Overclock Deposit EA

- Asesores Expertos

- Mihail Matkovskij

- Versión: 1.40

- Actualizado: 12 diciembre 2019

- Activaciones: 5

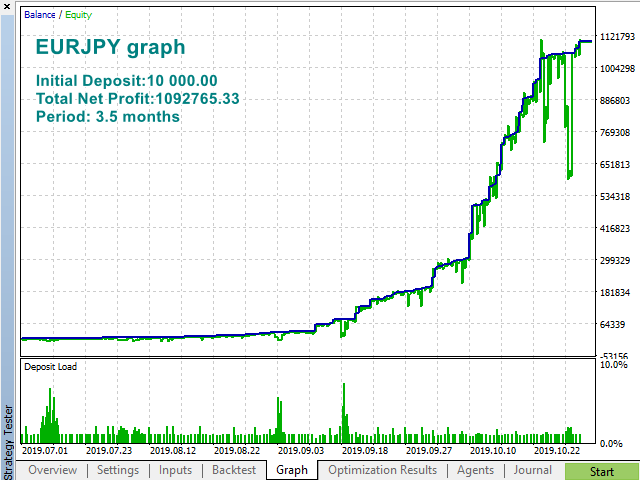

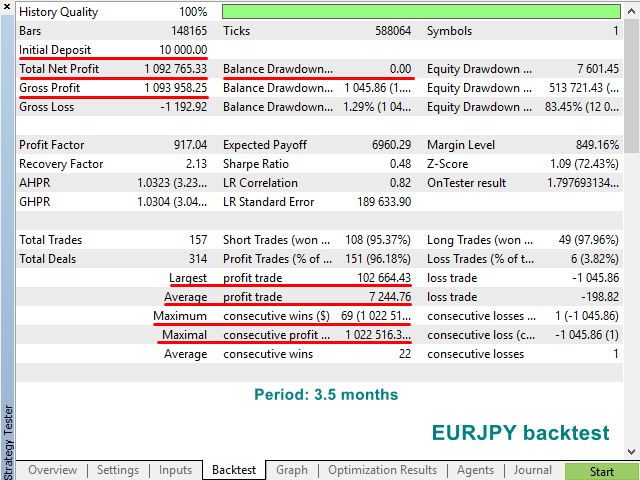

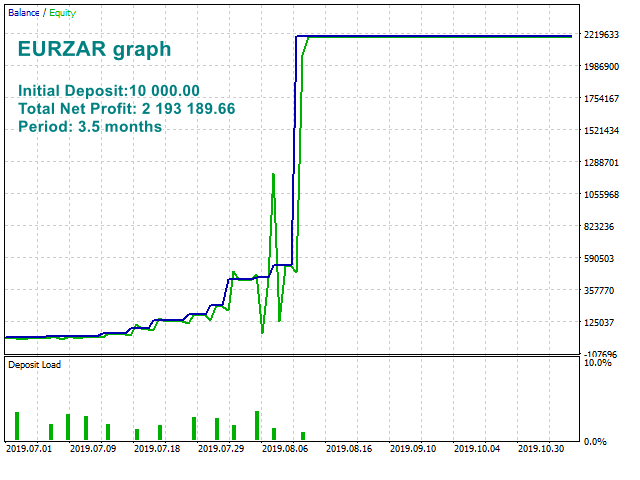

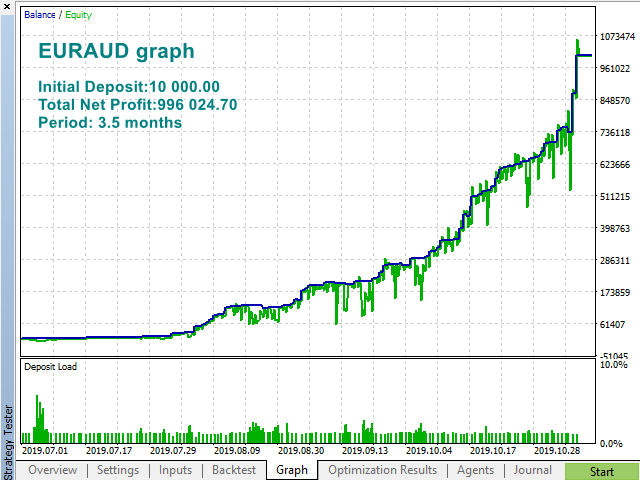

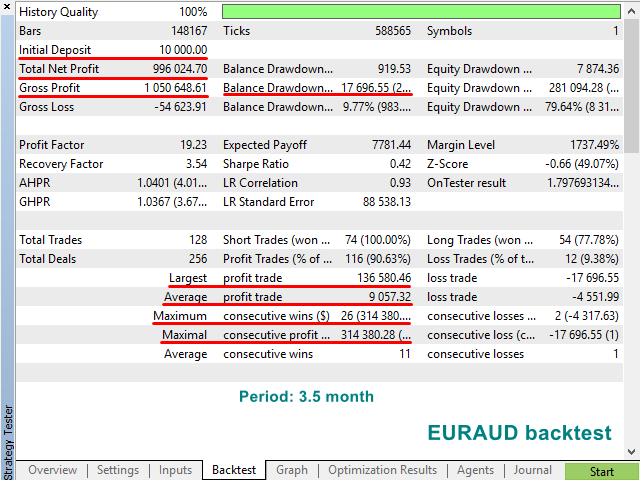

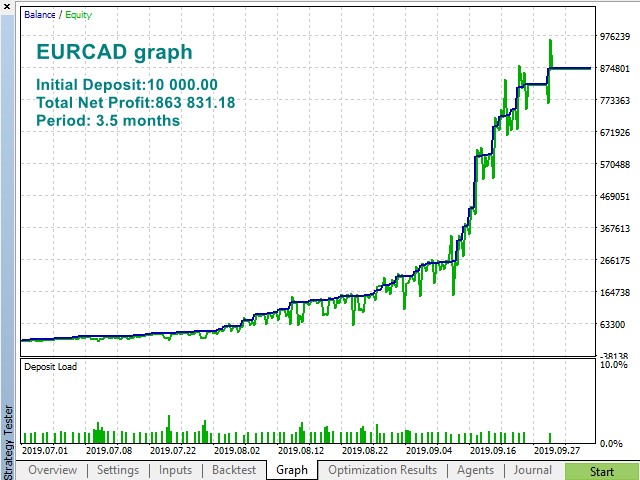

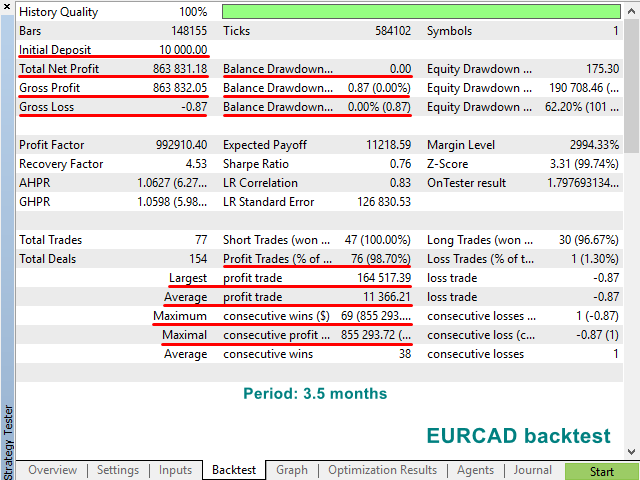

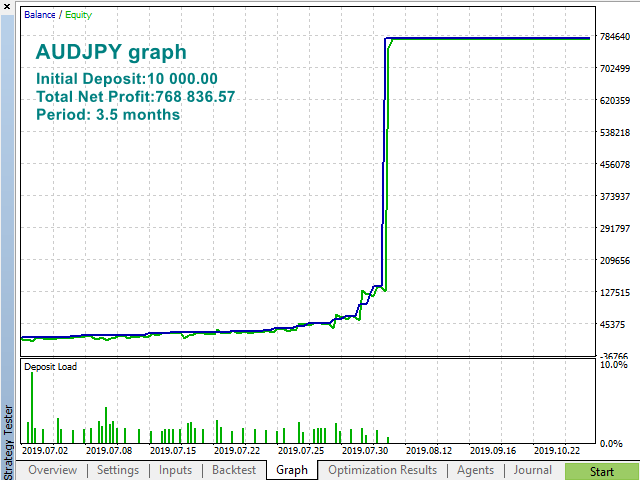

