Choppiness Index

- Indicadores

- Libertas LLC

- Versión: 1.4

- Actualizado: 1 diciembre 2021

- Activaciones: 20

"Wouldn't we all love to reliably know when a stock is starting to trend, and when it is in flat territory? An indicator that would somehow tell you to ignore the head fakes and shakeouts, and focus only on the move that counts?"

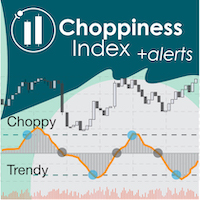

The Choppiness Index is a non-directional indicator designed to determine if the market is choppy (trading sideways) or not choppy (trading within a trend in either direction). It is an oscillating indicator between -50 (very trendy) and +50 (very choppy).

There are many strategies for trading using the Choppiness Indicator:

1. Buy or sell the breakout rebounding from extreme Choppiness Index values

- When CI moves below +11.8 (choppy to trendy) after rebounding from a high CI value, this may indicate upcoming trend. Look for confirmation of direction in the price

- For a more conservative trade, wait until the CI moves past 0 (shown in screenshot)

2. Ride the trend with the Choppiness Index (when to exit, and when not to)

- If the price is trending but the CI has not reached above the +11.8 threshold more than three times, then the trade is likely to continue. If CI crosses +11.8 three times or more, then the trend is likely to stop

3. Refine your trading strategy's performance by confirming current market conditions BEFORE entering a trade. Many trading strategies perform best under specific market conditions. Quantitatively pick your desired amount of choppiness/trendiness using the CI.

Additional Details

- Thresholds are commonly used with the Choppiness Index to determine choppy versus trendy movements. Common values are popular Fibonacci Retracements: +11.8 for the high (choppy) threshold and -11.8 for the low (trendy) threshold

- The Choppiness Index pairs well with trend lines and traditional pattern recognition

Alerts

Email, message, and sound alerts can be turned on/off for the following events. Please note that email recipient and SMTP information should be specified in MetaTrader 4/options before using email alerts.

- Choppiness Index is crossing 0

- Choppiness Index is above user-selectable upper (choppy) threshold (Default=11.8)

- Choppiness Index is below user-selectable lower (trendy) threshold (Default=-11.8)

Parameters

- CHOP period (Default=14): number of bars used for indicator calculations

- CHOP smoothing (Default=1): optional smoothing period applied to Choppiness Index. 1=no smoothing, >1 = increased smoothing (using this value as smoothing period)

- Plot circles when CI > upper threshold: True = crossovers are highlighted by circles

- Plot circles when CI < lower threshold: True = crossovers are highlighted by circles

- Plot circles when CI crosses zero: True = crossovers are highlighted by circles

- Turn on/off all alerts: True = alerts are allowed, false = all alerts are paused

- Alert when CI crosses 0: If true, alerts when Choppiness Index value crosses 0

- Alert when CI is above upper threshold: If true, alerts when Choppiness Index value is above user-defined upper (choppy) threshold

- Upper alert threshold (Default=11.8): User-defined upper alert threshold

- Alert when CI is below lower threshold: If true, alerts when Choppiness Index value is below user-defined lower (trendy) threshold

- Lower alert threshold (Default=-11.8): User-defined lower alert threshold

- Turn on alerts message: Message box alert

- Turn on alerts sound: Sound alert

- Turn on alerts email: Email alert

Thanks