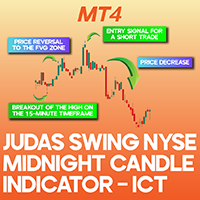

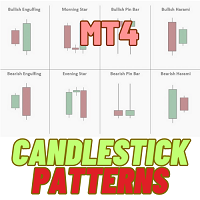

Judas Swing NYSE Midnight Candle Indicator ICT MT4

- Indicadores

- Eda Kaya

- Versión: 1.11

Judas Swing Indicator ICT MT4

The Judas Swing Indicator for MetaTrader 4 is a technical analysis tool designed to detect price reversals. It assists traders in pinpointing ideal trade entries and exits by identifying misleading price movements that often precede significant market shifts.

Indicator Overview

| Category | ICT - Smart Money - Liquidity |

| Platform | MetaTrader 4 |

| Skill Level | Advanced |

| Indicator Type | Continuation - Reversal |

| Timeframe | 1 Minute - 15 Minutes |

| Trading Style | Fast Scalping - Scalping |

| Market | Forex - Cryptocurrency |

Judas Swing patterns typically emerge between midnight and 5:30 AM New York time. During this window, prices momentarily move against the prevailing trend before reverting to their main direction.

This indicator highlights Change of Character (CHoCH) and retracements to Fair Value Gap (FVG) areas with a gray arrow. When the necessary criteria are met, it signals buy opportunities with a green arrow and sell setups with a red arrow.

Judas Swing Indicator in Bullish Markets

On a 1-minute GBP/JPY chart, an upward CHoCH occurs after liquidity absorption. Between 00:00 and 05:00 New York time, the indicator detects FVG zones or order blocks, confirming a buy signal.

Judas Swing Indicator in Bearish Markets

Following a liquidity absorption and a zone breakout, if a downward CHoCH is identified (between 00:00 and 05:00 New York time), as observed in the AUD/USD pair, the Judas Swing Indicator highlights an FVG zone or order block, prompting a sell signal.

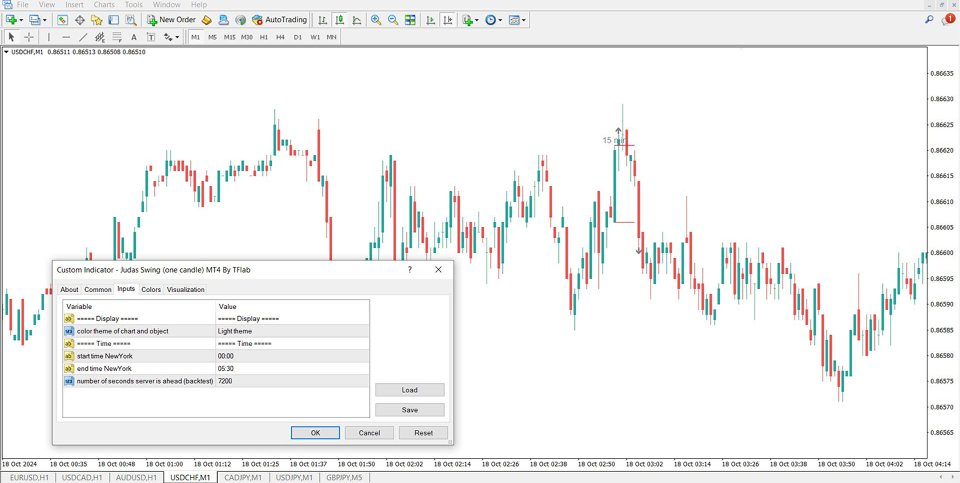

Indicator Configuration

- Chart and object colors: Customizable background and object colors.

- Start time (New York): Market open at 00:00 New York time.

- End time (New York): Market close at 05:30 New York time.

- Server time offset (Backtesting): Default setting is 7200 seconds.

Final Thoughts

The Judas Swing Indicator for MetaTrader 4 is a valuable asset for identifying price reversals and optimizing trade decisions. With its customizable parameters, it adapts to different strategies, improving trading precision.

A buy signal is triggered in an uptrend when liquidity is absorbed and an upward CHoCH occurs. Conversely, a sell signal appears in a downtrend following a downward CHoCH confirmation.