AUD Nexus

- Asesores Expertos

- Michael Prescott Burney

- Versión: 999.965

- Actualizado: 18 febrero 2025

- Activaciones: 20

AUD Nexus – High-Performance Expert Advisor for AUDUSD H1

Overview

AUD Nexus is an advanced trading algorithm designed for AUDUSD on the H1 timeframe. It incorporates a sophisticated risk management system and a strategic trading approach that ensures consistent profitability while maintaining controlled drawdowns. The backtest results confirm its efficiency, displaying a stable equity curve and strong trade execution.

Input Parameters and Strategy Configuration

AUD Nexus offers both dynamic and fixed lot sizing for optimal risk control. The strategy integrates trailing stops, break-even adjustments, and precision-based profit targets to maximize returns while mitigating exposure to losses.

The EA supports up to 100 open positions at a time and can be configured to trade both long and short positions or limit execution to sell-only strategies based on market conditions.

Account protection settings include a maximum spread filter, equity safeguards, and daily loss limits. The system also employs ATR-based stop-loss and time-based exit strategies for effective trade closures.

Profit-locking mechanisms enable traders to secure gains at predefined levels, while holiday trading settings prevent execution during periods of low liquidity.

A structured daily trade window ensures that trades are executed within optimal market hours. Walk Forward Optimization is used to maintain adaptability and performance stability in changing market conditions.

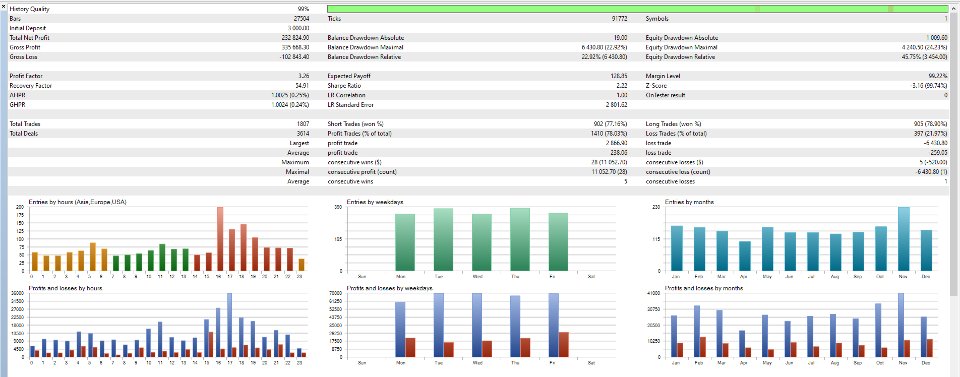

Backtest Performance and Key Metrics

AUD Nexus was tested on AUDUSD H1 with a $3,000 initial deposit, demonstrating robust profitability and well-controlled risk.

Total net profit reached $232,824, with a gross profit of $335,668 and a gross loss of -$102,843. The profit factor was 3.26, reflecting strong profitability, while the recovery factor was 54.91, highlighting the EA’s ability to recover from drawdowns effectively. The Sharpe ratio of 2.22 confirms high risk-adjusted returns.

A total of 1,807 trades were executed. Short trades had a win rate of 77.16 percent, while long trades had a win rate of 78.90 percent. The overall profit trade percentage was 78.03 percent. The largest profit trade was $2,866, while the largest loss trade was -$6,430. Maximum consecutive wins reached 28 trades with $11,052 in profit, while the maximum consecutive losses were five trades totaling -$520.

Drawdown and Risk Metrics

Balance drawdown absolute was $6,430, with a maximum balance drawdown of $4,240, representing 24.23 percent. Relative drawdown was 22.92 percent. Equity drawdown absolute was $19, while the relative equity drawdown was 45.75 percent.

Trading Patterns and Seasonal Trends

AUD Nexus performed best during high-liquidity sessions between 15:00 and 23:00 UTC, capitalizing on major trading hours. The EA maintained strong profitability throughout the week, with the highest performance observed from Monday to Friday. Seasonal analysis indicated peak profitability in November, with consistent returns throughout the year.

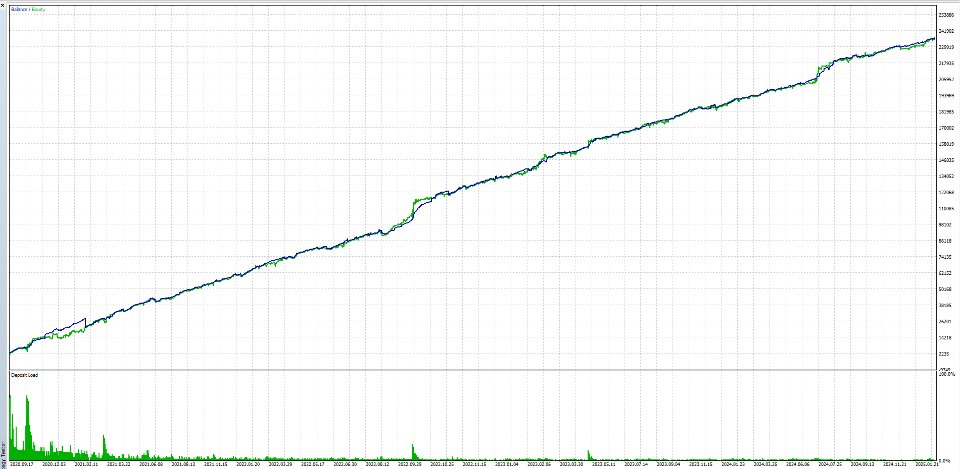

Equity and Balance Curve Analysis

The equity and balance curve demonstrated smooth and consistent growth, validating the EA’s reliability and efficiency.

AUD Nexus maintained steady capital growth with minimal stagnation, while the controlled deposit load distribution ensured balanced risk exposure and consistent gains.

Why Choose AUD Nexus

AUD Nexus offers high profitability with a profit factor of 3.26 and a win rate exceeding 78 percent. Its advanced risk management system incorporates ATR-based stop-loss, equity protection, and daily loss limits to safeguard capital.

The EA is highly adaptable, supporting both fixed and dynamic lot sizing for flexible risk management. Walk Forward Optimization ensures ongoing efficiency as market conditions evolve.

Designed specifically for AUDUSD on the H1 timeframe, AUD Nexus executes precise entries and exits while maintaining disciplined trade management. It is an ideal solution for traders seeking long-term profitability and risk-controlled performance in automated trading.