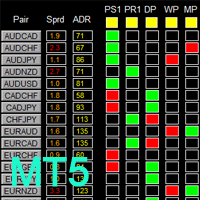

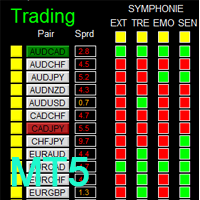

Dashboard Super Risk Reward Panel MT5

- Utilidades

- Wang Yu

- Versión: 1.1

- Actualizado: 23 noviembre 2021

- Activaciones: 5

如果产品有任何问题或者您需要在此产品上添加功能,请联系我

Contact/message me if you encounter any issue using the product or need extra feature to add on the base version.

To access the free demo version, please re-direct to this LINK.

To access the single pair version, please re-direct to this LINK.

There are two critical components in a profitable trading system, one is entry (place an order), and another one is exit (close an order). You can exit by time: closing order after London Close for example. You can also exit by position: closing an order when price reaches a certain support/resistance level.

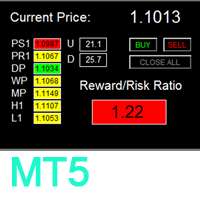

Dashboard Super Risk Reward Panel MT5 is an intuitive and handy graphic tool to help you to:

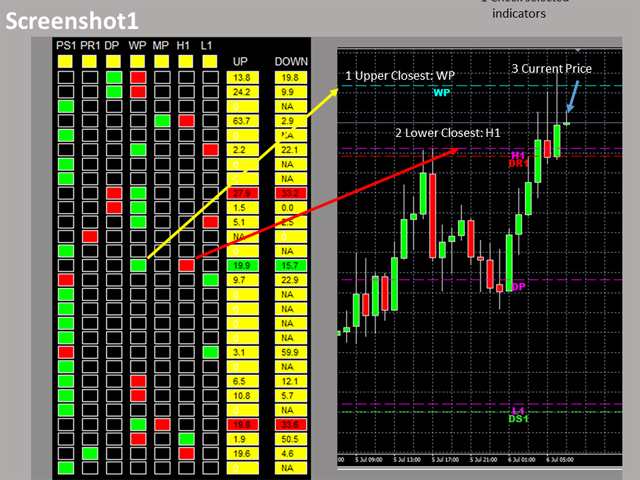

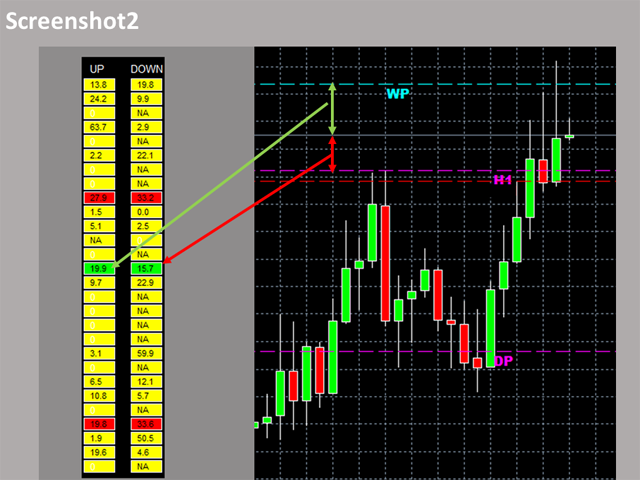

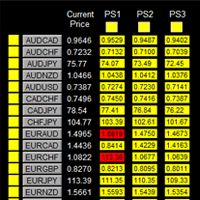

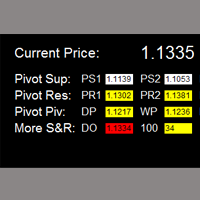

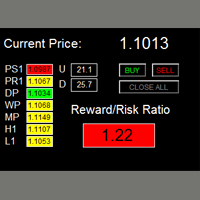

- Locate and highlight the closest upper and lower support/resistance level (among the 7 critical support/resistance level, which are pivot S1, pivot R1, daily pivot, weekly pivot, monthly pivot, previous daily high, and previous daily low) to the current price. See screenshot2.

