Fix Up

- Asesores Expertos

- Alena Frolova

- Versión: 1.71

- Actualizado: 6 noviembre 2018

- Activaciones: 5

Fix Up

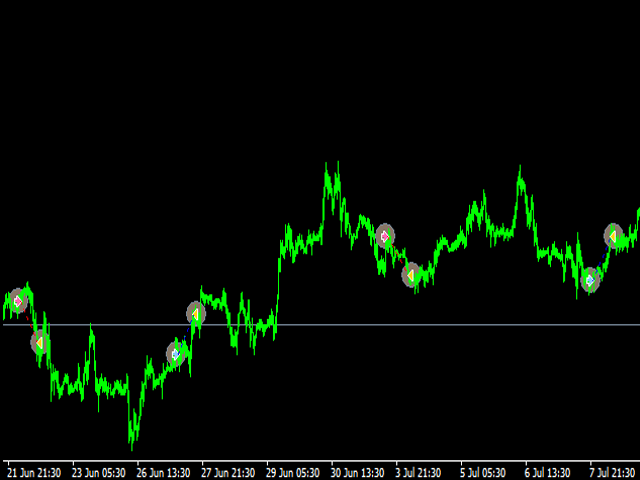

The adviser is based on a steady breakdown pattern of the current channel. This pattern is revealed by means of spectral analysis of the price over a long period of time and is successfully developed over a period of 20 years. Has a built-in mechanism for calculating profits, and also closes transactions for virtual Stop Loss and Take Profit, which are more than 40 points for 4-digit quotes. The adviser works on currency pairs: EURUSD, EURGBP, AUDUSD, NZDUSD, USDCAD, USDCHF. All settings are inscribed in the data file and transferred to the Expert Advisor directly.

The working timeframe is 30 minutes, but also takes into account the older timeframes of 60 minutes and 1 day.

The adviser does not use dangerous strategies: scalping, martingale and does not build a grid of warrants - there is always one deal in the market.

Options :

- Pairs - select settings for a currency pair.

- Magic - the unique identifier of the Magic Number.

- Slippage - the value of the allowable price slippage.

- Lot - the size of a fixed lot.

- Risk - the percentage parameter of the dynamic lot (if 0, then the lot is Lot).

- SL - value of Stop Loss for 5-digit quotes.

- TP is the value of Take Profit for 5-digit quotes.

- LEVEL - the value of the channel level from the price for protection against scalping.

- Use Trailing - use Trailing Stop.

- Trailing Stop Start - the value of the distance from the opening price of the order when Trailing Stop starts for 5-digit quotes.

- Trailing Stop Distance - the distance from the price when Trailing Stop Loss is set for 5-digit quotes.

- close_signal - closing of transactions on a return signal.

The default settings are for the EURUSD currency pair; in order to load settings for other currency pairs, you need to change the Pairs parameter. Nothing more is needed.

No need to download set files and other files!

在實際購買EA之前~我依照作者的建議~使用EURUSD來執行10年的回測~結果是相當優異的

幾經評估之後~我訂購了這款EA~並且從10月開始進行小部位的真倉測試~在槓桿比1:30的情況下

我用100美金來當作0.01手的依據,經過歷史回測停損及停利均設為50大點的情況下有最好的平均獲利,從10月到12月的結果如下:

10/25-10/28 一筆交易 獲利1.09美金(這次似乎在某種錯誤的因素下提前結束交易所以有獲利,但用歷史回測這段時間區間的時候是以虧損5美金停損出場)

11/20-11/20 一筆交易 獲利5.15美金

12/17-12/18 一筆交易 虧損5.04美金

12/18-12/19 一筆交易 獲利5.15美金

12/26-12/27 一筆交易 獲利4.97美金

以上10-12月共三個月,總計獲利4筆及虧損1筆,獲利11美金左右(月均獲利3.6%),如果扣除掉原本預計會虧損的那一次

是獲利3筆虧損2筆,獲利5美金左右(月均獲利1.66%左右)

