SMART MARTINGALE EA

1. OVERVIEW

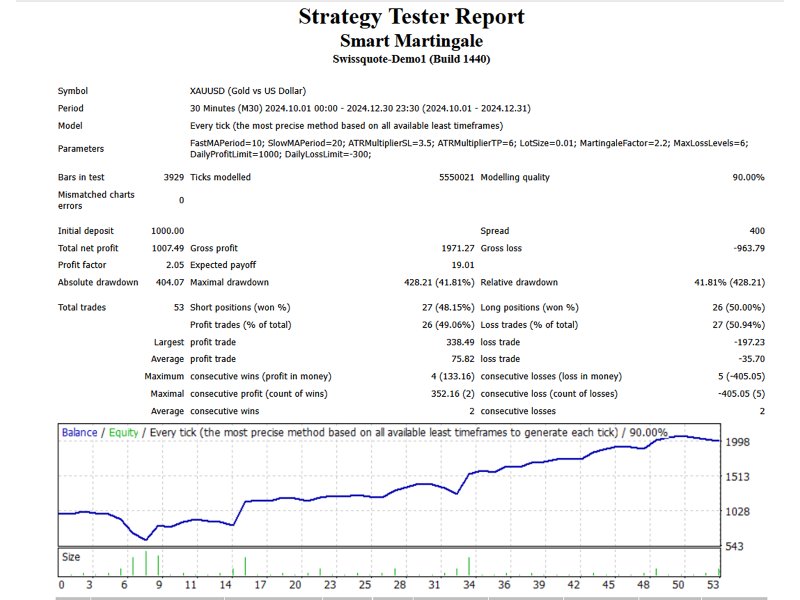

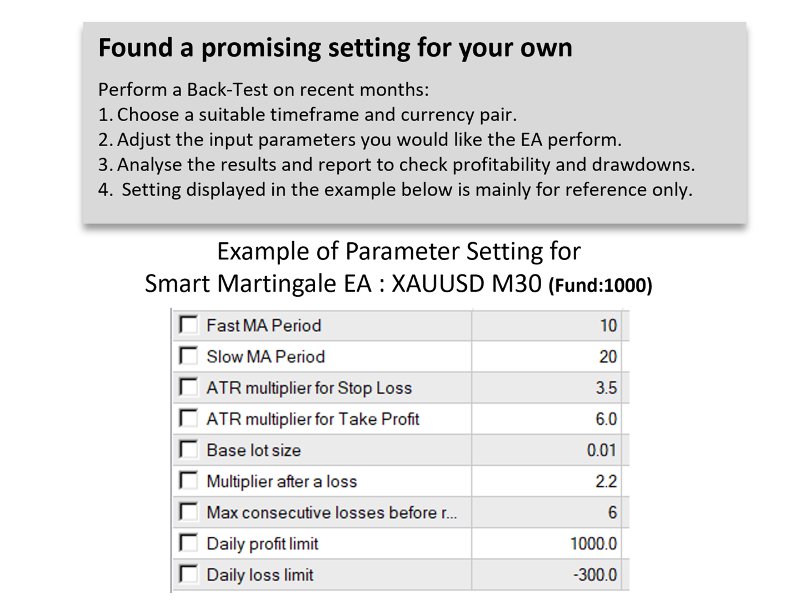

The Smart Martingale EA is designed to trade using a trend-following Martingale strategy that adjusts trade sizes dynamically based on market conditions. Unlike traditional Martingale systems that open random trades, this EA filters trades based on Moving Average crossovers to follow market trends. Additionally, it incorporates ATR-based Stop-Loss & Take-Profit for dynamic trade exits and risk control.

2. Trading Strategy

ØThe EA follows a trend-following Martingale approach:

ØTrade Entry Condition: BUY when Fast MA (10) crosses above Slow MA (50) (Bullish Signal).SELL when Fast MA (10) crosses below Slow MA (50) (Bearish Signal).

ØLot Sizing (Martingale Logic): If the previous trade was a loss, the lot size increases using a controlled Martingale factor. If the previous trade was a win, the lot size resets to the base lot size.

ØTrade Exit (Dynamic SL & TP Based on ATR). Stop-Loss (SL) = 2× ATR(14) → Adapts to market volatility. Take-Profit (TP) = 3× ATR(14) → Adjusts dynamically to market conditions.

3. Best Timeframes for Trend-following EA

Ø H1 (1-Hour) – Best for swing trading with moderate trade frequency.

Ø H4 (4-Hour) – Suitable for catching medium-term trends with reduced market noise.

Ø D1 (Daily) – Ideal for long-term trend following, minimizing false signals.

ØLower timeframes (M1, M5, M15) can generate too many signals, leading to false breakouts and overtrading.

4. Risk Management

Ø Important Considerations Before Using This EA:

ØUse a low-risk lot size to start (e.g., 0.01 lots per $1,000 balance).

ØTest in a demo account before using it on a live account.

ØRecommended Timeframes: H1, H4 (Avoid M1/M5 due to noise).

ØBest Trading Pairs: XAUUSD, EURUSD, GBPUSD, USDJPY (Trending pairs work best).