Sharpe3

- Asesores Expertos

- Sami Triki

- Versión: 3.1

- Activaciones: 5

Strategy Overview

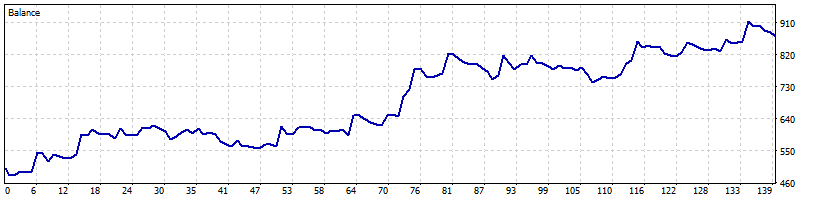

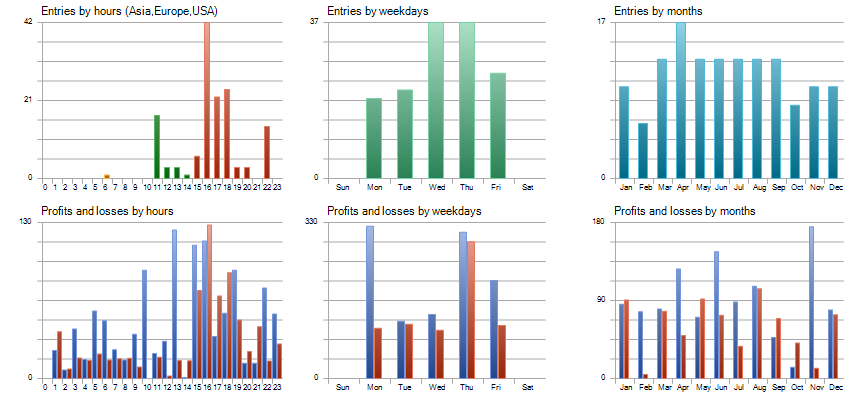

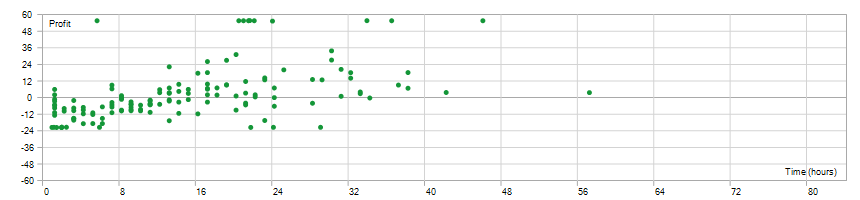

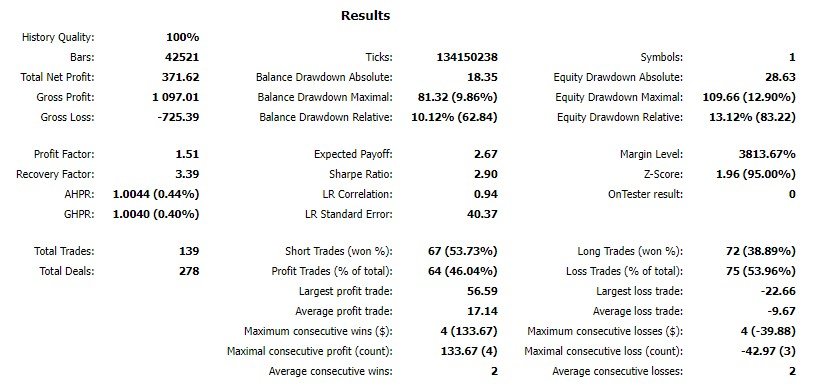

This EA employs a combination of ADX, Bollinger Bands, and Envelopes indicators to capitalize on momentum and volatility in the EUR/USD market, specifically on the H1 timeframe. The strategy aims to identify high-probability entries with a focus on risk-adjusted performance and capital preservation. It has been optimized to generate consistent returns with controlled drawdowns, achieving a Sharpe Ratio of 3 and a maximum equity drawdown of 13%.

Key Indicators and Approach

-

ADX (Average Directional Index): Used to assess the strength of market trends. Trades are only triggered when ADX signals strong momentum, helping to avoid weak trends and choppy price action.

-

Bollinger Bands: Utilized to gauge price volatility and identify potential entry points based on standard deviations from the mean. The strategy enters long positions near the lower band in uptrends and short positions near the upper band in downtrends.

-

Envelopes: This indicator is used to refine entry and exit points by filtering out price noise and capturing sustainable price moves within defined upper and lower bounds.

Risk Management

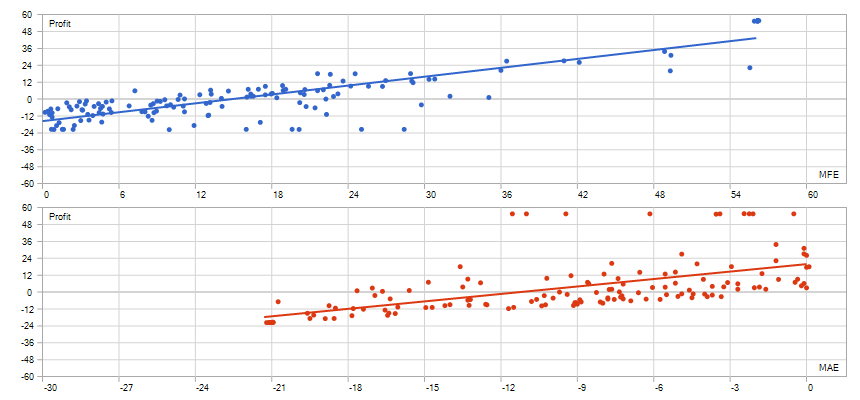

The EA is designed with robust risk management, leveraging a fixed stop-loss strategy and a high risk-reward ratio of 3. This approach ensures that potential losses are limited while maximizing profit opportunities.

Performance

- Sharpe Ratio: 3, highlighting a strong risk-adjusted return.

- Max Equity Drawdown: 13%, demonstrating a disciplined approach to capital preservation.

This EA is suited for traders seeking steady growth through a systematic, rule-based trading approach with controlled risk parameters.