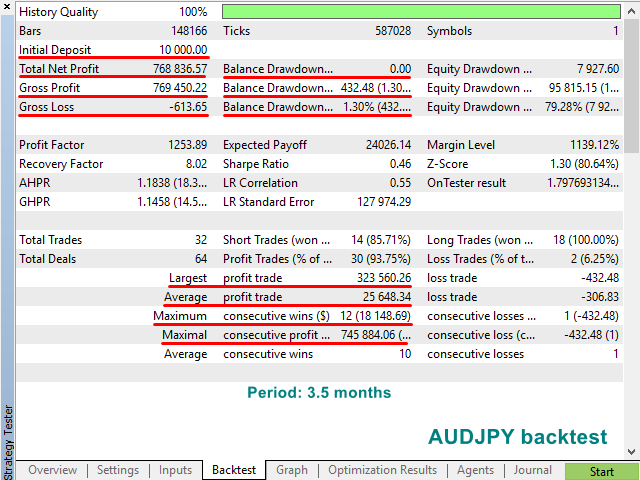

An EA created to overclock a deposit within the short period of time. The EA uses accurate signals towards the trend to be able to enter the market. Together with the author’s optimization criterion, the EA allows you to choose appropriate settings to overclock your deposit. The EA works on 4 timeframes, which increases the accuracy of signals. Sometimes it can involve 3 timeframes.

