Phoenix Ultimate GBPJPY

- Asesores Expertos

- Nuno Miguel Rocha Dos Reis Tavares

- Versión: 872.0

- Actualizado: 6 noviembre 2024

- Activaciones: 10

- What is Phoenix Ultimate Project?

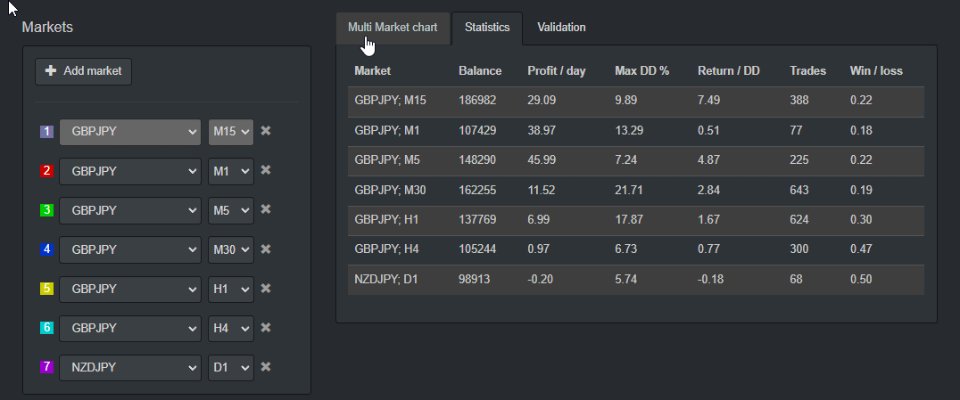

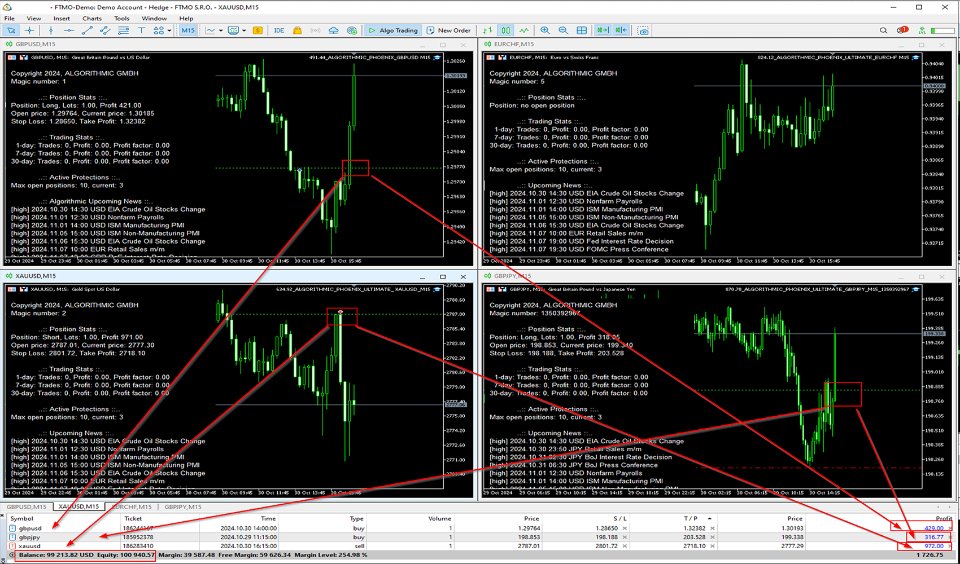

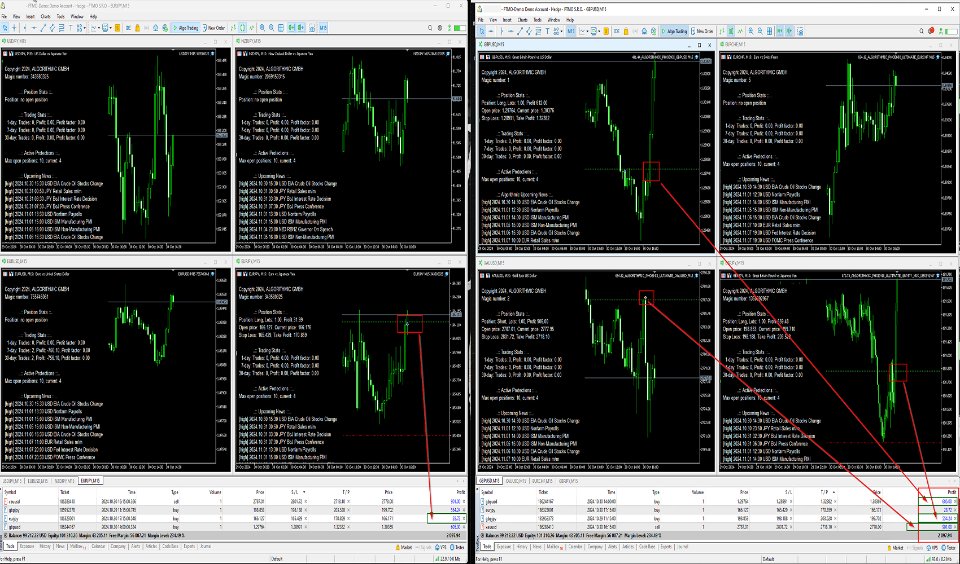

Phoenix Ultimate is a Risk Diversification Project which was meticulously engineered to maximize portfolio equity throught a specific custom engineered set of Expert Advisors (EAs), each meticulously crafted to provide unmatched risk diversification in dynamic trading environments.Developed by Algorithmic in Switzerland, Phoenix Ultimate is the culmination of years of dedicated coding, rigorous testing, and continuous refinement.Recognizing that markets operate in cycles upward, downward, and sideways trends and in seasons, Phoenix Ultimate bridges the gaps that single-strategy approaches leave, delivering a strategic blend of algorithms optimized for sustained portfolio resilience.

- Purpose

With Phoenix Ultimate EAs you can target several assets on the same account, allowing different Symbols on same portfolio mitigating risk. Like this, Phoenix Ultimate allows you to deploy a variety of algorithms across separate MT5 terminals on the same account, allowing for risk to be effectively spread across diversified strategies.

This comprehensive approach enables automatic adjustments based on market conditions, improving portfolio resilience and optimizing long-term outcomes.

Through the combination of its rigorous validation process, adaptable strategies, and real-time news-based risk management, Phoenix Ultimate is engineered to deliver powerful, risk-mitigated trading, ensuring stability and growth in fluctuating market conditions.

Phoenix Ultimate is a meticulously engineered portfolio of Expert Advisors (EAs), each meticulously crafted to provide unmatched risk diversification in dynamic trading environments.

This code and development process is the culmination of years of dedicated coding, rigorous testing, and continuous refinement.

- A Premier Selection Process.