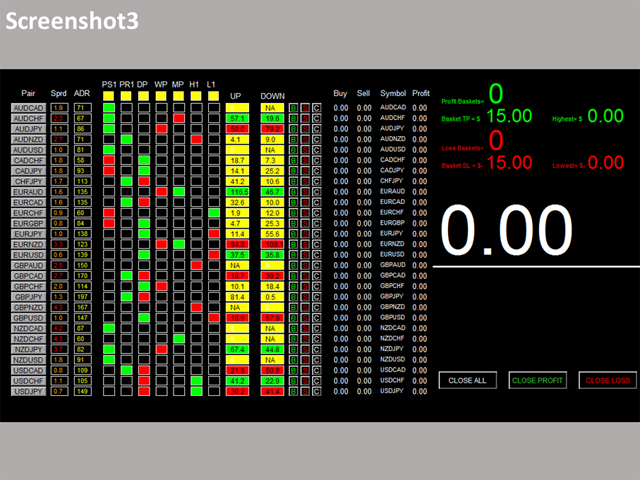

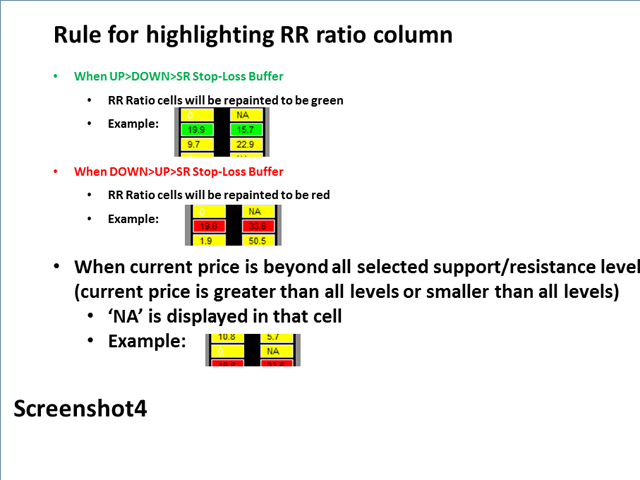

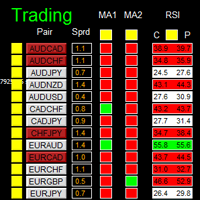

- Find the profitable RR ratio entry level with highlight by calculating and comparing the distance between upper closest to current price and distance between lower closest to current prices. See screenshot3

- Click one buy/sell button to place buy and/or sell order with TP and SL set at the above level, which gives you and good RR ratio.

Features

- User is able to select support and resistance levels for RR ratio generating.

- Adjustable indicator panel position

Important Action Items before Using Dashboard

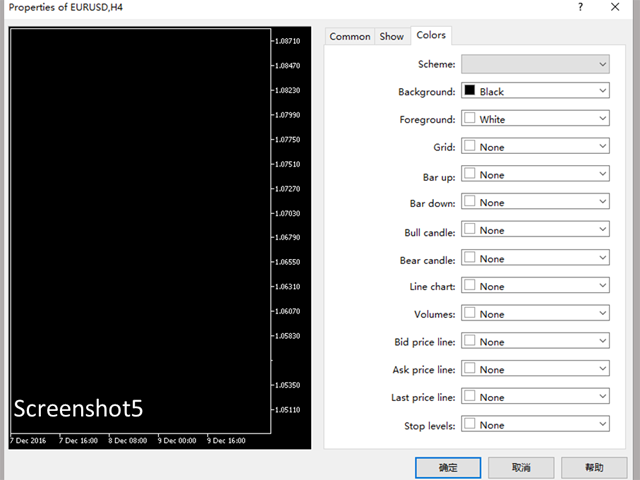

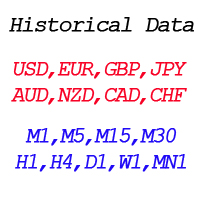

- For the first time loading Dashboard, it may take 3-5 minutes to download historical data. For subsequent loading, it only takes a few seconds.

- Make sure you have all 28 symbols in Symbol window (if your broker offers 28 pairs).

Input Parameters

- Use Pivot Support1

- Use pivot support for RR ratio calculation

- Same rule applied to the following 6 support/resistance levels.

- Use Pivot Resistance1

- Use Daily Pivot

- Use Weekly Pivot

- Use Monthly Pivot

- Use Previous Daily High

- Use Previous Daily Low

- SR Stop-Loss Buffer

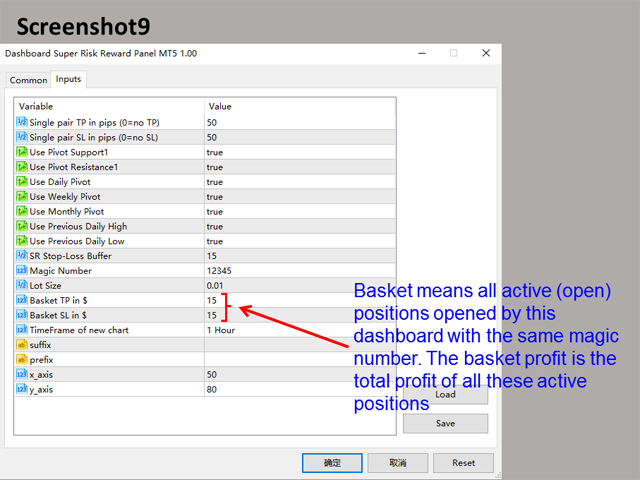

- Magic Number

- Lot Size:

