Rsi MA Adx

- Asesores Expertos

- Sylvestre Setufa Djagbavi

- Versión: 1.0

- Activaciones: 5

INTRODUCTION

Please, even if you already have a lot of trading knowledge, take the time to read before paying bots. Whether it's mine, or for someone else. You can't know everything.

Trading is a business of probability. No matter what type of strategy, robot or analysis (technical or fundamental) you use, you can never know for sure, if your next trade will win or lose, you can never know for sure if your next month will be a gain or a loss. All you can be sure of is that, if you have done a good backtest, and you apply the same setups that you used during the backtest, and if you use good money management, you will have a high probability of being profitable after executing several trades over a long term.

Our job as traders is how to increase our chances of being profitable in the long term, after having executed several trades in the long term. Do not only focus on 1 or 10 trades to judge the effectiveness of a strategy or robot.

If you don't understand that, there's no point in paying my robot or anyone's robot. If you can't understand that you have no control over the market, and that your only strength is how to increase your probabilities, so let trading, to go do another job, in which you are sure that per month you will have a salary.

I. GENERAL IDEA OF THE STRATEGY

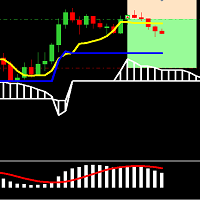

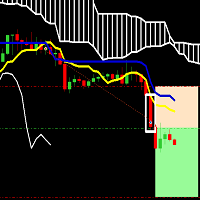

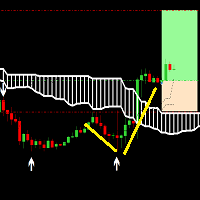

This robot does not use a Grid or a Martingale system. It just uses a simple strategy based on 3 indicators: Moving Average, Rsi, Adx.

- BUY

When price is below MA, it means that we are in downtrend. And when the vertical distance between price and Moving Average is large in downtrend, it means that we have a high probability of bullish retracement.

When Rsi is oversold it means that we have a high probability of bullish retracement.

When Adx, give us buy signal we will buy.

- SELL

When price is above MA, it means that you are in uptrend. And when the vertical distance between price and MA is large in uptrend, it means that we have a high probability of bearish retracement.

When Rsi is overbought it means that we have a high probability of bearish retracement

When Adx, gives us sell signal, we will sell.

II. EXPLANATION OF ROBOT SETTINGS

To have a good understanding of the robot's settings, click on this link to download this document:

https://drive.google.com/file/d/16M9YTMAc3tZUyPeE7OXFjuQD56yBT1fA/view?usp=drive_linkIII. EA PRICE

Just because my bot isn't expensive doesn't mean it's not good. Don't judge the effectiveness of a bot, based on its purchase price. You can pay a bot at $1000, but the robot won't be profitable in the future. You can take a free robot but it may be profitable in the future.

I could sell it for 1000 dollars, but I didn't because of the reasons below:

1. In my experience, after coding and back testing more than 1000 bots, I realized that robots that are profitable over a long period of time like at least 10 years, with a low drawdown, are always in the Higher Time Frames (>= H1). So, I recommend using bots on large time frames.

But the disadvantage is that, when you do Swing Trading, with a single bot on a single pair, the bot can take 3 to 4 months before finding a setup. This means that, despite the bot being profitable over 10 years of back testing, it profit will be very small, even over 1 year.it can make years in negative, before going back to positive.

That's why you need to use multiple bots, so that some bots fix drawdowns created by other bots at the same time. This will save you from being in drawdown for several years. This is the first reason why I lowered the price of my bots

2. According to your backtest, if a bot was profitable in past years, it doesn't mean that this bot can predict the future. There is no evidence that it will be profitable in the future. We can only say that there is a high probability that, it will be profitable in the future, because it has been profitable in the past. It is for this reason, you should never trade your capital with a single bot, if you want to increase your probability of being profitable. This is the second reason why I have lowered the price of my bots

So you have high probability, by trading with small risks, and increasing the number of bots that have been profitable in the past, than using a single bot with very high risks. It is for these 2 reasons, mentioned above, that I have lowered the price of my robots. So that you can buy other bots (even if they are not mine). It's true that I want to sell my robots, but I don't want to make my money on the failure of other trades.

