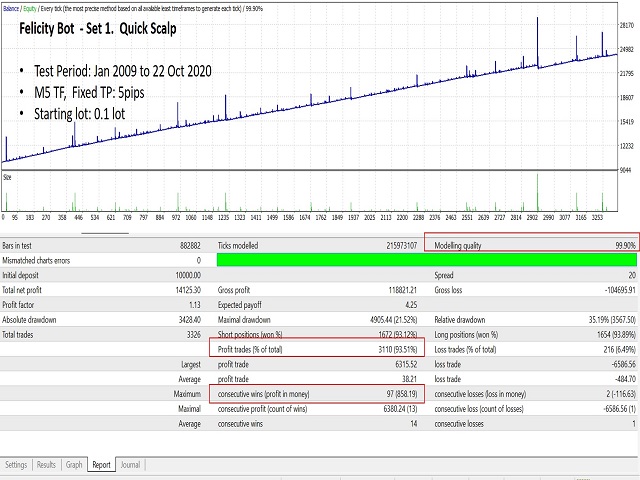

Felicity Bot

- Asesores Expertos

- Yeo Yew Boon Gary

- Versión: 1.43

- Actualizado: 27 octubre 2020

- Activaciones: 6

Felicity Bot is GBPUSD Specialist trading Robot that designed to work on the GBPUSD only. The basic strategy is based on pullbacks in the direction of trend from both the daily and chart entry timeframe. It is highly accurate with up to over 90% win-rates. The l10% times when it is wrong, the Expert Advisor (EA) will use an imbalanced hedging strategy to hedge its way out of loses.

This EA is one of the few gems in the market that survived 11years of in-and-out of sample of backtest. It is built with longevity as priority. This EA would help the trader to gain profits gradually over the long term, in the ever-changing market conditions.

The EA comes with 2 settings:

- Set 1 (GBPUSD /M5 timeframe)

Original strategy designed with the meaning of "Felicity" in mind: Instant Happiness. This setting for small but frequent wins. Produces over 90% of win-rates, average of 14 straight wins for every loses, over nearly 12 years of data.

- Set 2 (GBPUSD /M15 timeframe)

Similar to the original setting but uses one less option filter. This setting uses an “Adaptive TP” feature where the TP target, changes with the market conditions. It attempts to take more profits in a more volatile market and less, in a quieter market. This setting trade less frequent and have over 80% win-rates, average of 5 straight wins for every loses, over nearly 12 years of data.

- Minimum deposits: $1,000, Leverage 100. Need hedging account.

- Recommended Trading Size: 0.01 for every 1,000.

- The EA does not use averaging strategy, which looks good on backtests but rarely survive any sudden trend change and backtests over a longer period.

Set Files: download here

Disclaimer: Our strategies are created using in and out of sample testing, further supported by forward testing before being made available to public. Despite of our best efforts, simulated results might not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity or pandemic. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Please be aware of the potential risk from trading.