Attention! As you know, a trader's deposit is exposed to a risk in the Forex market. Especially, this should be taken into account when overclocking it. I recommend risking only with the money that you are ready to lose.

Please, pay attention to the default input parameters! petcRisk: 90%, percEquity: 90%, which corresponds to the maximum risk, minus 10%. Reducing this parameter will minimize the risk, but at the same time it will significantly reduce the chances of overclocking the deposit. Parameter optimalLotLimit is set to 0.5 of free margin. Decreasing this parameter will reduce the chances of overclocking the deposit. An increase in turnover will increase the risk of leaving the market by stop out.

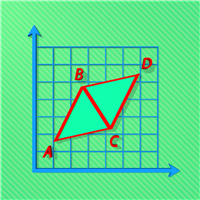

Attention! All EA input parameters are selected for MetaQuotes quotes. Your broker will need its own settings, which can be selected using optimization. How to do this is described below, shown in the video, as well as in the illustrations.

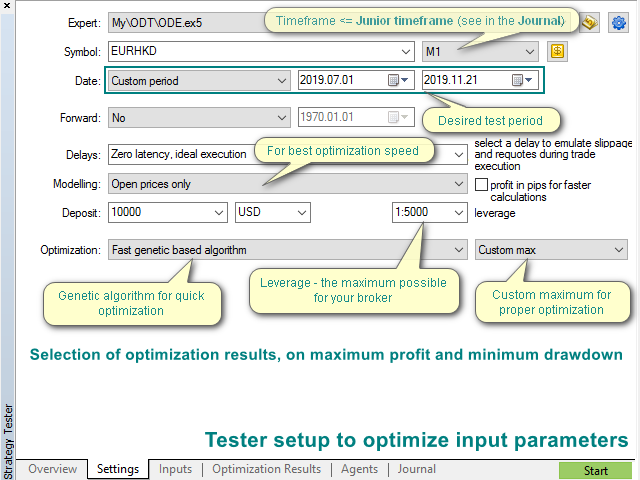

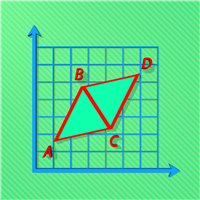

The otimization is carried out according to Custom max, with the maximum possible leverage for your broker. The timeframe in the tester settings should not exceed the Junior timeframe, which one can see in the log, as well as in the upper left corner of the graph during visual testing. If the test or optimization fails to start, then the timeframe should be set to M1. Appropriate testing/optimization period can be from 1 to several months. Leverage: the maximal possible for your broker. Optimization criterion: Custom max. It is recommended to choose optimization results with maximal profit and minimal drawdown.

Cache optimization files, settings files, as well as reports, are available in the discussion and here.

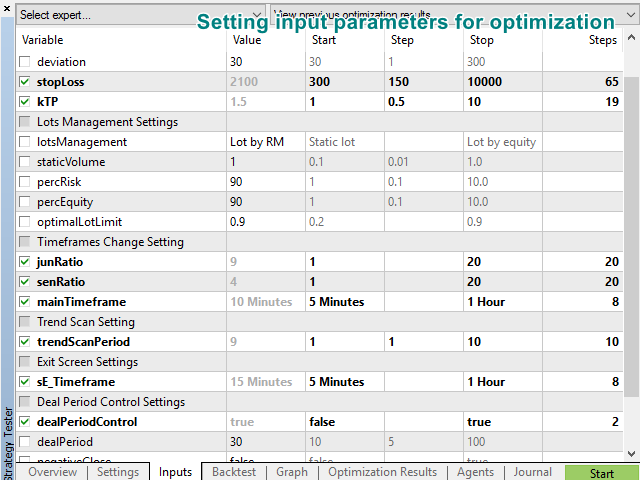

Input parameters

- magic - magic

- deviation - deviation

- stopLoss – stop loss

- kTP - how many times take profit is greater than stopLoss (if kTP <= 0, then take profit is not used)

- lotsManagement - lot management mode (Static lot - staticVolume, Lot by RM - percRisk, Lot by equity - percEquity, Max risk - percRisk = 90%)

- staticVolume - static volume

- percRisk – risk for risk management

- percEquity - risk for Equity

- optimalLotLimit - limit of maximum lot (from 0.2 to 1 of free margin)

- junRatio, senRatio - coefficients of choosing junior and senior timeframes, respectively

- mainTimeframe - main timeframe

- trendScanPeriod - trend scanning period

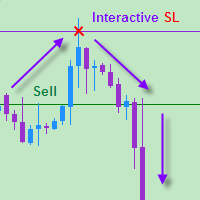

- sE_Timeframe - timeframe for receiving exit signal

- dealPeriodControl - enable deal period control

- dealPeriod – deal period

- negativeClose – close upon negative profit

- kProfit – desired profit to cancel closing the position