Deep Takeover Hedge

- Asesores Expertos

- Jeremy Scott

- Versión: 1.3

- Actualizado: 14 noviembre 2020

- Activaciones: 5

An adaptive and under fitted trading system like no other

- The best settings of one symbol also work on a majority of other symbols

- The majority of settings within the optimization parameters test well

Three versions for different types of accounts

- This version here is designed for MT5 hedge accounts

- The MT5 netting version is here: https://www.mql5.com/en/market/product/52725

- The MT4 FIFO version is here: https://www.mql5.com/en/market/product/52867

Check out all 3 versions for many more testing parameters!

The lot parameters are

- Lot size per trade

- X : the maximum number of trades allowed per position

The optimizable parameters F, P, A

You can try Fast Genetic Optimization perhaps with these [start, step, stop] values if you are determined for the absolute best testing set files per symbol on a time frame:

- F = [ 2 , 1 , 50 ]

- P = [ 2 , 1 , 1000]

- A = [ 2 , 1 , 200]

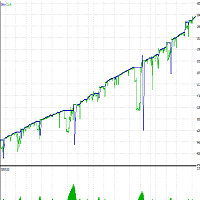

The first picture in the screenshots shows the best optimization range I found for H1

which surprised me and blew my assumptions out of the water - after this final test I said to myself: "My work here is done!"

- 10 Symbols tested

- H1 time frame

- 3 Years

- 343 settings

- 9/10 symbols with 100% of settings in profit (and EURUSD with 99% settings in profit)

You are responsible to determine your own set files for the EA

To do this efficiently:

- Optimize with "Open Prices Only Mode" - VERY FAST on M15 to H4, and reasonably fast below M15. All without having to use cloud computing for help.

- Unreliable? No, it is okay because the robot is designed specifically to trade only at new candle start times

- Take the settings you like and

- Test them on "Every tick based on real ticks" to be more confident

- For fun, test with "Random Delay" several times on the same settings - this simulates a slow unreliable server with lots of re-quotes and results are different every time.

It is a fact : the best settings of most trading robots fail when tested on other symbols, time frames, and time periods

It is a fact : price behavior, frequency, oscillation, pattern will not be the same next year as it was this year.

- Statistically, among a million trials, a coin flip can come out the same 20 times in a row.

- Combine that idea with a trade using a nearby take profit and a distant stop loss and you can find some setting outliers to fool yourself and others into believing a robot employs a good trading system.

- The most common red flag is hearing "it only works on this symbol or time frame". Such systems are over fitted, very risky no matter how good they appear in some screenshots.

My goal was to diverge from the norm and provide an easy to use robot where most settings test profitably.

So, here are many screenshots flashing from the 20 symbols available in the FOREX.all market watch set.

This presentation of Deep Takeover is as transparent possible. We are aiming for a higher probability of success given totally random settings.

If you are looking for millions or billions in profit in a short time, consider :

- MQL5 has existed for more than 10 years! And has had a signals area to copy trades for all these years

- I was one of the first developers on this websitewith an EA that could turn $25 dollars into more than $1,000,000,000.00 in 2 yearsin the back tester. "Freak" EA.

- If such a system worked in real life, at least one of them would be a public signal for the world to see, successful traders are proud and love to brag!

- Be rational. It obviously never works.

Give an under fitted system a try for a change!

It is provable that short term price overlap summed up over a long time is many times stronger than direct up or down movement.

This system attempts to keep it's variable and adaptive trading channels within the trend direction.

Deep takeover shines best in:

- Flat / High ATR oscillating price periods

- Weak to medium loose trends with roughly 50% retracements on movements

Deep takeover suffers worst when:

- When price moves are tight and strong with retracements consistently less than 25% for a long period of time

Try optimizing on any time frame from M1 to H4 and play with start and stop parameter ranges.

Enjoy, have fun, and may the odds be ever in your favor!

big disappointment for the expert and the author, rubbish