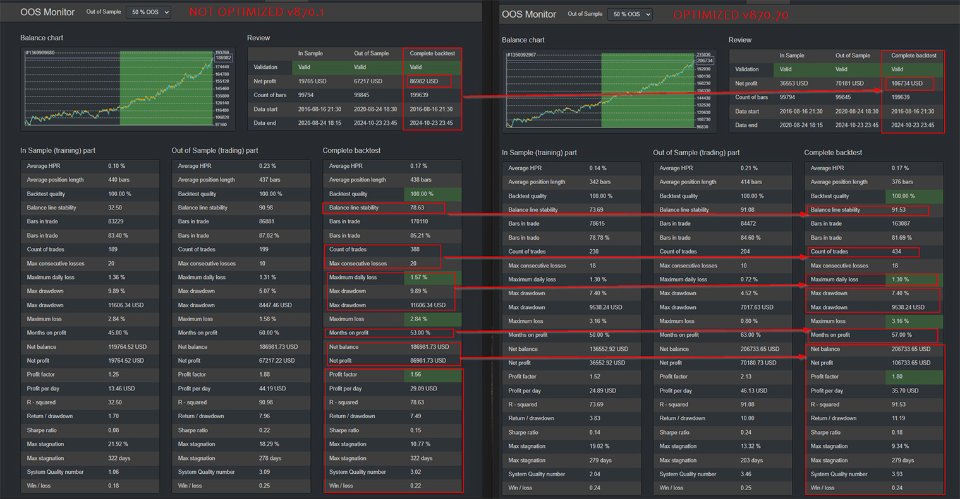

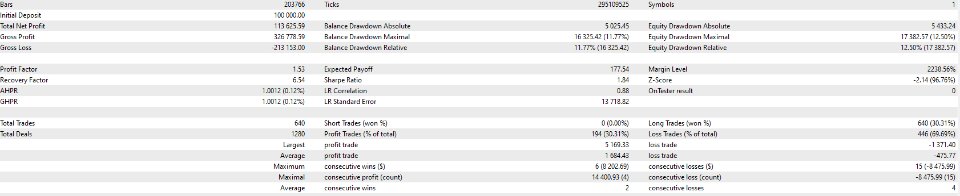

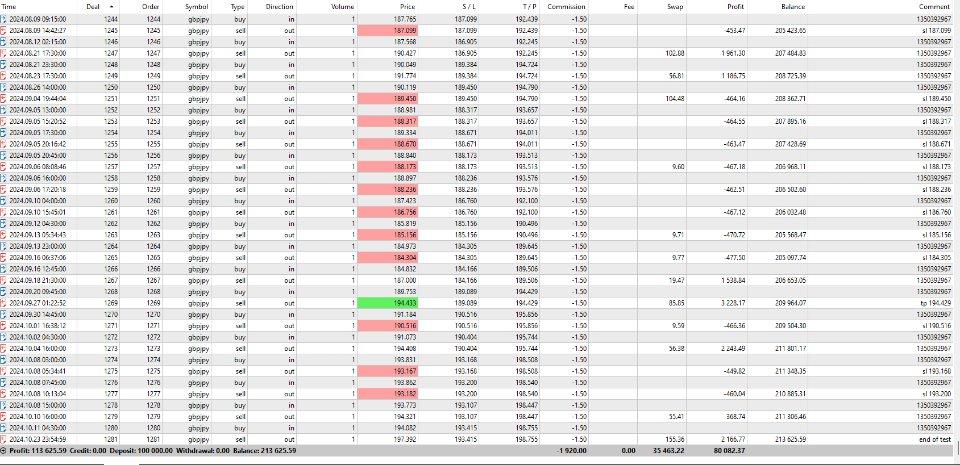

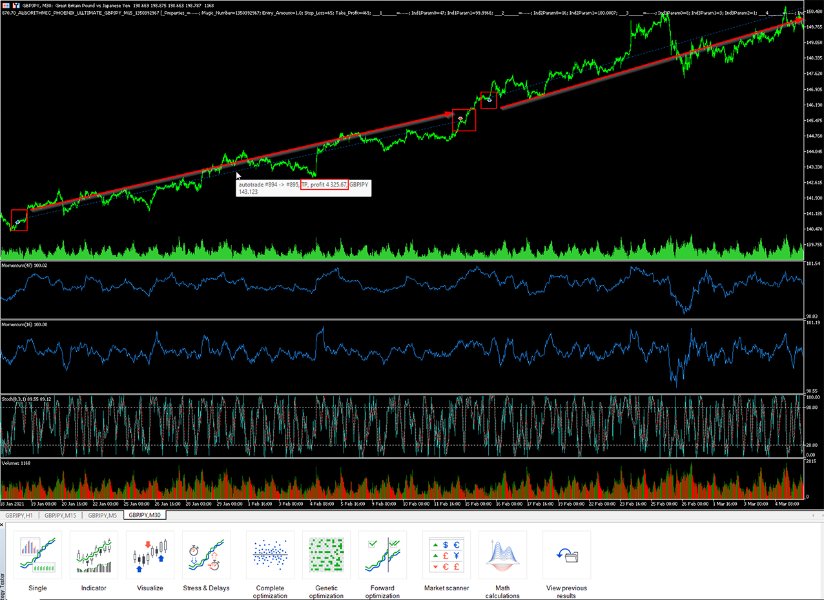

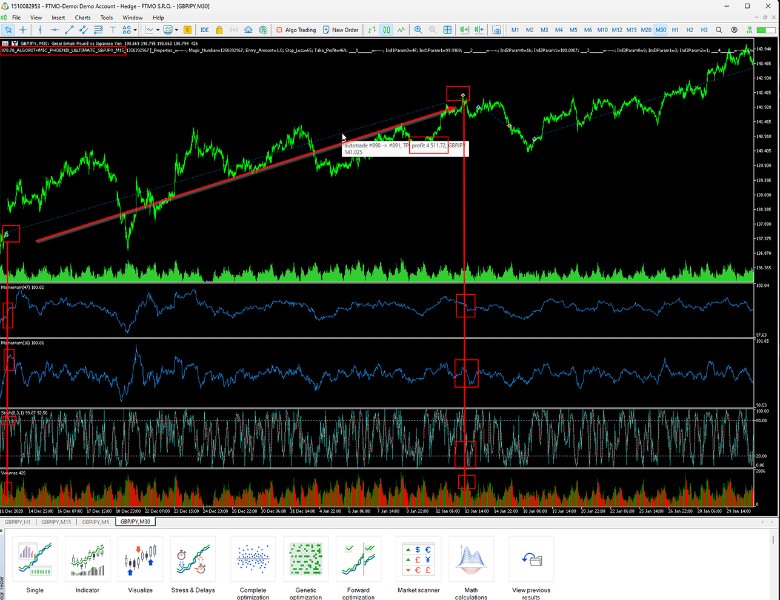

Each EA in Phoenix Ultimate underwent extreme backtesting, with only the top 5 emerging from an intense pool of 21 million cycles. Each EA then faced a further 1.7 million individual optimization iterations, with just 1 in every 1.7 million cycles passing our stringent validation criteria.Tested on Premium Data sets (DukasCopy tick data, FTMO data, Metaquotes, Blackbull, EightCap and DawrwinX) spanning 2016 to 2024 which we call DataHorizon, this intense evaluation ensures that Phoenix Ultimate contains only the most robust algorithms available today.After rigorous testing, we took this strategy through an unparalleled journey of optimization, starting from a pool of 37 indicators translating into a vast correlation array using cloud computing, data science and incredible software engineering, translating to million of strategies.We fine-tuned them, validated them, forward-tested and revalidated them, normalizing the code, and running them through Monte Carlo simulations for stress-testing.And as if that wasn't enough, we subjected them to multi-market validation for ultimate performance.This is more than just an algorithm, it's a one-of-a-kind trading tool crafted with precision and persistence.We're proud to share it with you, enjoy the power of elite algorithmic trading!

- Phoenix Ultimate’s Comprehensive Validation Process

Every EA in Phoenix Ultimate was rigorously vetted through a several stages of validation process to ensure consistent performance and durability across diverse market conditions:

- Full Data Optimization

Each EA is initially tested across comprehensive historical datasets to identify top-performing parameters across various conditions, creating a strong baseline for further testing.

