AnaliTickEA

- Asesores Expertos

- Aleksandr Prozorov

- Versión: 1.0

- Activaciones: 5

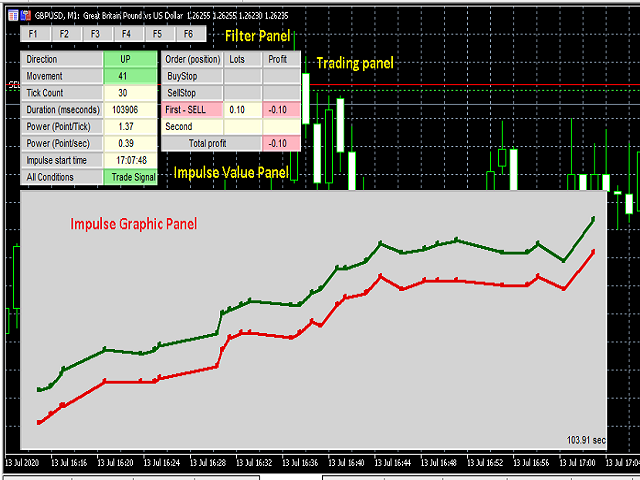

AnaliTickEA is an advisor for the Metatrader 5 platform. Together with the utility AnaliTick is a complete system for analysis, testing and automated trading based on impulse searches. Impulse in this text refers to such a sequence of quotes (ticks), which has a pronounced tendency to move prices to increase or decrease. The magnitude of the impulse is the maximum price change (in points). Based on the analysis of tick sequences with AnaliTick, the user determines the requirements for the input pulse. Filters are used to search for specific impulses, there are 6 in total. Using these filters you can set the magnitude of the impulse, the number of ticks in the impulse, its duration, as well as the strength of the impulse — movement in one tick or in one second. You can set the minimum and maximum valid parameter values. The time filter allows you to determine up to four time intervals during the day when trading is allowed. All or part of the filters can be disabled. If all filters are disabled, then a trading signal is generated when the pulse reaches the value of 40 points. The Deviation parameter determines the allowable deviation of the impulse from the trend. For example, if at a certain time the value of the impulse reached 40 points up with the value Deviation = 10, then a price decrease in the range of 1-4 points will not be perceived as the end of the impulse.

Using the ShowTable parameter in the value true, the user displays the parameters of the impulse, as well as the results of the trade. The ShowImpGraph parameter allows you to display a graph of the pulse in real time.

The user determines the trading strategy after an impulse is found that meets all the requirements defined by the filters. There are two ways to generate a signal. The first way - the signal is considered formed if all filter conditions are met. The second way - the completion of the pulse formation is expected, and its characteristics are checked for compliance with the filters. The choice of signal generation method is determined by the input parameter StartTrade.

A market position can be opened both in trend (direction of momentum) and against the trend. In addition, pending orders BUYSTOP and SELLSTOP can be placed. The user defines the parameters TakeProfit, StopLoss, as well as TralingStop. Parameters can be set both in points and as a percentage of the pulse value. It is possible to open the opposite position after closing the first position. The user in the input parameters determines the condition for placing the second position, as well as TakeProfit, StopLoss, TrailingStop values for it. Zero values of the parameters mean that they will not be used.

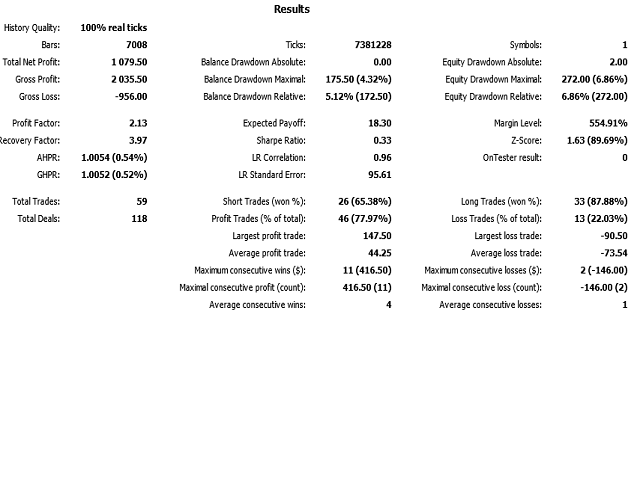

Testing of the adviser must be carried out in real ticks mode taken from the terminal base. Testing in other modes is meaningless.

The developer draws attention to the fact that the adviser does not provide a ready-made automatic strategy. The user himself determines the parameters of the pulses and trading actions after detection. To develop momentum requirements and trading strategies, it is recommended to use the AnaliTick utility.

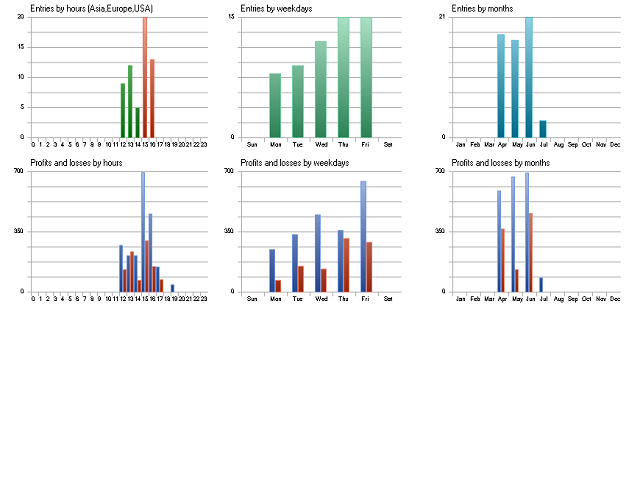

Below are screenshots explaining the operation of the adviser, as well as test results for one of the pulse configurations. Filter and trading parameters were determined using AnaliTick utility and then tested in the Metatrader 5 strategy tester.