MS A pattern at the resistance or support level

- Asesores Expertos

- Dmitrii Orlovskii

- Versión: 1.2

- Actualizado: 7 febrero 2025

- Activaciones: 5

Signal - https://www.mql5.com/en/signals/2286646?source=Site+Signals+My trading since February. The risk is 0.25% per transaction from the deposit.

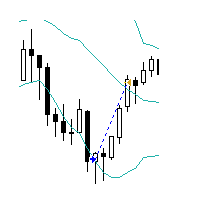

The Expert Advisor searches for 16 patterns of 4 bars at a strong support or resistance level. The levels are being searched on a higher timeframe.Moreover, patterns can be on M1, and levels are taken from M5 or M15. As testing has shown, levels from different timeframes are rarely duplicated, i.e. different returns are obtained. Therefore, the set files are separate and the Expert Advisor distinguishes between open transactions on Magik.

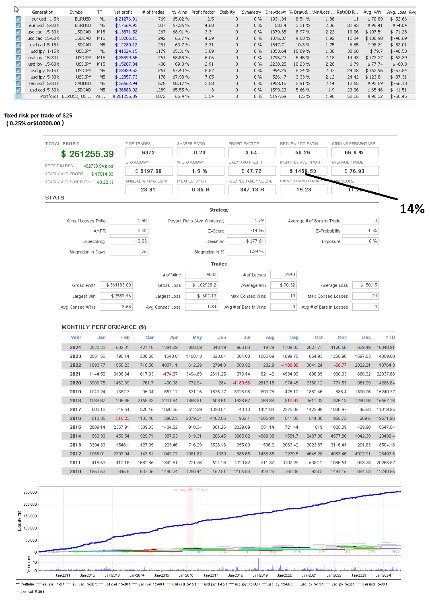

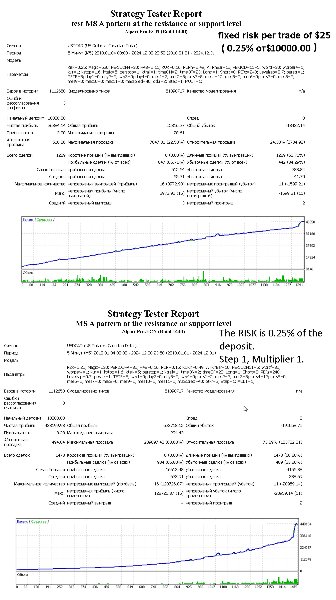

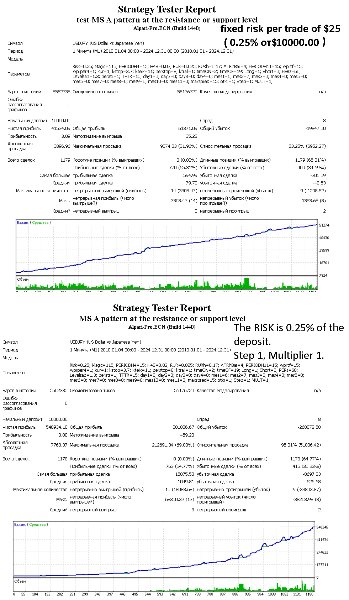

The testing was conducted over the period of 15 years 2010-2024(12) with a fixed risk of $25 per trade (test), which is the equivalent of 0.25% of $10,000 dollars (or 2.5% of $1,000). The fixed risk allows you to see the correct operation of the bot. In this case, the lot is not fixed, but is calculated from the stop loss (grid step). With the simultaneous operation of the bot on all currency pairs with attached set files, the average return for 15 years was 14% per month with a risk of 0.25%. The risk can be changed in the settings.