IV. BACKTEST

Here are the reasons why you should do your own backtest:

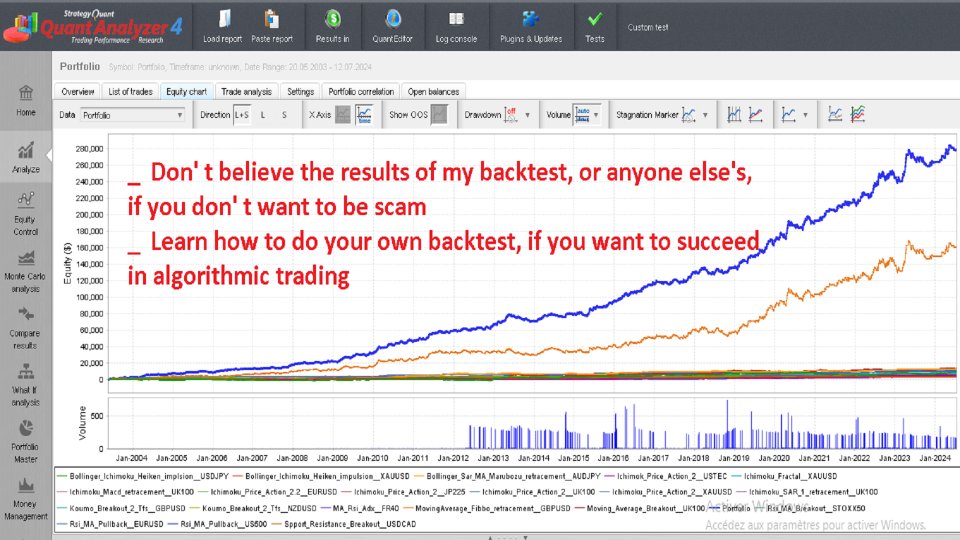

- There are a lot of dishonest people who use a lot of coding methods to manipulate backtests results. If you want to avoid being scammed, and if you want to succeed in algorithmic trading, learn how to do your backtest yourself.

- Before buying robots, if you don't try to understand how the robot works (strategy), and you use someone's backtest settings to trade, when the robot is in drawdown, you will want to change the inputs settings at every moment. In real account, stop changing the settings, when the robot loses a few trades.

- Before buying robots, If you don't try to understand how the robot works (strategy), and you use someone's backtest settings to trade, with certain broker or prop firms, the will refuse the payout.

Don’t believe that a robot will be profitable, because the strategy is based on indicators, or price action, or ICT, or SMC…….

If you want to know, if a robot maked money or not in the past, do the backtest. Stop drawing conclusions in your mind.

