Opposite

- Asesores Expertos

- Richard Hoehne

- Versión: 1.2

- Actualizado: 30 junio 2017

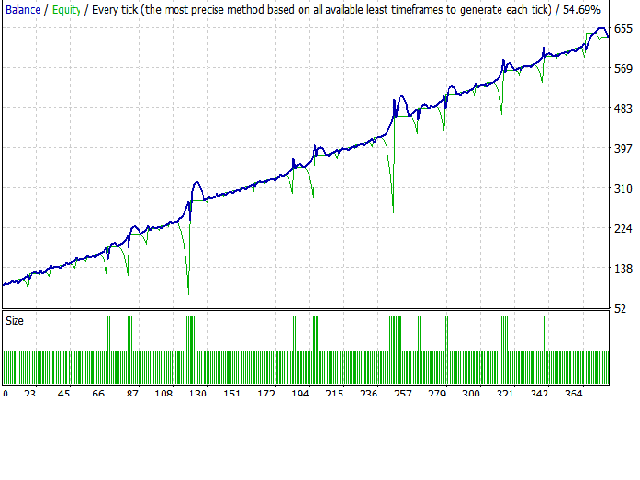

- Activaciones: 5

The EA "Opposite" is a full automated trading expert. The EA uses the hedging strategy as follows: He opens a buy and a sell position at one moment and closes one of the positions after reaching the take profit. Then he opens again two orders in two directions, but in one direction the lot size is bigger than in the other one. Thus one has two possibilities: Either one takes the profit in the direction with less lot size or one takes the profit in the direction with bigger lot size. In the last case, all positions will be closed. All further orders will be opened multiplied by a chosen factor.

Live Monitoring

https://www.mql5.com/en/signals/305467

Basic facts

- Minimum deposit: 1000 EUR / USD (for AUDCAD a smaller deposit is possible)

- Timeframe: all timeframes allowed, it does not matter

- Spread: as always, the lower the spread the better the profit

- Currency Pairs: actually all pairs are possible, but best results found with EURUSD. Pairs including JPY need a larger balance

Settings

- method: two methods are available, I recommend to choose the 2nd method, which allows closing all positions. Please check the difference by using the strategy tester.

- round: two possibilities:

- 'yes' means that a new cycle of orders is allowed

- 'no' means that the current cycle of orders will be continued until the take profit is reached, then no orders will be opened.

- Lots: initial starting lot size

- maxLot: maximum allowed lot size

- magic: magic number, for every new chart you have to use a different magic number

- multiplication: factor by which the next position will be opened

- TakeProfit

- slippage

- Percent: i.e. when set to 80%, then all positions will be closed then Equity divided by Balance is 80%.

- Per: close orders in direction of higher lot size when reaching the profit calculated by TakeProfit times Per, example: Per=0.5, TakeProfit=300, then the positions will be closed after 150 winning pips.

- add: after closing a position with take-profit, the EA adds the value to the TakeProfit. After a cycle is completed, the EA restarts with initial TakeProfit.

- SLequity: the maximum allowed loss. When Balance minus Equity is larger than SLequity the EA closes all positions.

- SLposition: EA closes a position if the loss of this position is larger as the value you have set.

My recommendations

(for balance = 1000 EUR / USD): I recommend the following settings for EURUSD or AUDCAD,

- Use Method 2!

- Round: 'Yes'

- Lots: 0.01

- multiplication: 1.1, a factor of 1 is possible too

- TakeProfit = 300 or 200 for AUDCAD

- Percent = 0

- Per = 1

- add = 50

- no SL option

Note

In a long trend, the drawdown can be high! So be careful with the multiplication factor! By a simple calculation, one can show that the minimum recommended balance is enough to "survive" the last year (01/2016-01/2017). In 2014, during the Greek crisis, the balance is not enough. Use the strategy tester for individual settings for other currency pairs!