Market structure indicator bos choch MT5

- Indicadores

- Eda Kaya

- Versión: 1.11

Market Structure Indicator BOS CHOCH MT5

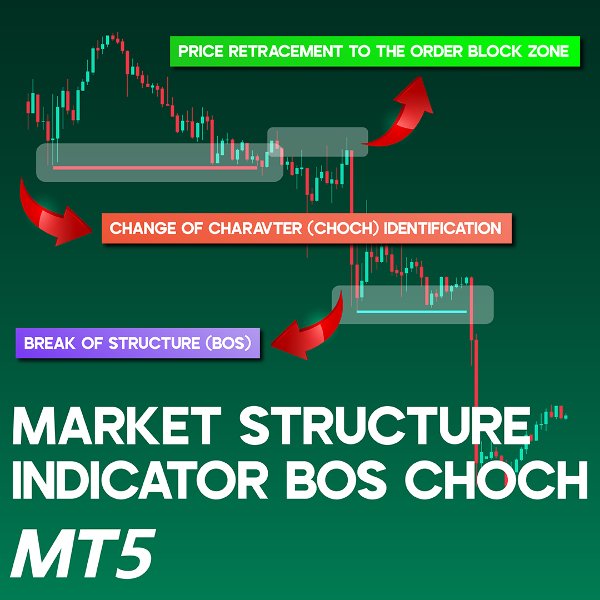

The Market Structure Indicator (BOS-CHOCH) is a specialized ICT-style tool designed for MetaTrader 5 (MT5). This indicator detects both primary and secondary market character shifts (CHOCH) and breaks in structure (BOS) across multiple levels, offering valuable insights for ICT and Smart Money traders. By helping traders analyze price behavior, it enhances market structure recognition and provides more precise trade opportunities.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Market structure indicator bos choch MT4 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Money Management: Easy Trade Manager MT4

Market Structure Indicator (BOS-CHOCH) Overview

Below is a summary of the key specifications of this indicator:

| Category | ICT - Smart Money - Liquidity |

| Platfom | MetaTrader 5 |

| Skill Level | Advanced |

| Indicator Type | Continuation - Strength - Breakout |

| Timeframe | Multi-Time Frame |

| Trading Style | Scalping - Day Trading - Intraday Trading |

| Markets | Forex - Stocks - Indices |

Indicator at a Glance

The Market Structure Indicator (BOS-CHOCH) is an essential tool for ICT traders aiming to analyze market structure. This indicator efficiently marks Change of Character (CHOCH) zones, distinguishing between primary and secondary shifts, alongside Breaks of Structure (BOS) for a clearer understanding of price movements. As a result, traders gain deeper insights into trend dynamics, allowing for more informed decision-making.

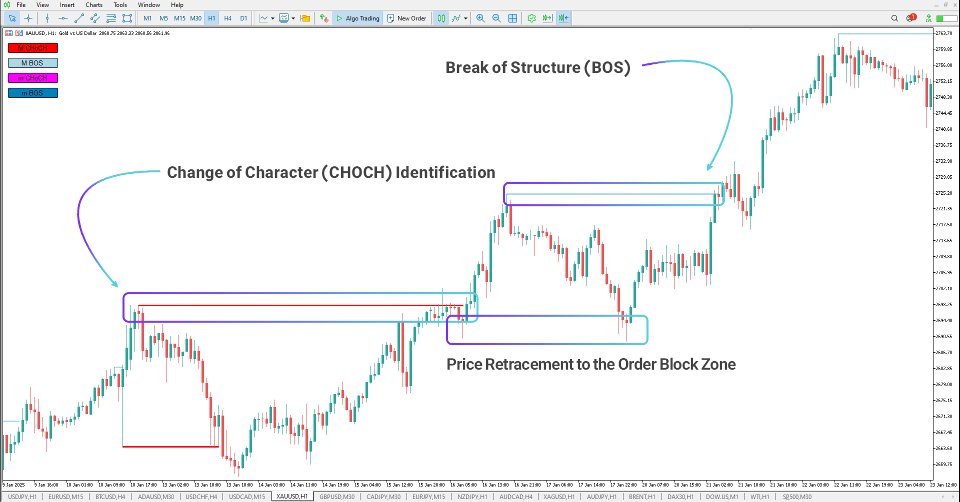

Bullish Change of Character

On a 1-hour Gold chart, the Market Structure Indicator (BOS-CHOCH) signals a transition from a bearish to a bullish market phase. It highlights CHOCH occurrences by drawing a red trendline, alerting traders to the market shift.