- Walk Forward Validation

Walk Forward analysis (WFA) or Walk Forward optimization (WFO) is a sequential optimization applied to an investment strategy. The name of the analysis is called “walk forward” because we have a moving window that progressively traverses the whole period of the data history with a pre-established step.

Algorithmic traders apply this type of analysis to decrease the over-optimized parameters used in the investment strategy as we don’t want only a great looking backtest result, we also want a system that doesn't fail in a live, real money account.

- Monte Carlo Validation

To assess each EA’s resilience against randomness, we apply Monte Carlo simulations, introducing variations in market data and trade sequences. This step ensures stability amid market volatility. Monte Carlo is the best tool for testing the strategy robustness. When you create a strategy, you see its backtest statistics. However, the strategy might be over-optimized (curve fitted). The goal of the Monte Carlo tool is to verify that the strategy is not over-optimized.

- Multi-Market Validation

Each EA is then tested across multiple asset classes and market types, proving its versatility and adaptability beyond specific market conditions.

- Normalization

In this final phase, each EA’s parameters are refined to ensure stable and consistent behavior across all market phases, supporting reliability regardless of market shifts.

The Normalization prcess tries to make a strategy tidier and at the same time, it is capable of increasing its performance.

We believe a strategy is better when it has a lower number of components and when their indicators have more meaningful parameters.

Through these stringent processes, Phoenix Ultimate delivers a high-performance suite of EAs that embodies stability, adaptability, and balanced portfolio growth.