總結來說~我想要在此給作者一個支持,雖然我不清楚本EA實際交易的原則是甚麼,但是真的要把時間拉長來觀察實際上的收益

而非在短時間內期望有高頻交易的巨大獲利,希望作者不要因此停止優化這個EA

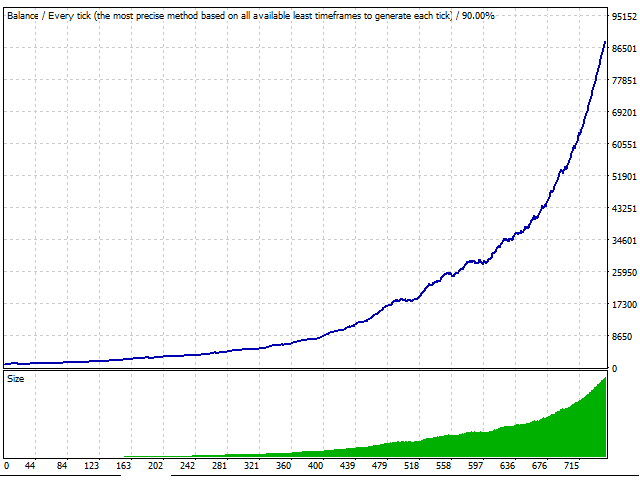

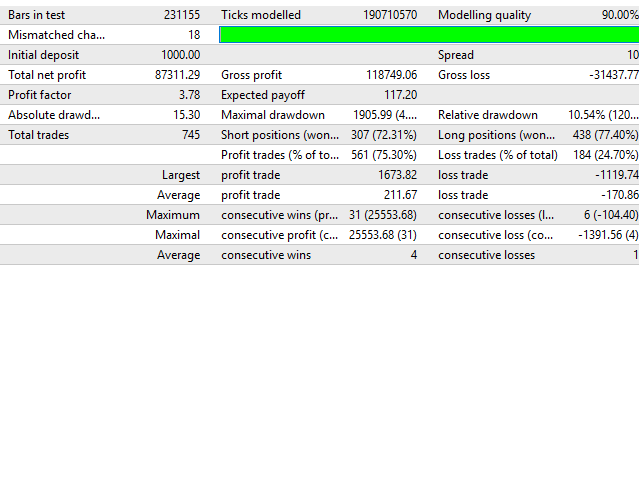

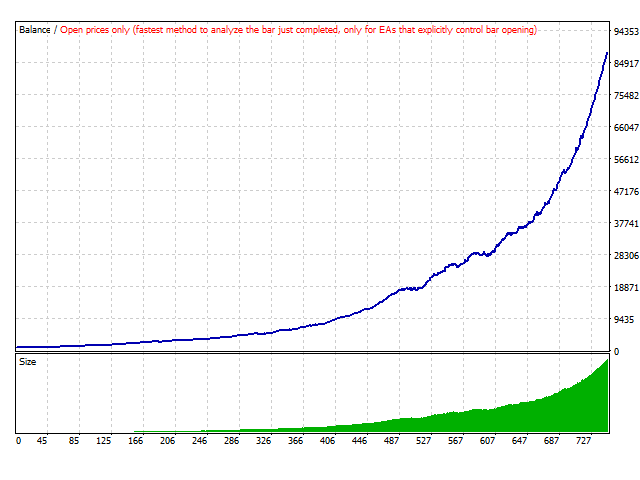

Before actually buying EA ~ I follow the author's suggestion ~ use EURUSD to perform a 10-year backtest ~ the result is quite excellent

After several evaluations~ I ordered this EA~ and started the real-life test of small parts from October~ in the case of a leverage ratio of 1:30

I used $100 as the basis for the 0.01 lot. After the historical backtest stop and the stoppage were set to 50 points, the best average profit was obtained. The results from October to December are as follows:

10/25-10/28 A profit of 1.09 US dollars in a transaction (this seems to be profitable in advance of some wrong factors, so it is profitable, but when using historical backtesting, the time interval is stopped by a loss of 5 dollars. )

11/20-11/20 A transaction profiting 5.15 US dollars

12/17-12/18 A transaction with a loss of $5.04

12/18-12/19 A transaction profiting 5.15 US dollars

12/26-12/27 A transaction made a profit of 4.97 US dollars

In the past 10-12 months, a total of 4 profit and 1 loss, profit of about 11 US dollars (average monthly profit of 3.6%), if you deduct the original expected loss

It is profitable 3 losses, 2 profit, about 5 dollars (average monthly profit of 1.66%)

To sum up, I want to give the author a support here, although I don't know what the EA's actual trading principles are, but I really want to lengthen the time to see the actual benefits.

Rather than expecting a huge profit from high-frequency trading in a short period of time, I hope that the author will not stop optimizing this EA.