After identifying the change of character, traders can anticipate a price pullback to the order block that initiated the transition. Once the price revisits this level, an upward movement follows, reinforcing the emerging bullish trend.

Following this pattern, the Break of Structure (BOS) confirms the trend continuation, leading to a strong upward movement in price, which often results in a more aggressive bullish rally.

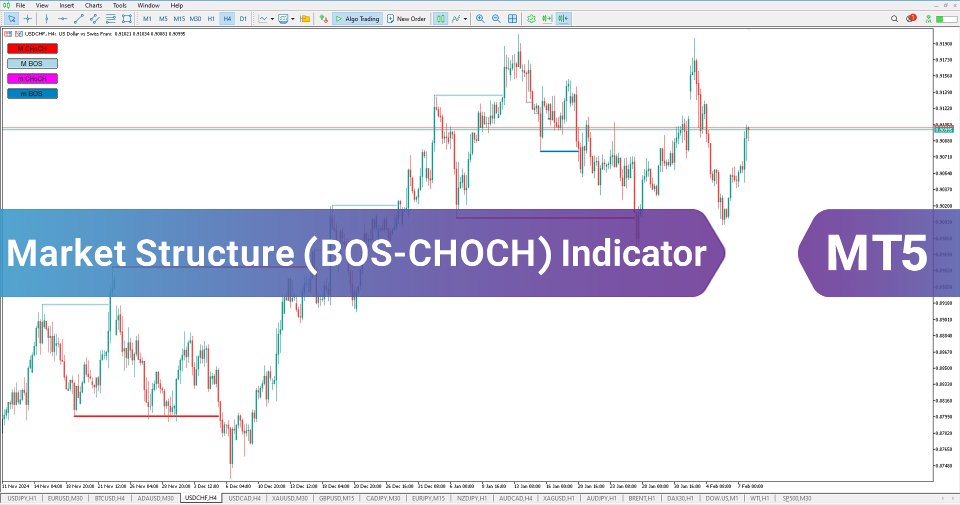

Bearish Market Structure

On a 15-minute USD/CAD chart, the Market Structure Indicator detects a market shift alongside a break in structure. CHOCH is marked in red, while BOS is represented in blue, giving traders a structured view of price dynamics.

This tool is particularly beneficial for ICT and Smart Money traders, allowing them to analyze price behavior more accurately and spot potential trade setups. By leveraging this indicator, traders gain a refined perspective on market conditions and execute strategies with greater precision.

Market Structure Indicator (BOS-CHOCH) Settings

Below is an overview of the key settings available within the Market Structure Indicator (BOS-CHOCH):

General Settings:

- Candle Count Selection: Defines the number of historical candles used for market structure analysis.

- Trend Calculation Mode (ZigZag or Candle): Allows users to select between ZigZag-based or candle-based trend calculations.

Conclusion

The Market Structure Indicator (BOS-CHOCH) is a powerful Smart Money trading tool in MetaTrader 5 (MT5), helping traders identify market shifts and trading opportunities through trendline visualization.

By detecting Change of Character (CHOCH) and marking it with red lines, traders gain clearer insights into price trends. Additionally, Break of Structure (BOS) is highlighted with blue trendlines, offering a visual representation of trend shifts and liquidity zones.

With its ability to pinpoint both primary and secondary structural changes, this indicator empowers traders to analyze liquidity areas, order blocks, and key reversal points, ultimately improving trade accuracy and market understanding.