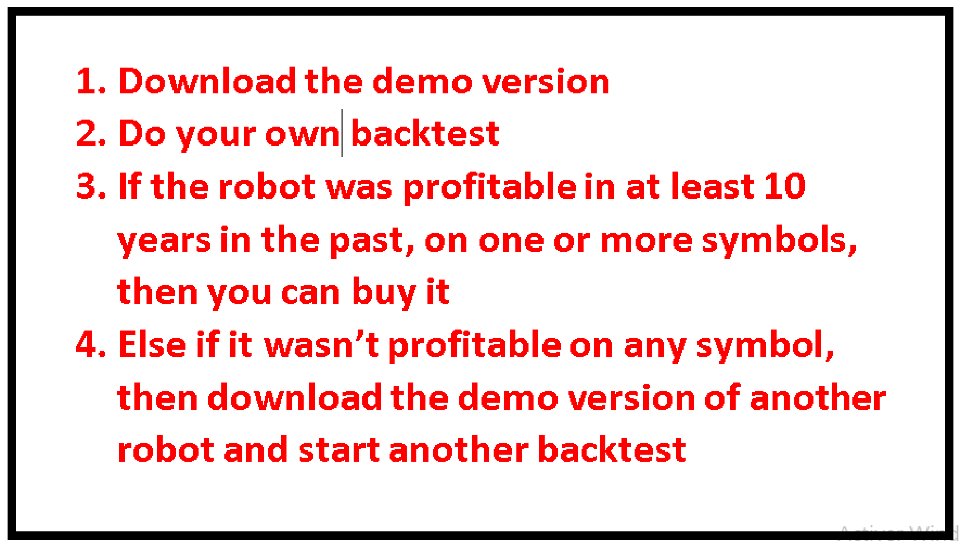

Before buying a bot, download the demo version to do your own backtest. After backtesting if the robot is profitable on certain symbols, then you can buy it. Then connect the bot to a demo account, for at least 1 month, to check if the bot executes the trades with the risk you have chosen. This is not to check if the bot is profitable, because 1 month is insufficient, to conclude that a bot is profitable or not.

After the backtest, if the robot is profitable, on one symbol, with certain settings, you should use the same settings in live account, until the robot takes at least 100 trades. This is at that time, you can decide to continue to trade or stop trading the robot on this symbol according to the risk you have taken. The same process must be applied to all symbols.

After the backtest, if you find that the robot is not profitable, on all symbols, then download the demo version of another robot, and start another backtest. After all this work, you will find profitable robots that you can use on a real account.

Trading is not an easy job. If you want to make money without spending money, and without making any effort, go and look for another job.

Stop believing that a robot will be profitable, just because it had more views or more purchases in the market. Nowadays, all of this can be manipulated.

Do your own backtest over a minimum of 10 years, on every symbol. I said to do this on every symbol, because if a bot is profitable on one symbol, it doesn't mean it will be profitable on every symbols.

If you don't know how to backtest on MT5, use this YouTube videos links, to learn it:

https://youtu.be/lXn4QqNnoRQ?si=-D3i0Aq6c8IRP53a

https://youtu.be/j4ZlJfHAWy4?si=Thdbc6XL_IzMQdKb

https://youtu.be/i-TmnHvCZms?si=CbOeuFfDvgYnHB0P

After backtesting, if the robot is profitable on a symbol, and you to save the settings, use this YouTube video link to learn how to do it: https://youtu.be/csMOM6toFkw?si=y7bNiSFQB-SuqMrt

After finding that the robot is profitable on multiple symbols, or after finding profitable robots, when you want to create a portfolio (combination of all the results on one account), use this YouTube video link, to learn how to do it: https://youtu.be/PsxMXbKow8I?si=ljWe5KjVRlECRAZ_

To do the backtest, don't use the historical data provide by brokers, because most of them have quality below 100%. If the data quality is low, it means that the results of your backtest do not accurately reflect what happened in the market.

I advise you to use the histories provided by the Dukascopy bank, because they have a quality of 100%. You will make a monthly subscription to Tick Data Suite, to download these Dukascopy histories.

If you don’t know how to download histories in MT5, use this YouTube video link, to learn it: https://youtu.be/OThnhXKf60k?si=R3-txleUKDaRUW0l

A bot can be profitable depending on the backtest with a broker, then if you change brokers and then do another backtest with the same durations and settings, the bot will no longer be profitable. This is because brokers do not have the same spreads, commissions and swaps. For your backtests, choose brokers, which have small spreads, commissions and swaps, because it has an impact on your profitability. I use the brokers Exness, and IC Market. It's not a broker recommendation that I'm making, make your own choice.

V. VPS

After doing the backtest, if you want to connect to a real or demo account, make sure to connect your bot to a good VPS so that in case of load shedding, your bot can secure the trades already in progress, and also continue to look for new setups.

If you don't know how to connect a robot on VPS, use this YouTube videos links to learn it:

https://youtu.be/9O1wElRvX2E?si=v_0yxHm7dUp_D_Z8

https://youtu.be/C1kaI69kxx8?si=qgCKg0XI9O0xXIye

CONCLUSION

Thank you for your time. Even if you don't buy my robot, I'm glad I added you may be at least some trading knowledge.

And above all, if you notice an imperfection in the way the robot works, don't hesitate to send me an email on djagbavisylvestre12@gmail.com, so that I can correct it.