MFI Breakout Dashboard Multi Analyzer

- Utilidades

- Dominik Mandok

- Versión: 1.1

- Actualizado: 30 noviembre 2021

- Activaciones: 10

MFI Breakout Dashboard is a tool for multiple currency pairs analysis at the same time in terms of breakout from Oversold or Overbought Zone.

Money Flow Index (MFI) uses both price and volume to measure buying and selling pressure. MFI is also known as volume-weighted RSI (Relative Strength Index).

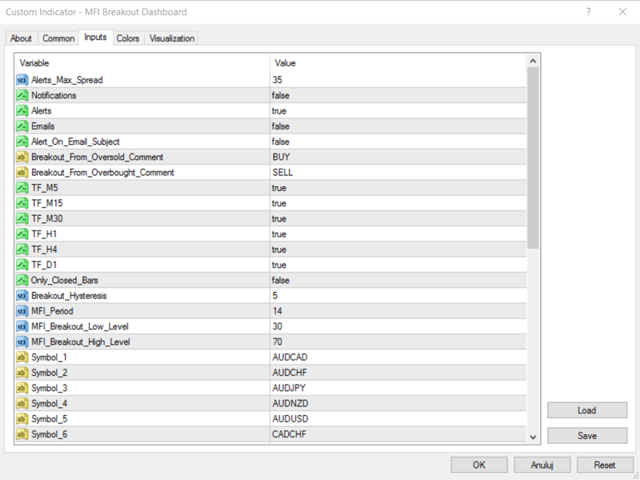

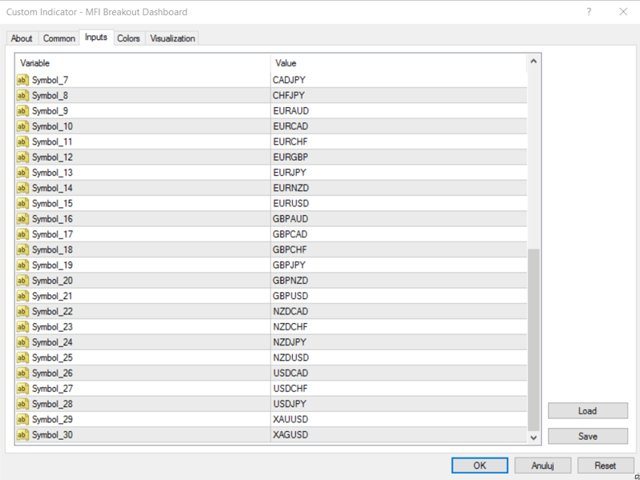

The number of displayed symbols is 30 and the name of each symbol can be edited in the parameters.

The analyzer is perfect for alert notifications, push notifications and email alerts. We can also select timeframes to receive notifications from and set maximum spread, at which the notifications will come.

The most important parameters are period of Money Flow Index (MFI_Period) and two MFI Levels (MFI_Breakout_Low_Level, MFI_Breakout_High_Level). We get notifications above low and below high level if the value of MFI previously exceeded high or low level increased or decreased with value of hysteresis (Breakout_Hysteresis). That gives us opportunity to filter bad/false signals from fluctuations of the MFI value.

The best explanation will be an example.

We set three parameters:

- MFI_Breakout_Low_Level=20

- MFI_Breakout_High_Level=80

- Breakout_Hysteresis=5

Oversold - BUY (MFI goes from Oversold to Neutral Zone):

When the value of MFI appears below or is equal to 15 (MFI_Breakout_Low_Level - Breakout_Hysteresis), the indicator waits until MFI_Breakout_Low_Level is crossed and then triggers the alert. In case of overbought, the case is opposite.

Another parameter is Only_Closed_Bars. If True, the indicator analyzes only values from closed candles and alerts come after candles are closed. If False, values are analyzed in real time and alerts come immediately from current values. With Only_Closed_Bars, we can filter signals, which I call "noise", between closures of candles.

