NN8D Points

- Indicadores

- Aleksandr Nikolskii

- Versión: 1.4

- Actualizado: 23 julio 2018

- Activaciones: 5

NN8D Points is one of the indicators included into NN8D (Nikolsky's Nesting Doll) trading system.

NN8D Points is an indicator containing multiple tools for analyzing Forex market: candle analysis and area system.

Rather than simply averaging by Open, Close, High and Low prices, NN8D Points performs a complex analysis of the current and previous bars by various parameters: bar color; bar body size; bar wicks; bar core (average value between Open and Close, as well as between Lows and Highs); analyzing bar volumes by a certain unique formula that defines the strongest movement within each bar - bullish or bearish; analyzing the relationships of the current bar's parameters mentioned above with the same parameters of the previous ones - after that, NN8D Points provides signals in the form of dots having a certain color and type. They show the presence of a trend and its strength.

NN8D Points has a built-in Area System module, which represents an alternative for the levels. This module analyzes charts finding accumulations of quotes (rather than levels), i.e. places on the chart where the price spent most time. The period of the area system can be changed in the indicator settings. The longer the period, the stronger the detected areas but the less sensitive the indicator is for sharp price reversals. Therefore, you can choose the indicator period at your own discretion or apply the default one (which is tested on all timeframes and six major currency pairs, and proved to be optimal).

Parameters

- Area Width - area line width

- Area Period - number of bars for defining the areas. The longer the period, the stronger the detected areas but the less sensitive the indicator is for sharp price reversals.

- Area Auto Period - number of bars for defining the areas is defined automatically: M1 - 5; M5 - 3; M15 - 4; M30 - 4; H1 - 4; H4 - 6; D1 - 5; W1 - 5; MN - 3

- True - enable

- False - disable

- Area Type - area type

- Tail - by bar tails: High and Low

- Body - by bar bodies: Open and Close

- Area Filter - sort areas (remove redundant lines) if a higher area enters into a lower one (this may happen during a long flat)

- True - enable

- False - disable

- Tester - test by history. Display the vertical line for selecting a bar, from which the areas are calculated, to check how areas at a specific time were displayed.

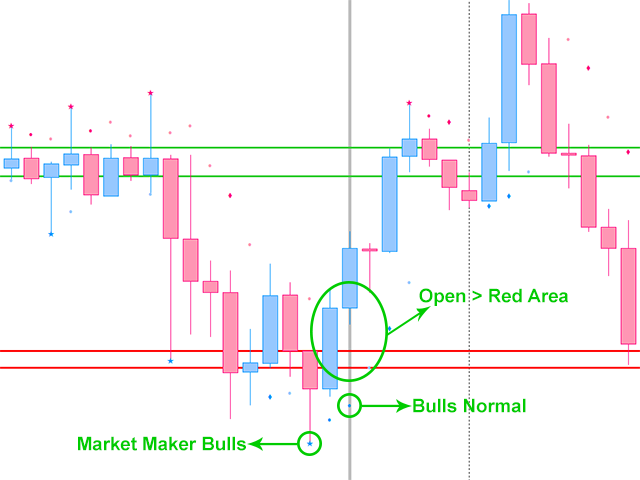

Buy checklist:

- Bulls Strong or Bulls Normal (preferably Bulls Strong).

- On one of the previous bars, Market Maker Bulls (in most cases).

- The current bar Open price is above the Red area (if the signal on the current bar is Bulls Normal) or the Close price is higher than the Red area (if the signal on the current bar is Bulls Strong).

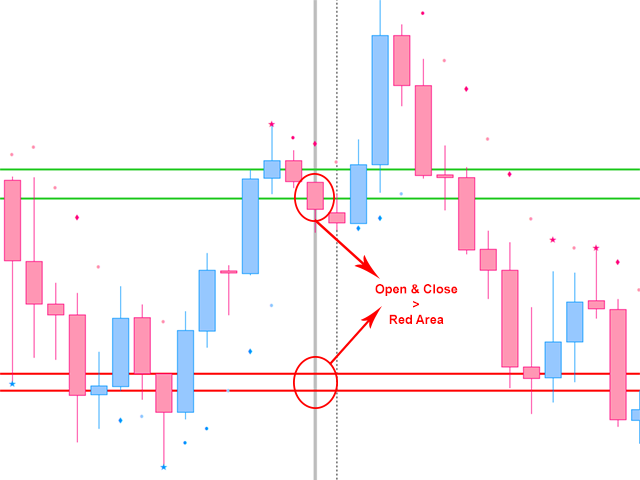

Sell checklist:

- Bears Strong or Bears Normal (preferably Bears Strong).

- On one of the previous bars, Market Maker Bears (in most cases).

- Current bar Open price is lower than the Red area (if the signal on the current bar is Bears Normal) or the Close price is lower than the Read area (if the signal on the current bar is Bears Strong).

When opening an order, it is advised to combine signals on the checklist from the current and older timeframes. It is recommended to combine signals from M5-H1 timeframes.

Close checklist:

A checklist signal from the current or lower timeframe is received.

It is recommended to close an order by a lower timeframe if the market is highly volatile and a candle on the current timeframe moves against an open order, while there is no an opposite signal on the current timeframe.