MACD Project

- Asesores Expertos

- Osama Echchakery

- Versión: 24.112

- Actualizado: 20 noviembre 2024

- Activaciones: 20

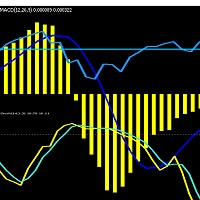

The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that calculates the difference between two EMAs (usually 12-period and 26-period). It consists of the MACD line, signal line (9-period EMA), and a histogram. Trading strategies using MACD focus on crossovers (MACD crossing above/below the signal line), overbought/oversold levels, and divergence patterns, which can signal potential reversals or trend continuation.

Unlock the potential of automated trading with our state-of-the-art MACD PROject Expert Advisor (EA), designed to provide a seamless trading experience. This EA integrates robust filters and comprehensive settings, making it an ideal choice for traders of all experience levels.

$32 (3 copy left) next price $99

Key Features and Benefits:

Full Control Over Your Trading:

- No Martingale, Hedging, or Grid: Ensures a safe trading approach without risky strategies.

- Easy Installation: Get started in minutes with a straightforward setup process.

- Low Capital Requirement: Perfect for traders with limited initial funds.

- No Artificial Intelligence or Neural Networks: Focuses on proven technical analysis.

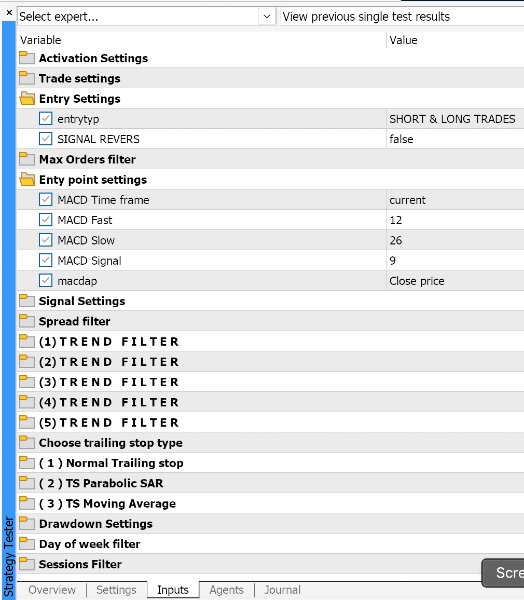

Activation Settings

- Auto-trade Activation: Allows users to enable or disable automatic trading ( ON / OFF ).

Benefit: Provides flexibility to manually intervene or fully automate trades.

Trade Settings

- Lot Size: Configurable lot size for each trade (default: 0.01).

- Stop Loss (Pips): Adjustable stop loss to protect trades (default: 200 pips).

- Take Profit (Pips): Adjustable take profit level (default: 200 pips).

- Magic Number: Unique identifier for each strategy (default: 1111).

- Dollar-Based Take Profit/Stop Loss: Option to use dollar-based exit points for trades. Set to 0 to disable.

Benefit: Allows both pip-based and dollar-based exit strategies for enhanced control.

Entry Settings

- Entry Type: Choose between long-only, short-only, or both (default: both).

- Reverse Entry Signal: Option to reverse trade signals ( false by default).

Benefit: Flexibility to adjust trading direction based on market conditions.

Max Orders Filter

- Limit Buy/Sell Orders: Define whether to limit buy/sell orders and the maximum number allowed.

Benefit: Helps in managing risk by limiting open positions on either side.

Entry Point Settings

- MACD Settings: Use MACD indicator with customizable time frame, fast/slow periods, signal line, and applied price.

Benefit: Provides a customizable entry indicator based on a widely used technical tool.

Signal Settings

- Use Alerts/Arrows: Enable visual and sound signals for trade setups, with customizable arrow width and colors.

Benefit: Visual and auditory cues ensure traders don’t miss trade opportunities.

Spread Filter

- Max Spread: Option to limit trading during high-spread conditions (disabled by default).

Benefit: Reduces risk in volatile or illiquid market conditions by avoiding high-spread trades.

Trend Filters (1-5)

- Moving Average Filter 1: Optional use of MA for filtering trades, with customizable period and time frame.

- Moving Average Filter 2: Second MA filter for added trend confirmation (enabled by default).

- RSI Filter: Optional RSI filter with adjustable period, time frame, and overbought/oversold levels.

- MACD Filter: Additional MACD filter for more precise trend following.

- Parabolic SAR Filter: Option to use Parabolic SAR with adjustable step and maximum parameters.

Benefit: Multi-layered trend confirmation for precision in entering trending markets or detecting reversals.

Trailing Stop Options

- Normal Trailing Stop: Traditional trailing stop with customizable trigger and trailing points.

- Parabolic SAR Trailing Stop: Uses Parabolic SAR values to trail stop losses dynamically.

- Moving Average Trailing Stop: MA-based trailing stop with adjustable time frame, period, and method.

Benefit: Various trailing stop methods to suit different market conditions and strategies.

Drawdown Settings

- Max Drawdown: Ability to disable trading if a maximum drawdown percentage is reached (default: 50%).

Benefit: Protects the account from excessive losses.

Day of Week Filter

- Day Filters: Allows traders to enable or disable trading on specific days of the week.

Benefit: Customizes the trading schedule to avoid historically less profitable days or align with user availability.

Sessions Filter

- Session Filters: Configurable trading times for major trading sessions (Sydney, Tokyo, London, New York).

Benefit: Prevents trading during low-liquidity periods and focuses on high-volume market hours.

This set of filters and settings makes the EA highly customizable, allowing traders to adapt it to various market conditions and trading strategies while managing risk through drawdown limits, stop losses, and order restrictions.