Dolphin Bands

- Indicadores

- Vitalii Zakharuk

- Versión: 1.0

- Activaciones: 5

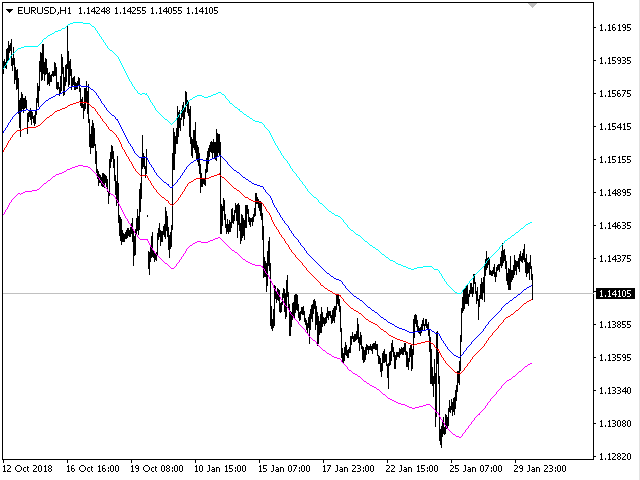

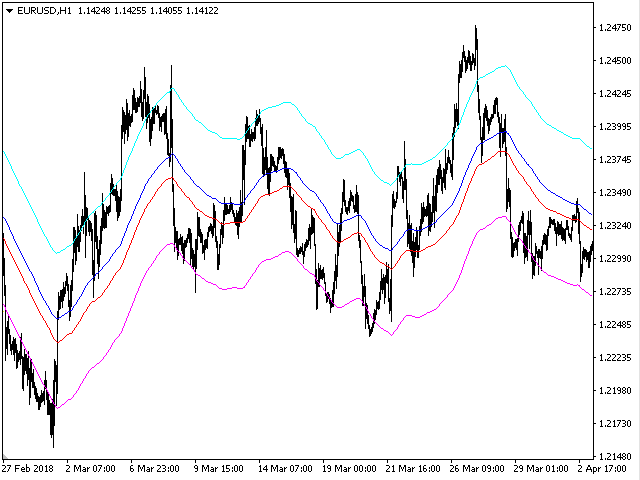

Dolphin Bands indicator works equally well on any timeframes. For medium-duration trends, it is recommended to use the standard setting. To

study long-term trends, it is recommended to use an indicator value greater than the standard. To analyze short-term trends, it is

better to use a lower indicator value. Most often, an exponential method is used to calculate the indicator, but other varieties can

also be used.

Dolphin Bands is a collection of lines. The two center lines of the indicator are moving averages of a given type and period, they also form a small

channel. The large channel is formed by the center line of the indicator plus / minus the estimate of the standard deviation multiplied

by the coefficient chosen by the user.

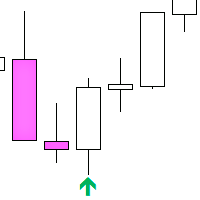

The main rule when building Dolphin Bands is that about 5% of the prices should be outside the lines of the big channel, and 95% inside. If the

price too often crosses the upper or lower line (of the big channel), the period should be increased, and if the price rarely reaches

external bands, the period must be reduced.