Fisher Reversals

- Indicadores

- Jean Francois Le Bas

- Versión: 1.0

- Activaciones: 20

This indicator weigth the actual close price with the high and the low of past values

then it is computed by a simple 1 lag IIR filter before being processed by a final logarithmic algorithm to order the data.

This Indicator is perfect to find precise reversals.

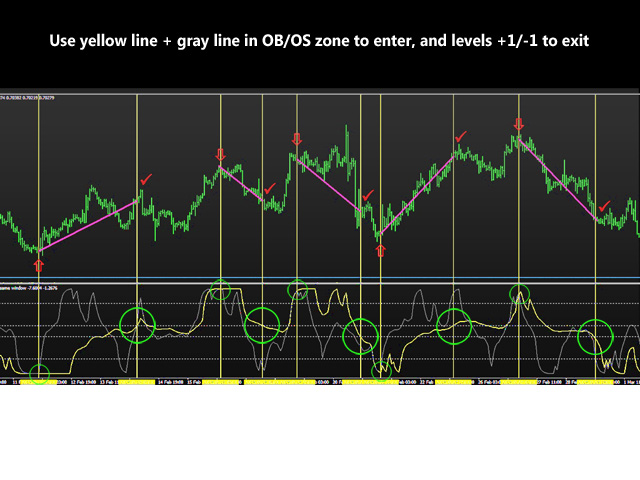

Rules of Trading :

1) Be sure that the yellow line is in overbought/oversold (above +5 or under -5)

The higher/lower, the better.

2) Wait for the gray line to touch the yellow line then separate from it : this is the signal.

3) If the yellow line is in Overbought/Oversold area for quite some time, it means we are in a trend. Then it is wise to wait for the end of the trend before entering the next top/bottom reversal. To that effect, it is better to wait for the yellow line to cross the +1/-1 level before entering the next reversal.

Targets are defined when the yellow line crosses the +1/-1 levels (please refer to screenshots).

Parameter description

- len1 (default 130) = period of the yellow line.

- offset1 (default 0) = allows computations to be offseted by a positive or negative amount

- len2 (default 13) = period of the gray line.

- offset2 (default 0) = allows computations to be offseted by a positive or negative amount

Yellow line : this is the Trend line

Gray line : this is the Action line.