Market Sessions Pre

- Indicadores

- Cao Minh Quang

- Versión: 1.2

- Actualizado: 9 diciembre 2024

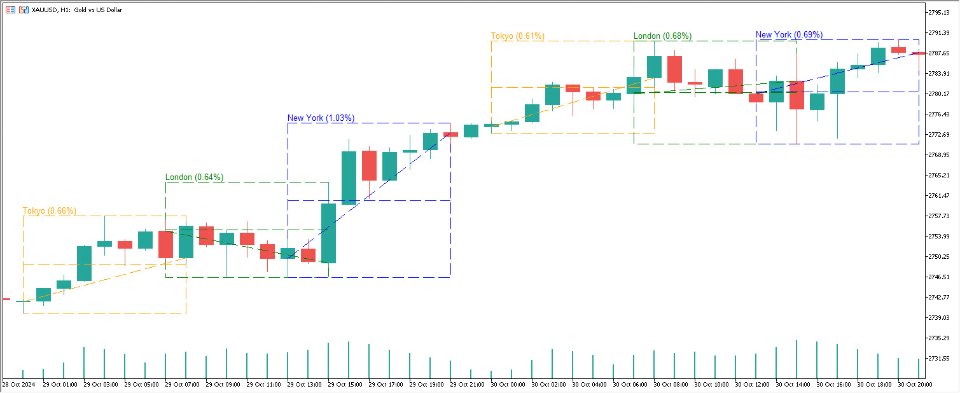

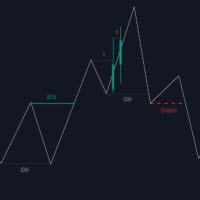

The Market Sessions indicator is a popular tool among forex and stock traders for visually representing global trading sessions on a price chart. It highlights the time periods for major trading sessions — such as the Asian (Tokyo), European (London), and American (New York) sessions — directly on the chart. This helps traders identify when markets open and close, allowing for better decision-making based on session-specific trading behavior.

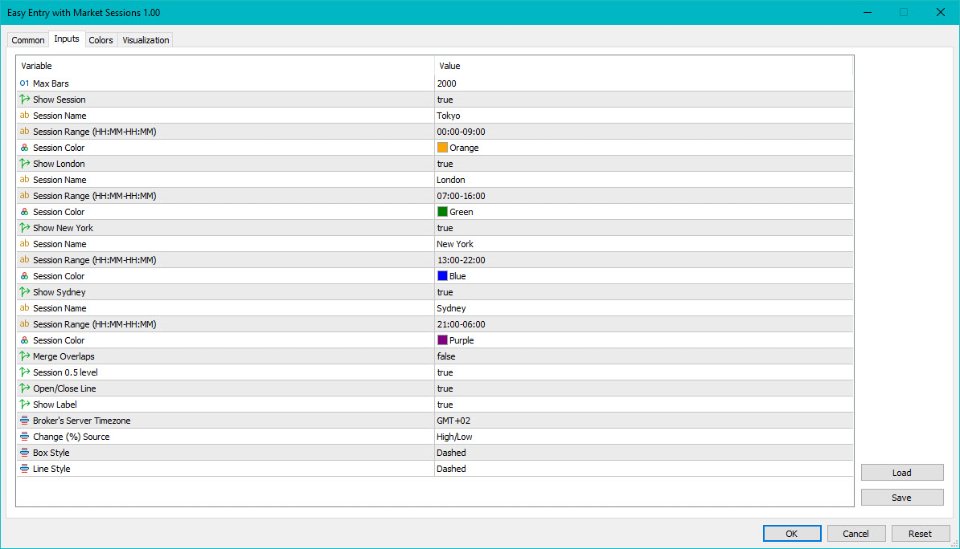

- Asian Session (Default: 00:00-09:00)

- London Session (Default: 07:00-16:00)

- New York Session (Default: 13:00-22:00)

- Sydney Session (Default: 21:00-06:00)

Key Features of the Market Sessions Indicator

-

Session Timing and Overlaps:

- The indicator marks the start and end times for each session. This feature is helpful as each session has unique characteristics — the Asian session, for example, is generally calmer, while the London session often sees high volatility. Overlaps, like the London-New York overlap, are marked as well, indicating times of increased activity.

-

Customizable Session Colors:

- Traders can often customize colors for each session, which makes it easy to visually distinguish between them. This personalization adds clarity and helps traders focus on particular sessions they may prefer.

-

Adjustable Time Zones:

- Since traders are located globally, the indicator usually allows for adjusting time zones, aligning session start and end times with the trader’s local time, which is particularly useful for those in different time zones than major trading centers.

-

Session-Specific Strategies:

- Each session has distinct characteristics. For example, the London session is often the most volatile, presenting breakout opportunities, while the Asian session tends to be calmer, which can suit range trading strategies. Understanding these nuances allows traders to tailor their strategies based on session trends.

Why Use the Market Sessions Indicator?

-

Better Timing of Trades:

- By knowing which session is active, traders can adjust their strategies to take advantage of different levels of volatility and liquidity.

-

Improved Analysis and Strategy Development:

- With session times visually marked, traders can analyze price behavior across sessions to develop and refine strategies that best suit each session's characteristics.

-

Increased Awareness of Market Volatility:

- Volatility often spikes during session openings, closings, and overlaps. The indicator helps in anticipating these moves, reducing the likelihood of being caught off-guard by sudden market shifts.

Example Use Case

A trader interested in volatility might target the London-New York overlap period to take advantage of higher market movement. By using the Market Sessions indicator, they can plan trades to coincide with this overlap, potentially increasing the chances of capturing significant price action.

In summary, the Market Sessions indicator is essential for traders who want to make informed decisions based on time-specific market behaviors. It provides clarity, enhances analysis, and can support more effective trading strategies.

Just discovered this indicator and compared to the one I used before (for the same purpose of indicating sessions), this one is far better. Excellent while simplistic. Doesn’t disturb my work and the screen is relatively clean. Very helpful to see the trend line between open and close of the specific market. I like it so far. Thank you!