DYJ Hedging MT4

- Asesores Expertos

- Daying Cao

- Versión: 2.91

- Actualizado: 13 agosto 2020

- Activaciones: 5

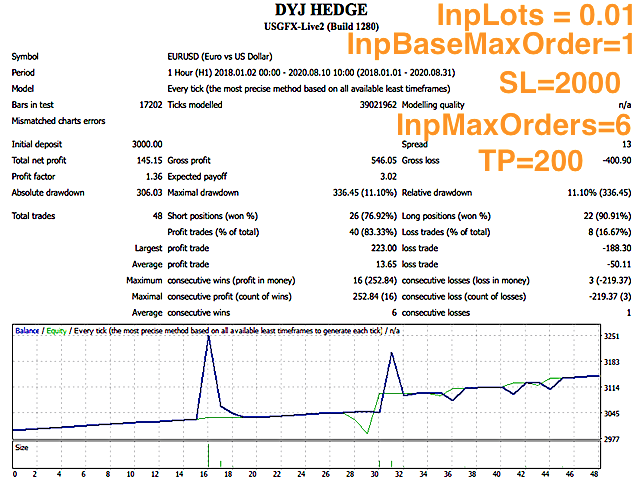

The DYJ Hedging is based on the following idea:crossing of two Moving Average lines (Fast and slow ) is used as a signal for opening positions.

We will now apply game theory strategy on the future of per currency instead of a price chart of history. This is one level higher. Dynamic Market game theory is a special feature of Advanced Currency Health Bars indicator and you cannot find in any other Currency Meter! This is a very unique function. Dynamic Market game theory strategy Health Bars are based on the entire Market activity (all 35 pairs).

This EA can correct the future loss rate through my mathematical algorithm.

The DYJ Hedging searches for position opening conditions only on a new bar (performs operations at the moment of new bar emergence), while Total Profit is controlled on every tick. When a condition for opening a position is found (a check is performed for the Base symbol on which the EA is running), the EA opens two positions at once: on the Base symbol and on the Hedge symbol.

An example of launch on the EURUSD symbol, while the Hedge symbol is USDCHF

Recommended operation in any paris of hedge M5-D1 chart or optimize other timeframe

The recommended SPREAD is less than or equal to 20.

In any time range of the per pair chart, the Expert Advisor performs well in any time period backtest.

EA performance is the sum of the backtest performance of per currency pair

Note: MT4 backtesting cannot simulate all currency signal markets!EA is usually run directly in a demo or real account, and the results are more realistic than backtesting

Recommendations

| Recommend pairs | Any pairs |

| Time Frame | First choice M5, or M15 to D1; For news transactions, choose M1 to H1 |

| Recommend deposit | First choice $5000 or 1000 to 10000USD or more |

| Recommend settings | Default |

| lever | 500 |

| spread | First choice 0 to 20,or 10 to 40 |

Input Parameters

- InpMagic = 26719034 // magic number

- InpBase=EURUSD -- Base symbol; comma-separated list of symbols to be traded.

- InpHedgePairs = USDCHF -- The default hedge symbol is USDCHF. comma-separated list of symbols to be traded. Not used if empty

- InpEMAShortPeriod = 8

- InpEMALongPeriod = 21

- InpIsUseRSI = false

- InpRSIPeriod=21

- InpRSIOversold=30

- InpRSIOverbought=70

- InpLots = 1 -- Order Lots or [-x=Rsik(%)]. Manage lots automatically if inplots is less than or equal to 0. When InpLots are negative, it is the risk percentage.

- InpTotalProfits = 100 -- Profit target for closing all positions

- InpLoss=100000 -- Loss target for closing all positions

- InpEquityDelta = 1.1 -- Equity target multiple for closing all positions

- InpPipStep=300 -- Order step

- InpTakeProfit=200 -- TakeProfit

- InpStoploss=1400 -- StopLoss

- InpMaxSpread =20 Maximum Spread

- InpBaseMaxOrders = 1 -- Base Pairs Counts

- InpMaxOrders = 1 -- Maximum Orders

- InpDynamicHealthBars = 0 -- [x<=0] - Dynamic Health Bars (1 - 3); [x>0 and x<=4]-Static Health Bars

- InpDistanceDivisor = 3 -- Pending Distance fraction. Do not use pending if it is 0.

- InpIncreasedProfit =10 -- Increased Profit($) for GrowthRat

- InpMaxOpenTime = 3.5 -- block of a trade validity time(Minute) checking, if MaxOpenTime=0, do not check.