Instead of a stop loss, a grid is set up. The same bot with a stop loss taken for https://www.mql5.com/en/market/product/130136?source=Site+Market+Product+From+Author

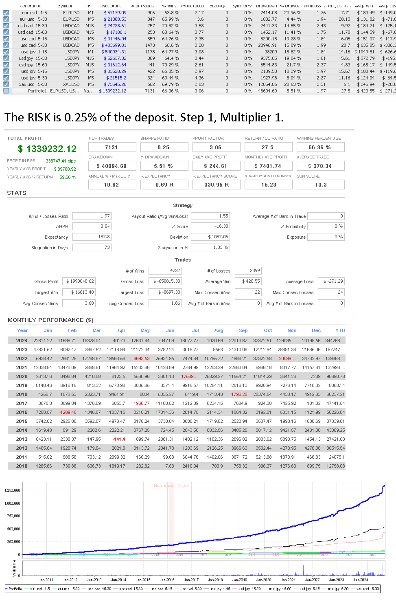

It was also tested with a risk of 0.25% of the deposit for the probability of draining the deposit. The advantage of the advisor is the initially low risk of the transaction, which is 0.25% of the deposit.With this risk, the grid account will hold up well and the probability of draining the deposit is very low.There is a lot multiplier, but it is better to use the initial minimum 0.25%, i.e. multiplier 1. There is a grid step, you can adjust it through the stop loss size in the settings.

The ADVISOR has been able to withstand the test without draining for 15 years.

The EA has a built-in restriction on opening new positions on tabs where no positions have been opened before, when the number of open positions on the account reaches 30 pcs. ( 30*0,25%= 7,5%). At the same time, it is allowed to continue opening positions for grid construction.

Bot settings(.set files in the discussion section):

- "the risk of the transaction is a percentage of the deposit" - the percentage of the deposit that is placed on the transaction in case of a stop loss. It is recommended to set 0.25% risk per trade. With this risk, the average return for 15 years was 20% per month, with a maximum loss of 16% in January 2012. Next is the return on your risk taking: 0,5% - 40 % , 0,75% - 60% and so on.

- " Magic " is a special number .

-"timeframe for finding a strong level" - the timeframe on which strong support or resistance levels are determined

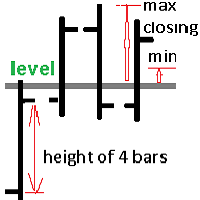

-"height of 4 bars" - the height of the 4 bars of the pattern. The higher the bar, the stronger the level and pattern, as the price stopped after a strong movement. It uses finding patterns of 4 bars (there are also pin bars, etc.) because there are stronger entry patterns.

-"minimum closing height of 1 bar from the level" - the minimum closing height of 1 bar from the level. The entrance is carried out by the market. When testing entry with limit pending orders, many transactions are skipped, so it was decided to enter the market with a minimum closing distance from the level and a maximum

-"maximum closing height of 1 bar from the level" - the maximum closing height (see earlier)

-"the ATR period for calculating the height of the pattern" - the height of the bars is compared with the average height of the bars of the time frame from which the level is taken, respectively, this is the period of this indicator

-"timeframe for the trailing stop" - the time frame on which the trailing is carried out is high or low bars

-"timeframe for trend confirmation by the oscillator" - during a trend, the oscillators are usually in the overbought or oversold zone, so we look at the oscillator on a certain time frame.

-"the period of this oscillator" - the period of this oscillator.

-"accuracy and error of level construction" - accuracy or error of level construction . The smaller, the more accurate.

-"stop setting coefficient from ATR" - setting a stop loss is a coefficient from the ATR level

-"take setting coefficient from ATR" - setting a take profit is a coefficient from the ATR level

-"ATR stop and take period" - ATR period for stops and profits

-"trailing stop ratio" - the coefficient of the trailing stop* (Take minus the opening price)

-"getting started" - the start time. time filter

-"end of work" - the hour of the end of work. time filter

-"1=buy"- purchase filter

-"1=sell"- sale filter

-"timeframe of the power reserve by ATR" - a time frame for calculating the power reserve by ATR

-"power reserve ratio" - power reserve ratio

-"power reserve ATR period " - period

- "timeframe of the trend from the bars" - the time frame on which the trend is tracked. For example, in a bullish trend, the candle closes above the maximum of the previous bar or closes inside the previous bar, if the close is below the minimum, then the model is broken

-"out of the market 1-4 day of the week" filter by days of the week, you can prohibit entry into the market on this day 1 Monday, 2 Tuesday, etc.

-"off-market month of the year" month filter can be disabled 1 -January 2 February, etc. -"spread limit " - entry spread limit

-"open positions at the same time" allows the number of simultaneous open trades on an open chart.

-"grid pitch" - grid pitch

-"the Martin multiplier" - lot multiplier