Seven Candles for MT5

- Asesores Expertos

- Luiz Tim

- Versión: 1.3

- Actualizado: 26 noviembre 2021

- Activaciones: 5

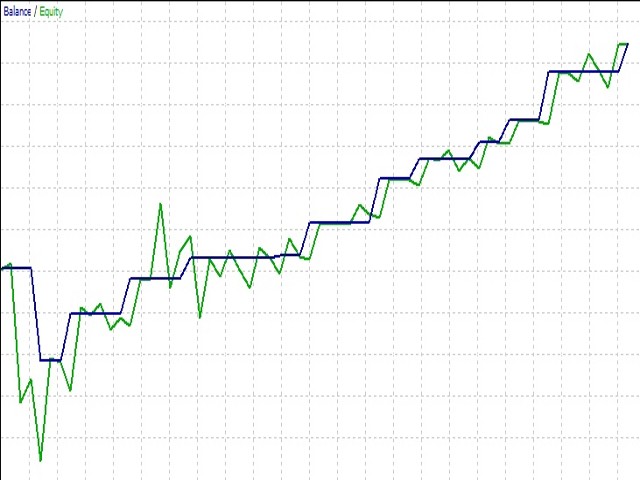

The Seven Candles is an Expert Advisor that implements a strategy originally described on the book Short Term Trading Strategies That Work by Larry Connors and Cesar Alvarez.

Developed to trade stock indexes (SP500, Down Jones, NASDAQ, BOVESPA, Nikkei, etc.), this strategy seeks for trading opportunities based on where the close price is in relation with Simple Moving Average indicator. However, in order to be triggered, a pattern between candles also must occur.

The original strategy seeks long positions on daily charts only, but the Seven Candles EA can also seek short positions as well.

Long Entry Rules

- Price is above 200 SMA.

- Lowest low of last seven candles occurred on last candle.

Short Entry Rules

- Price is below 200 SMA.

- Highest high of last seven candles occurred on last candle.

Long Exit Rules

- Highest high of last seven candles occurred on last candle.

Short Exit Rules

- Lowest low of last seven candles occurred on last candle.

This strategy boasts a 60%-75% success rate in average and works very well on trending markets. As the original strategy does not uses stop loss nor take profit (because the exit is strictly conditioned by the price behavior), the losing trades outweigh the winning ones. However, the Seven Candles EA has additional built-in features, like take profit, stop loss and trailing stop allowing it to yield different results than the original strategy.

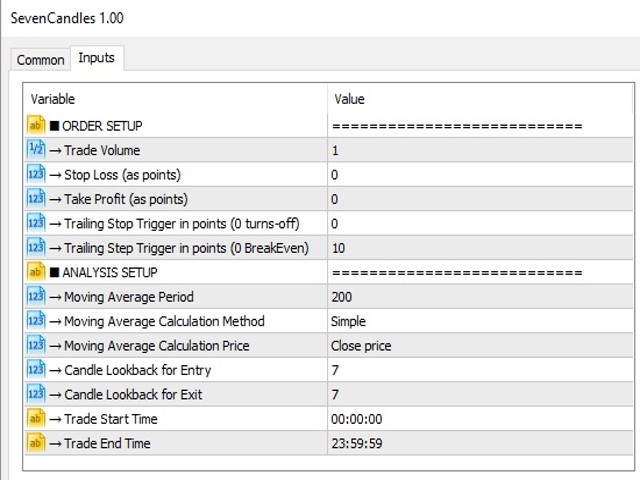

*Expert Parameters

- Order Type - List with options that inform the EA what trade type it will seek, as follows:

- LONG ONLY - EA will search only for buy opportunities.

- SHORT ONLY - EA will search only for sell opportunities.

- LONG & SHORT - EA will search for both buy and sell opportunities.

- System ID - Identifies trades opened by the EA.

- Trade Volume - Lots of each trade.

- Stop Loss (as points) - Stop Loss.

- Take Profit (as points) - Take Profit.

- Trailing Stop Trigger in points (0 turns-off) - When an opened position is on profit, informs the EA when it should perform trailing stop operations. Zero (0) value turns-off this feature.

- Trailing Step Trigger in points (0 BreakEven) - When trailing stop is going to be triggered, tells EA where it should adjust the first stop value on profit. Zero (0) value puts stop on break-even.

- Moving Average Period - Period for Moving Average Calculation.

- Moving Average Calculation Method - Informs the EA how the Moving Average should be calculated. Options are:

- Simple.

- Exponential.

- Smoothed.

- Linear weighted.

- Moving Average Calculation Price - Informs the EA what price will be used during Moving Average calculation. Options are:

- Close price.

- Open price.

- High price.

- Low price.

- Median price.

- Typical price.

- Weighted price.

- Candle lookback for Entry - Informs the EA how many candles it will analyze for entry.

- Candle lookback for Exit - Informs the EA how many candles it will analyze for exit.

- **Trade Start Time - Start time to seek for new trading opportunities.

- **Trade EndTime - End time to seek for new trading opportunities.

(*) Using default parameters value, the EA will behave exactly as the original strategy described on the book.

(**) Trade time does not interfere with management of opened positions. Also, using default time values the EA will search trades while the market is opened.

This EA works on any pair/timeframe.