YinYang hedging

- Asesores Expertos

- Jun Feng

- Versión: 1.20

- Actualizado: 21 septiembre 2018

- Activaciones: 5

YinYang hedging

This is a fully automatic EA base on two currency hedging.The parameters are simple and adaptable,the EA can deal with any type of market, and the performance is stable.

Using Requirements:

Run timeframe: H1;

EA loading currency:currency A,currency B do not need to loading the EA;

Minimum account funds:$1000;

When used,the parameters "Test" should be adjusted to "false" from "true" by default;

VPS hosting 24/7 is strongly advised;

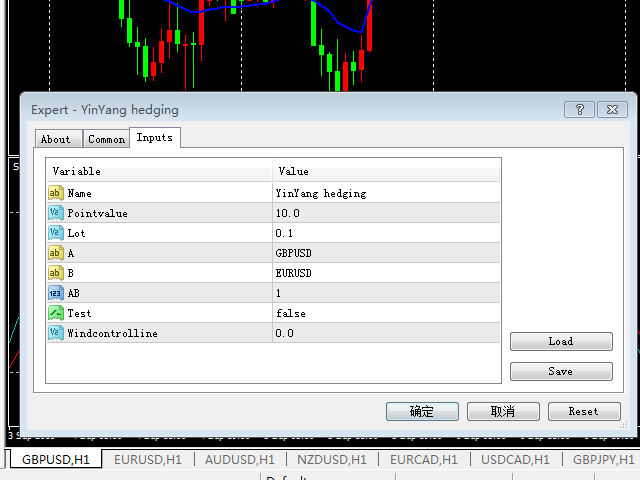

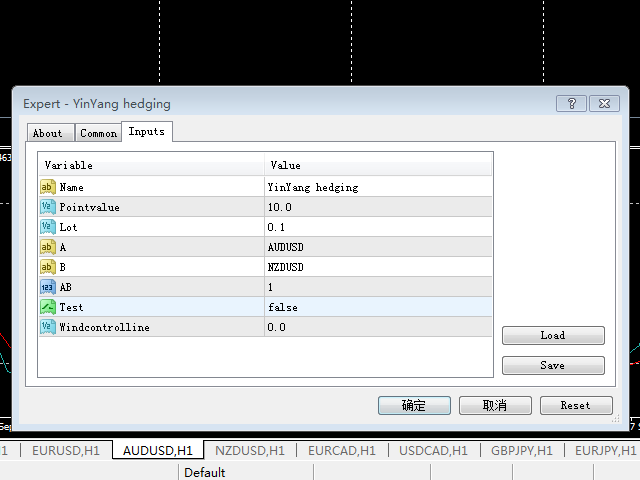

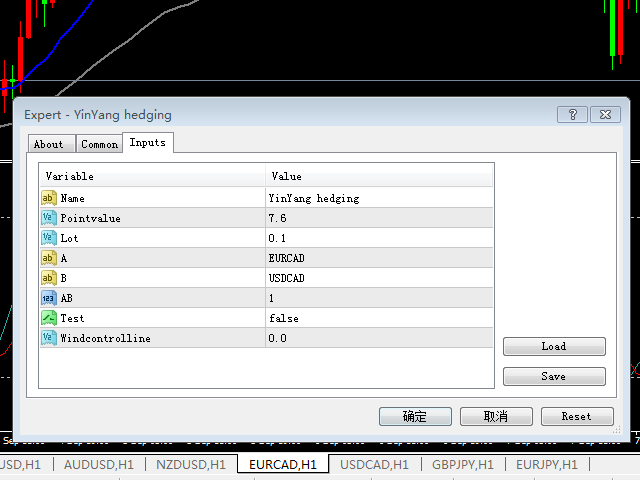

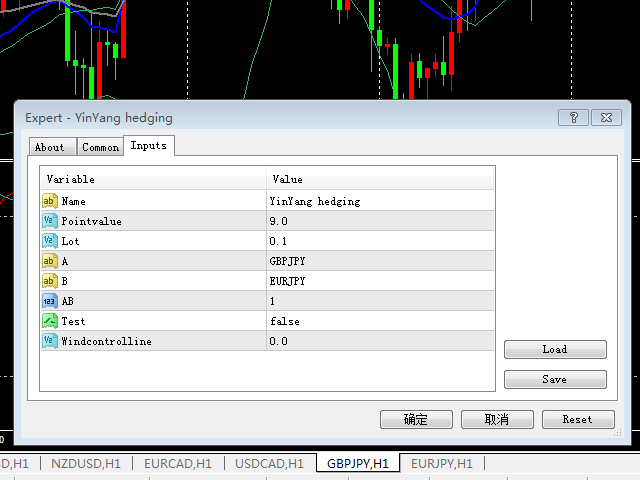

Currency pairs are recommended:A-GBPUSD,B-EURUSD;A-AUDUSD,B-NZDUSD;A-EURCAD,B-USDCAD;A-GBPJPY,B-EURJPY.

Statement:

Because the MT4 can open only a single currency when testing,currency B can not opened when testing,But there is no problem in actual using,and the EA can be used safely.

Input parameters:

- Name=YinYang hedging - the name of EA.

- Pointvalue=10 - Variety of currency point,for example,GBPUSD/EURUSD is 10 dollar for a standard point,and other currency pairs can be calculated by yourself.

- Lot=0.10 - lots coefficient,0.10 means open 0.10 lot every 10000 dollars,and it adjusted automatically accordding to the balance.

- A=GBPUSD - one of the hedging currencies.

- B=EURUSD - one of the hedging currencies.

- AB=1 - the relationship between currency A and currency B,"1" is the same direction,"-1" is reversed.

- Test=true - test switch,it should be adjusted to "false" when EA is used.

- Windcontrolline=0 - risk control line, you can set it yourself based on you account funds, all orders will be closed for controlling the maximum risk when the account equity is below the "Windcontrolline".