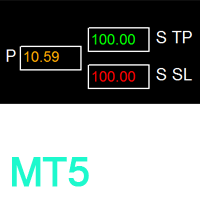

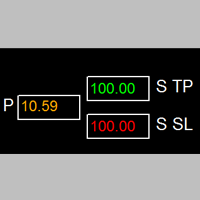

- Basket TP in $

- Basket SL in $

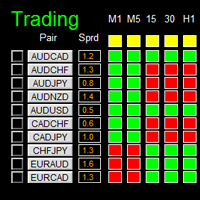

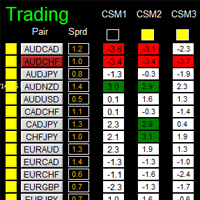

- Max Spread: once spread exceeds max spread, spread of that pair will be highlighted in red.

- Suffix: suffix string of your symbol. i.e.: your symbol is ‘EURUSDx’ instead of ‘EURUSD’, input ‘x’ in suffix cell, leave prefix cell blank

- Prefix: prefix string of your symbol

- X_axis:dashboard x position

- Y_axis: dashboard x position

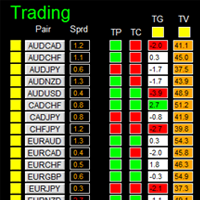

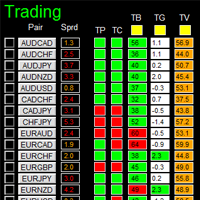

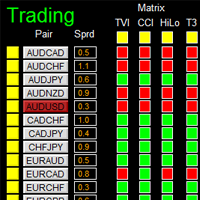

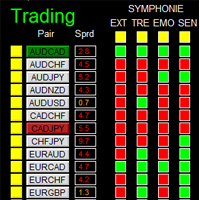

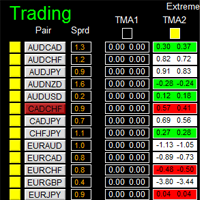

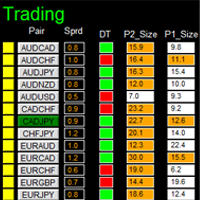

Dashboard Objects

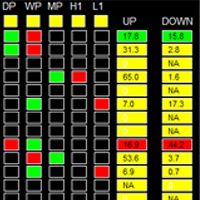

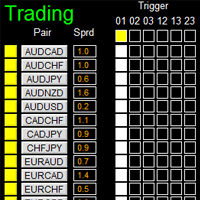

Please refer to screenshot 6 to 8.

- Pair Tick Button: Click once to active the corresponding pair for trading. Click once more to de-active.

- Spread column: show current spread of each pair.

- SR Status Panel: indicates which Support/Resistance level is selected for RR ratio calculation

- Upper Closest Column: cell is repainted to be green to indicate that this support/resistance level is the upper closest level

- Lower Closest Column: cell is repainted to be red to indicate that this support/resistance level is the lower closest level

- Up Column: indicate the distance between upper closest SR level to current price

- Down Column: indicate the distance between Lower closest SR level to current price

- Buy Button: place buy order with upper closest SR level as TP, and lower closest SR level as SL

- Sell Button: place sell order with lower closest SR level as TP, and upper closest SR level as SL

- Close Button: close all positions of corresponding pair

- Buy Volume Column

- Sell Volume Column

- Symbol:

- Profit Column

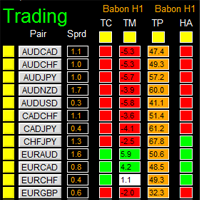

- Profit Baskets: calculate the number of baskets hitting TP

- Basket TP: Basket take profit

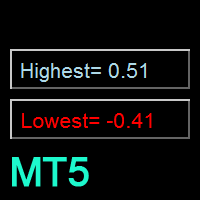

- Basket Highest: the maximum profit that current basket ever reach

- Loss Baskets: calculate the number of baskets hitting SL

- Basket SL: Basket stop loss

- Basket Lowest: the maximum loss that current basket ever reach

- Current Basket Profit: Current basket profit

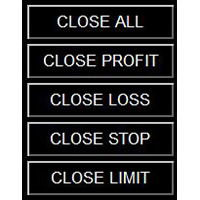

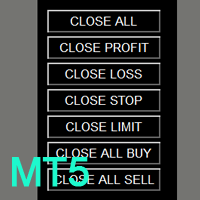

- Close All: close all positions

- Close Profit: close all positions in profit

- Close Loss: close all positions in loss