Reverse Martingale EA

- Asesores Expertos

- Yeoh Kia Gee

- Versión: 1.20

- Activaciones: 5

Reverse Martingale EA

1. OVERVIEW

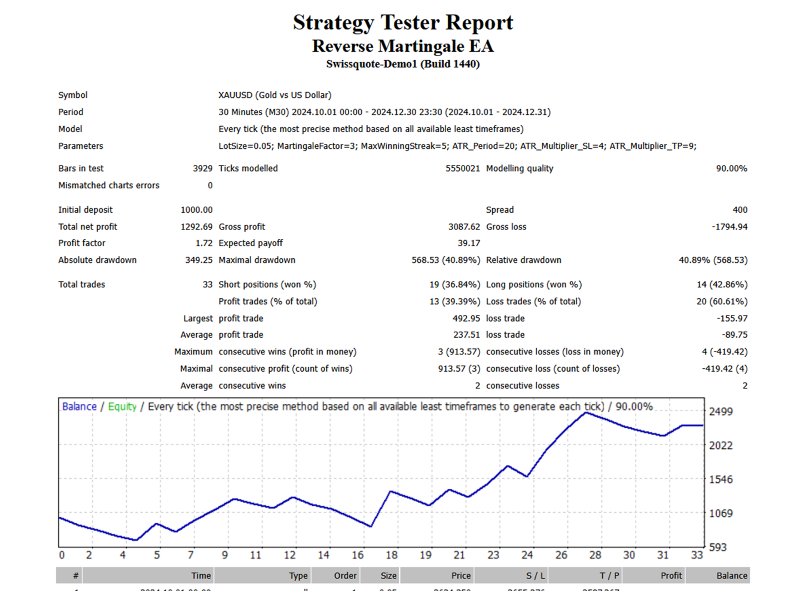

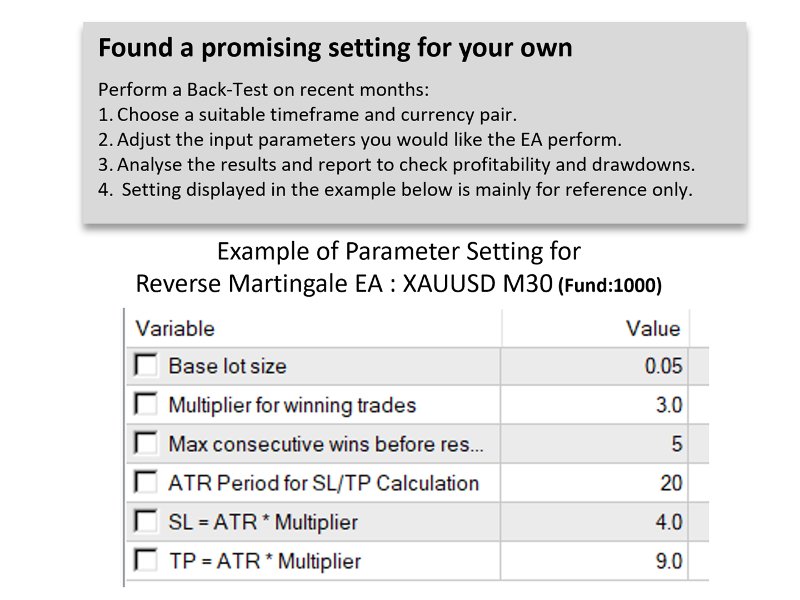

The Reverse Martingale EA is a profit-maximizing trading system that increases lot size after winning trades while resetting to the base lot size after a losing trade. This strategy allows traders to maximize gains during winning streaks while ensuring minimal exposure during losses. Unlike the traditional Martingale strategy, which increases lot size after a losing trade (high risk), the Reverse Martingale approach compounds profits safely by reinvesting only when the market is favorable. This EA also features ATR-based stop-loss and take-profit, time filtering, and max winning streak control, making it one of the safest ways to apply Martingale principles.

2. Unique Features

ØATR-Based Stop-Loss & Take-Profit – Adapts dynamically to market conditions.

3. Trading Logic

ØRisk Management: ATR-based SL/TP dynamically adjusts risk levels. Max Trades Control prevents overexposure in the market.

📌 Best Timeframes for the EA:

✔ M30 (30 Minutes) – Ideal for short-term compounding.

✔ H1 (1 Hour) – Captures trend continuation.

✔ H4 (4 Hours) – Best for swing trading strategies.

📌 Trending Currency Pairs (Best for Breakouts): EURUSD / GBPUSD / USDJPY/ XAUUSD (Gold)