Mediana

- Indicadores

- Arkadii Zagorulko

- Versión: 1.3

- Actualizado: 31 mayo 2023

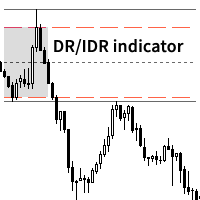

The median indicator is a type of technical analysis tool commonly used in forex trading. It is based on calculating the median price of a currency pair over a specific period of time. The median price is the middle value between the high and low prices.

Compared to the widely used moving average (MA) indicator, the median indicator offers a unique perspective on the market. Here are some advantages of using the median indicator:

-

Robustness to outliers: The median is less affected by extreme price movements or outliers compared to the MA. Since it focuses on the middle value, it provides a more stable representation of the price range.

-

Smoother price representation: The median indicator can smooth out price fluctuations, reducing the impact of short-term market noise. This can help traders identify the underlying trend more easily.

-

Reflects price distribution: By using the median, traders gain insight into the distribution of prices within a given period. It provides information about the concentration of prices around the middle value, which can be valuable for understanding market sentiment.

-

Supports range-based strategies: The median indicator is particularly useful for range-bound markets, where prices fluctuate between support and resistance levels. It helps traders identify the central point of the range, which can be used as a reference for potential buy and sell levels.

-

Complementary to other indicators: The median indicator can be used in conjunction with other technical analysis tools to confirm signals or filter out false signals. For example, combining the median indicator with a moving average can provide a comprehensive view of the market by incorporating both the central tendency and the overall trend.

excelente