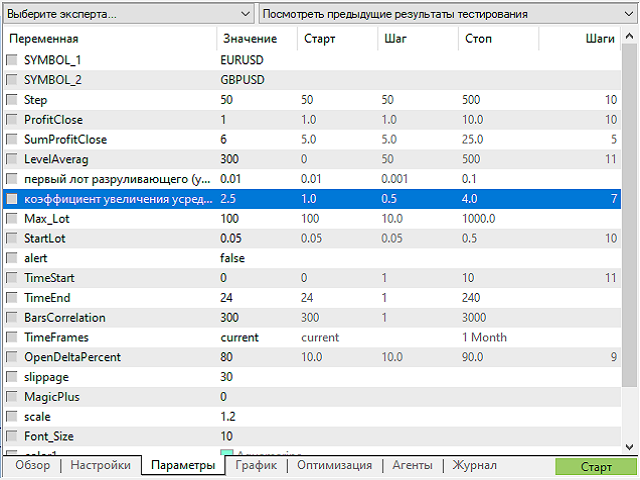

Parameters:

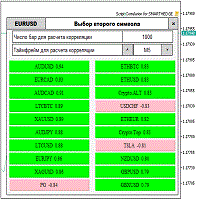

SYMBOL_1 = ” EURUSD”;

SYMBOL_2 = “GBPUSD”;

Step = 50; – minimum step between orders

ProfitClose = 1.00; – profit in the currency at which we bite off the averaging

SumProfitClose = 10.00; – profit in the currency at which we close everything

LevelAverag = 300; – distance to the clearing order in points

LotRUL = 0.01;/ / first lot of the clearing (averaging) order

K_Lot = 2.5;/ / increase coefficient of the averaging order

Max_Lot = 100.0;

StartLot = 0.05; – auto

trade lot time filter

TimeStart = 0,

TimeEnd = 24;

BarsCorrelation=300;

TimeFrames=0;

OpenDeltaPercent = 80; – percentage of the maximum Delta at which the first positions are opened

MagicPlus = 0; – addition to the calculated magic

scale = 1.2 ;- size of the information window

Font_Size = 10; – font size