ClassicTrader

- Asesores Expertos

- Andriy Sydoruk

- Versión: 1.0

- Activaciones: 5

ClassicTrader is a universal and fully automatic Expert Advisor developed specifically for real Forex trading, which does not require any strict conditions or a specific broker. The minimum deposit is $100! The important advantage is frequent trading of large lots, which allows you to make additional profit on spread in partnership programs.

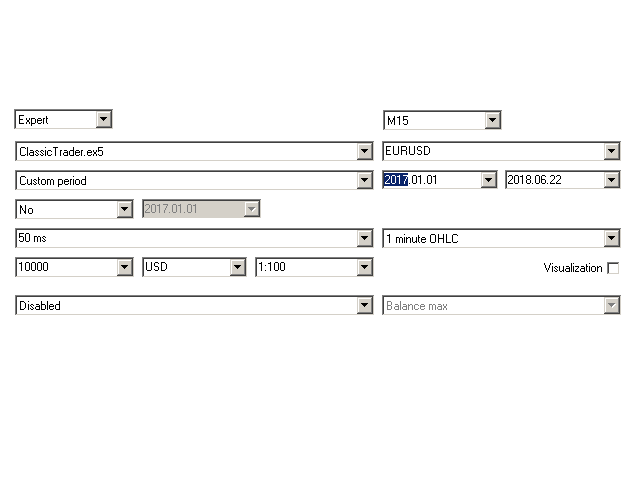

You can run the robot on any symbols. All parameters can be optimized for any trading style. For other instruments, select the parameters on 2-3 year period with a forward period of 6 months before trading. Do not optimize parameters on a short period of time, this will lead to overfitting. If you want to globally optimize all parameters, use Open prices only first, since the work will be slow on all ticks or control points. The next refinement optimization can be made redundant by several parameters (kStepGrid [0.05.. 0.5], MinClose [0.01.. 0.7], SL and TP [100.. 250]).