For every alert, we can add comments: Breakout_From_Oversold_Comment (default: BUY) and Breakout_From_Overbought_Comment (default: SELL), which are embedded between timeframe and MFI period. Information received in the alerts are: symbol, timeframe, comment, MFI (with given period) breakout from Oversold/Overbought zone at MFI level, e.g.:

EURUSD M15 BUY - MFI (14) breakout from Oversold zone at 20.

If we leave blank fields in these parameters, we will get alerts without comments.

We can also choose whether the whole text of email alert is in the body or in the subject of email message (Alert_On_Email_Subject). When set to False, alerts look like:

- Subject: GBPUSD

- Body (comments on): M15 SELL - MFI (14) breakout from OverBought zone at 70

If we set Alert_On_Email_Subject to True, the whole text will be in subject.

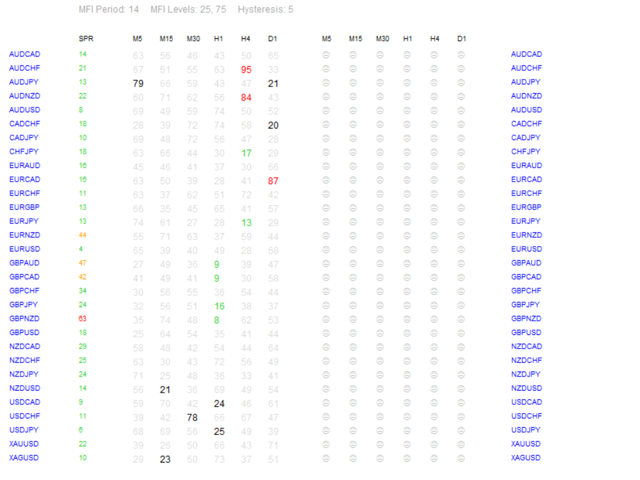

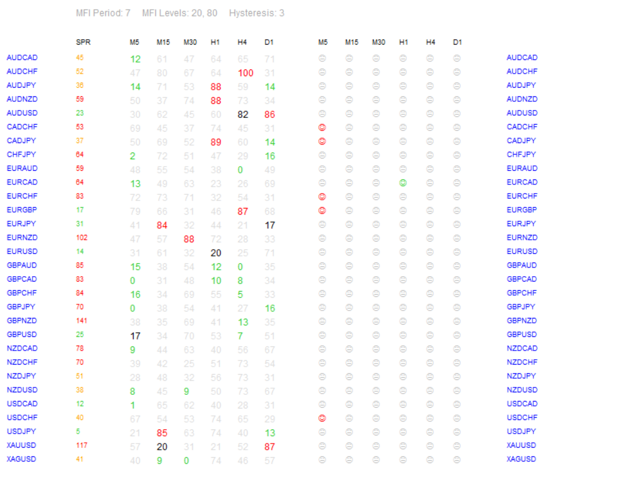

The four actual parameters are displayed in the dashboard header: MFI Period, MFI Breakout Low and High Level and Hysteresis.

Displayed values of MFI are rounded to the nearest integer.

- Color green means that value of MFI is below MFI_Breakout_Low_Level decreased with Breakout_Hysteresis (Oversold Zone).

- Red - MFI is above MFI_Breakout_High_Level increased with Breakout_Hysteresis (Overbought Zone).

- Black - MFI is between MFI_Breakout_Low_Level-Breakout_Hysteresis and MFI_Breakout_Low_Level or between MFI_Breakout_High_Level+Breakout_Hysteresis and MFI_Breakout_High_Level (Hysteresis Zone).

- Gray - MFI is between Low Level and High Level (Neutral Zone).

We can set maximum spread at which the notifications will come with Alerts_Max_Spread. Spread values can have different colors. When value is lower or equal to maximal spread, the color is green, between 1 and 1.5 times higher - orange and above 1.5 times higher - red.

I suggest to make a new template with "MFI Breakout Dashboard" and scheme without colors ("None") with Background and Foreground set to "White".

Remember, no one except yourself is responsible for any investment decision made by you.

You are responsible for your own investment research and investment decisions.

Good luck!

Купил, в итоге алертов нет по указанным мной уровням. Upd. Ошибся, понял принцип индикатора.