Slippery Slope

- Asesores Expertos

- Mikhail Kontsevoy

- Versión: 1.0

- Activaciones: 5

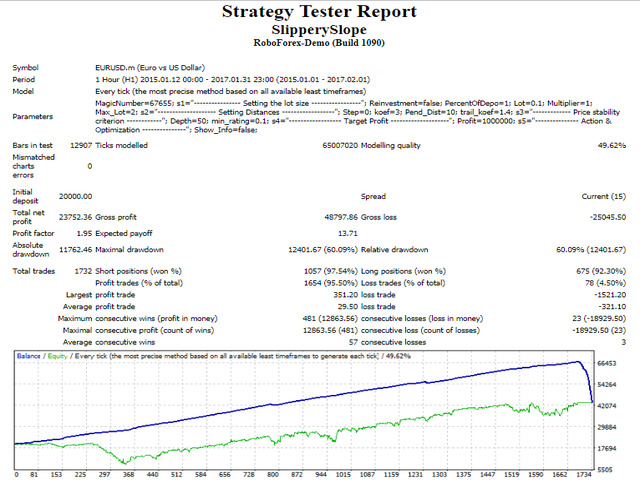

Grid Expert Advisor with floating step. The strategy of this EA is based on the main idea of trading - "Buy Low & Sell High". Pending orders "slip" behind the price in order to open a buy or sell order at an optimal price. The EA has several tactical techniques to reduce the loss.

Features

Grid Expert Advisors have a serious drawback. It consists in the fact that there is a high risk of the deposit drawdown as a result of imbalance in a large number of BUY or SELL orders.

This EA contains protective tactics to reduce this risk.

- Orders are opened in the direction of price movement at the market price at the distance of Pending Distance from each other. Pending orders are placed in the opposite direction, which follow the price at the distance of Pending Distance+Step+Order Quantity Factor *("weight coefficient").

- To avoid losses in case of sharp price movements (for example, upon the announcement of the Brexit referendum results), orders will be opened only if the price has stabilized. This mode can be managed using the Deep Analysis and Factor of Stability parameters.

- In the case of a sharp price reversal, profitable orders are closed by trailing stop.

In the directory <MT4 terminal>\MQL\Files, the EA creates a configuration file SlipperySlope<Symbol>.txt

Recommendations (with default parameters)

- 0.01 lot per $2000 (for a cent account, 0.1 lot per $200 or 20000 cents) for one currency pair.

- Recommended pairs: EURUSD, AUDUSD, NZDUSD, USDCHF.

- Period: H1.

Warning

This Expert Advisor is unlikely to bring instant profit with the default parameters. Therefore, patience must be exercised.

Parameters

- MagicNumber - magic number.

- Reinvestment - trade a percentage of the deposit. Related to the value of Percent Of Depo.

- Percent Of Depo - lot size calculated as a percentage of the free margin value.

- Lot - initial lot size, if Reinvestment = false.

- Multiplier - lot multiplier.

- Maximum Lot Size - the maximum allowed lot size. If Reinvestment=true, the value of Maximum Lot Size is indexed in proportion to the value of Percent Of Depo and calculated according to the formula: Maximum Lot Size *Lot (depending on PercentOfDepo)/Lot.

- Use Step - type of the step when moving pending orders (off - disabled, mode(1) - "weight coefficient" is equal to the number of orders of this type, mode(2) - "weight coefficient" depends on the volumes, Order Quantity Factor is calculated automatically).

- Step - the distance (step) in points the price must pass to move the pending order, if Order Quantity Factor = 0. The general formula for calculating the step: Step + Order Quantity Factor * ("weight coefficient").

- Order Quantity Factor - coefficient for multiplication ("weight coefficient"). It is included in the formula for calculating the step.

- Pending Distance - the distance in points between the price and the pending orders. This is also the distance in points after which orders are opened at the market price.

- Trailing stop factor - parameter for managing trailing stop of multiple orders. The higher the value, the faster and closer the trailing stop moves to the price.

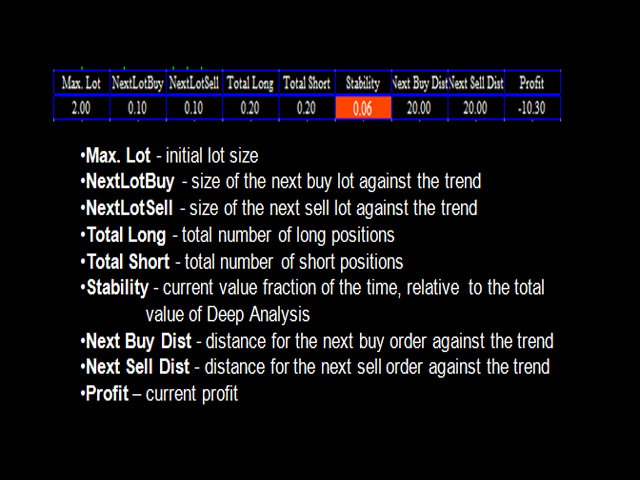

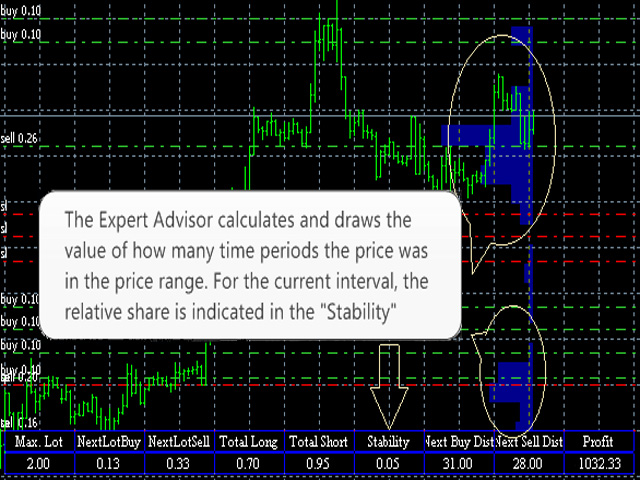

- Deep Analysis - the number of time periods to consider in calculation of the price stability in the price ranges of Pending Distance multiples. The recommended value is 50.

- Factor of Stability - threshold value of the time relative to the total value of Deep Analysis, during which the price must be within the range of Pending Distance for the price to be considered static. This parameter applies only to the type of orders that are more numerous.

- Profit - the amount of profit to close the grid of orders. If Reinvestment=true, the value of Profit is indexed in proportion to the value of Percent Of Depo and calculated according to the formula: Profit *Lot (depending on PercentOfDepo)/Lot.

- Action - Working (the EA is active); Pause (the EA is suspended); Close orders and Pause (all orders are force closed and the EA operation is suspended)

- Show Info – display information on the screen. Set to false during optimization.

- Optimization – real (consider every tick), opt(n) (consider ticks only every “n”-th second). The higher the value of “n”, the lower the quality of testing.