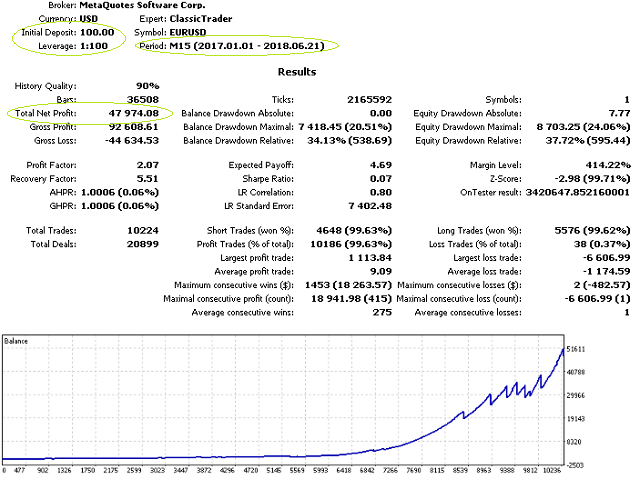

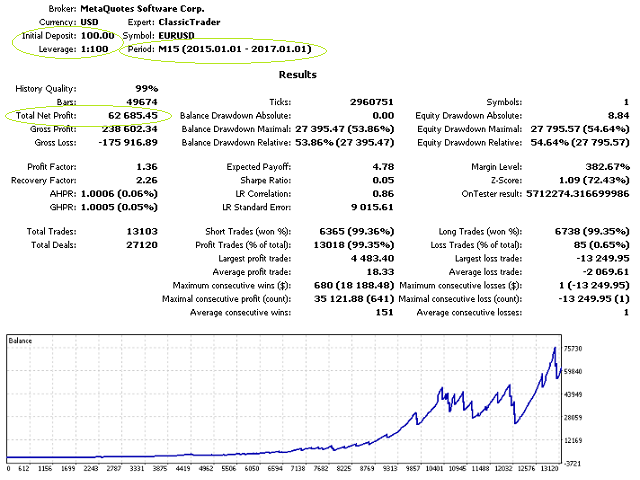

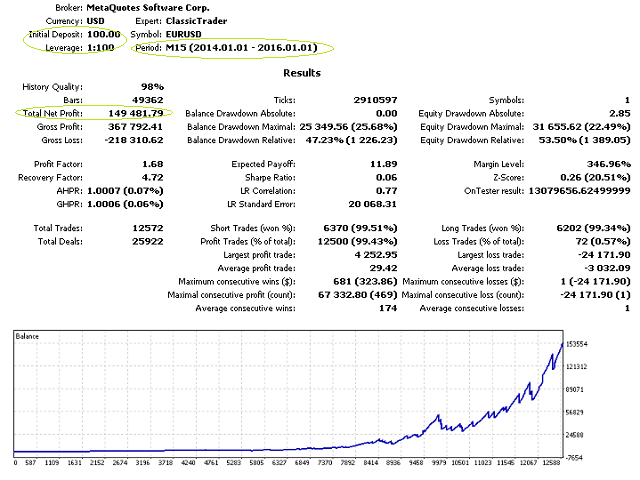

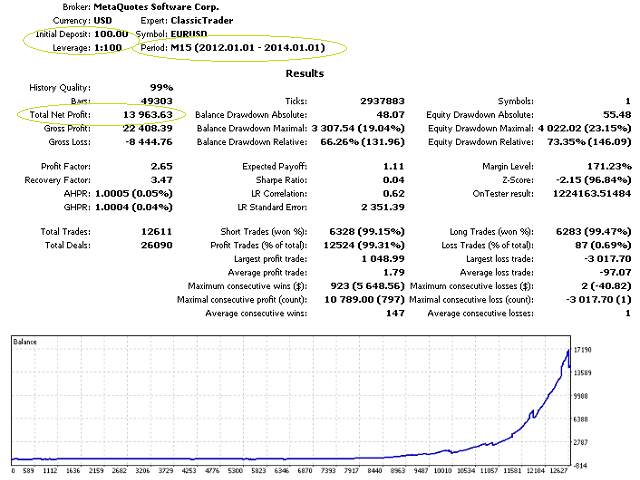

All tests on the screenshots are passed with a single setting - the one set by default but on different time intervals. Testing is performed with the minimum deposit of $100. Therefore, the drawdown may be somewhat larger than if you test with a deposit of $1000 or $10 000.

The default settings are as follows: timeframe - M30, symbol - EURUSD, leverage - 1:100, minimum deposit - 100$.

Features

- works with any broker;

- the system can run with brokers providing floating spread;

- the lesser the spread, the better - this applies to any trading system;

- no need for fast VPS;

- works on netting accounts;

- applies loss limiting stop levels - loss limitation level is low;

- uses only the best features from various systems, such as martingale, hedging, etc. SL and TP are always present;

- good test results on various time intervals;

- excellent results when tested in different ways;

- no need to disable the robot during news;

- does not require exceptional execution.

ClassicTrader operation is based on one well-known strategy. The strategy focuses on a special trading algorithm and a limiting channel. The regression indicator is applied to form a trading channel. The number of opened orders can be adjusted in the parameters, by default there are two orders. The EA uses short and similar stop levels, stop loss is equal to take profit and is defined by SL and TP parameter. The robot can be used in different modes, including scalper. The EA can be easily configured for any trading style satisfying demands of any trader.

For real trading and testing on real ticks, set MinClose to 0.25. When working with control points (draft testing), leave the default MinClose value (0.025).

Options

- TypeFilling - order filling policy.

- Magic - magic number.

- Risk - calculate lot depending on a deposit. We recommend that you use Risk, rather than Lot, since the MinClose parameter is related to it.

- Lot - lot size for entering the market (priority is higher than the Risk field).

- LotExponent - ratio that defines the progressive lot increase.

- LimitGrid - order limitations, either for a common grid, or for a martingale (any option is limited by stop levels).

- kStepGrid - ratio that defines the minimum step between two orders and calculated as a % ratio relative to the SL and TP parameter.

- MinClose - minimum profit that can be closed by a signal (in % of a deposit).

- SL and TP - stop levels - stop loss is equal to take profit, so both levels are set by the single parameter.

- DrawDown - maximum drawdown, at which closing occurs (in % of a deposit).

- Degree - regression indicator parameter.

- Kstd - regression indicator parameter.

- Bars - regression indicator parameter.