- Integrated News-Based Risk Management

Phoenix Ultimate incorporates advanced risk management by integrating high-risk and medium-risk news alerts via our REST API.

This feature automatically pauses trading activity two minutes before and after significant news events, reducing exposure to high volatility and adding a critical layer of protection for your account.

- Engineered to Exceed in Prop Firm Standards

Phoenix Ultimate is designed to meet prop firm standards with strict acceptance criteria, including custom definition on following risks/thresholds criteria:

Position Sizing based on % defined of account balance instead of lots. you can choose from 0.25, 0.50, 0.75, 1.0 and 2.0% of the account balance.

1. Entry Protections

- Max Spread

- Max Open Positions on all experts

- Max Open Lots on all experts

2. Daily Protections

- Max Daily Loss (currency)

- Max Daily Drawdown %

3. Account Protections

- Min Equity (currency)

- Max Equity Drawdown %

- Max Equity (currency)

- Backtested from 2016 to 2024

Only EAs Symbols that meet these benchmarks were selected for real-market optimization, ensuring high performance and reliability in professional trading environments.

- Recommended Settings:

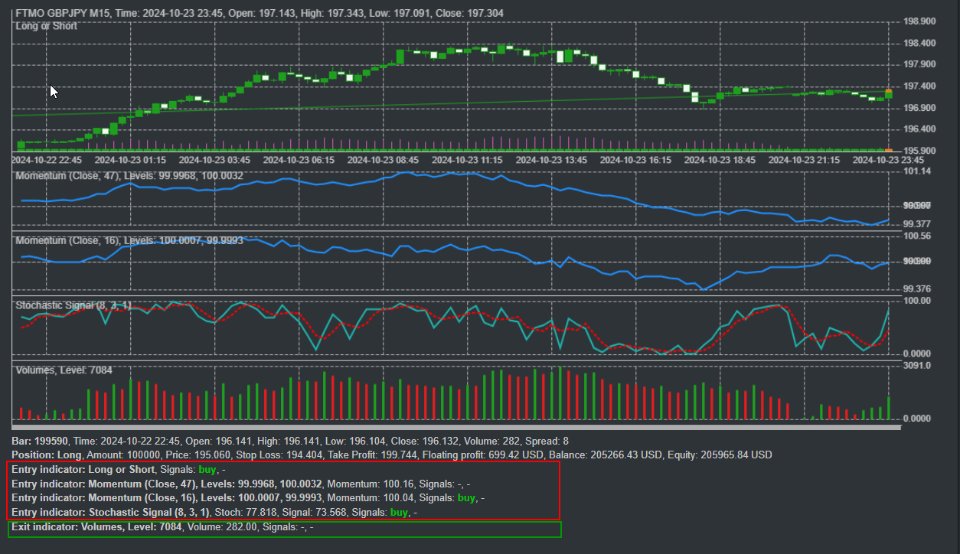

- Instrument/Symbol: GBPJPY

- Timeframe: M15

- Prop Firms Risk: We recommend using Super Low (0.25%) to High (1.0 %).

- Prop Firms Leverage: We recommend using 1:30 Leverage.

- Account Sizes: We recommend using this EA with a minimum account balance of 1,000 USD to ~.

- Individual Personal Accounts: At your criteria.

- Note

Please enable the news filter and add the following URL on your MT5 terminal under TOOLS > OPTIONS > EXPERT ADVISORS > ALLOW WEBREQUESTS for Listed Url > https://news.algorithmic.one

- Support:

For support please message me anytime.

There is no single click and its done for everyone, that is a true misconception that its required to understand before actually trading live.

Only do so when you have sustainable support metrics for that purpose and the road to reach them is to undergo optimization.

Looking forward to hear from you.

- Release Roadmap and Lifecycle:

We do weekly updates as part of our development lifecycle and we value your input in which we translate it into a better functionality.

- Risk Warning:

Before you buy Phoenix Ultimate EA please be aware of the risks involved. Past performance is no guarantee of future profitability (EA could also make losses). The backtests shown (e.g. in the screenshots) are highly optimized to find the best parameters, so the results are not transferable to real trading. Please do not invest or risk money you cannot afford to lose.