Zephyrlar Expert MT5

- Asesores Expertos

- Ruengrit Loondecha

- Versión: 24.8

---------------------------------------------------------

---------------------------------------------------------

Zephyrlar Expert MT5

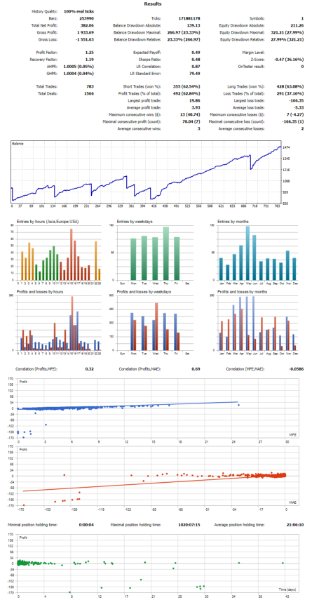

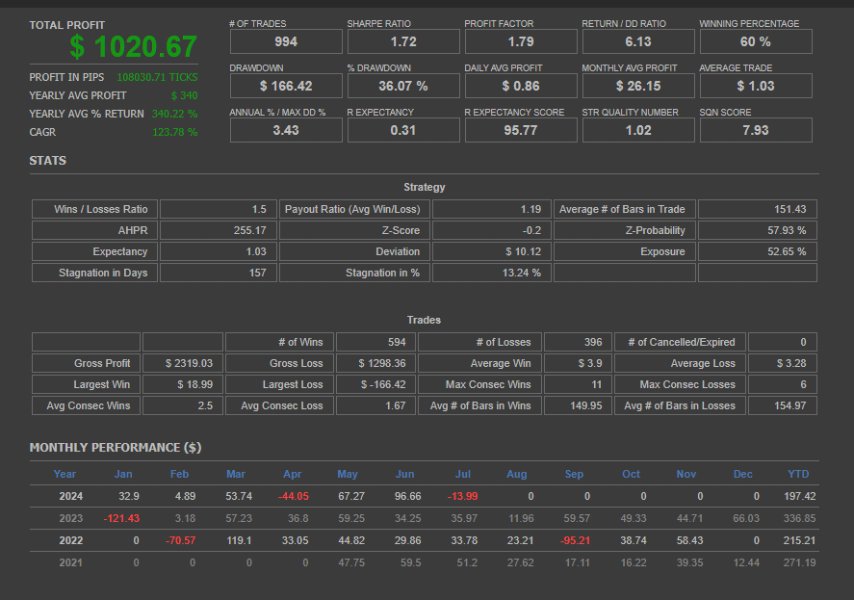

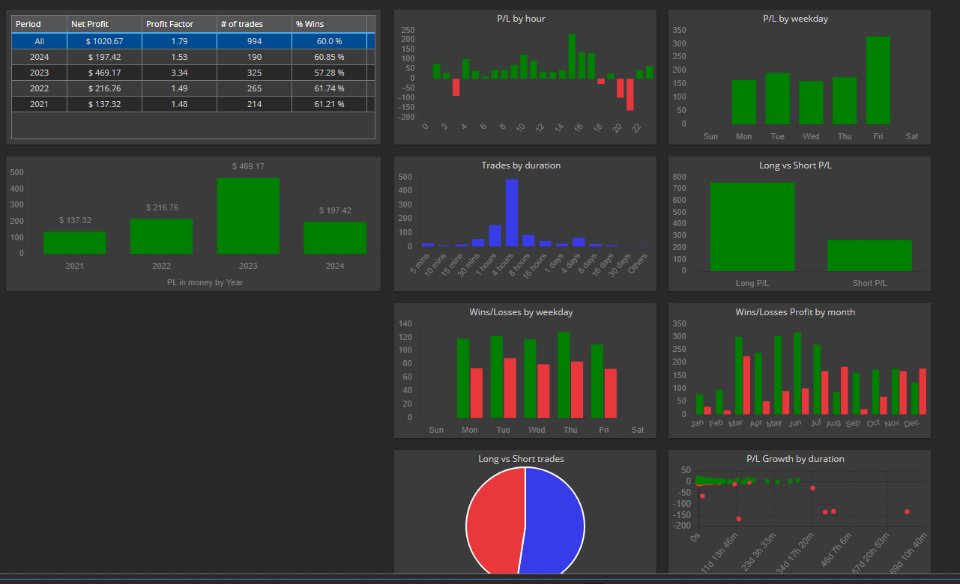

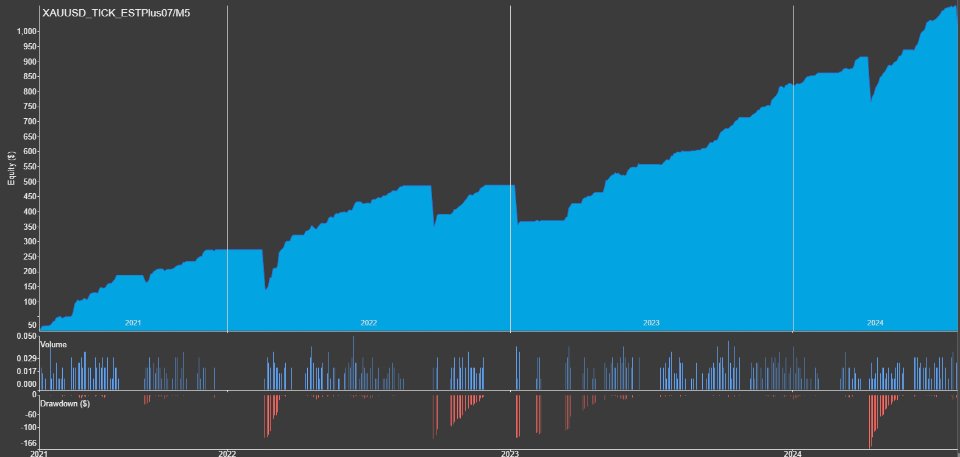

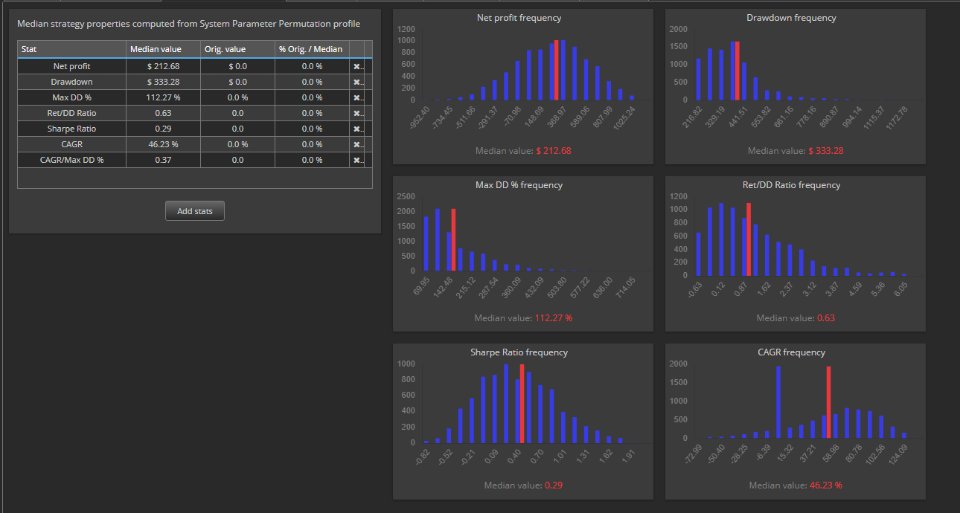

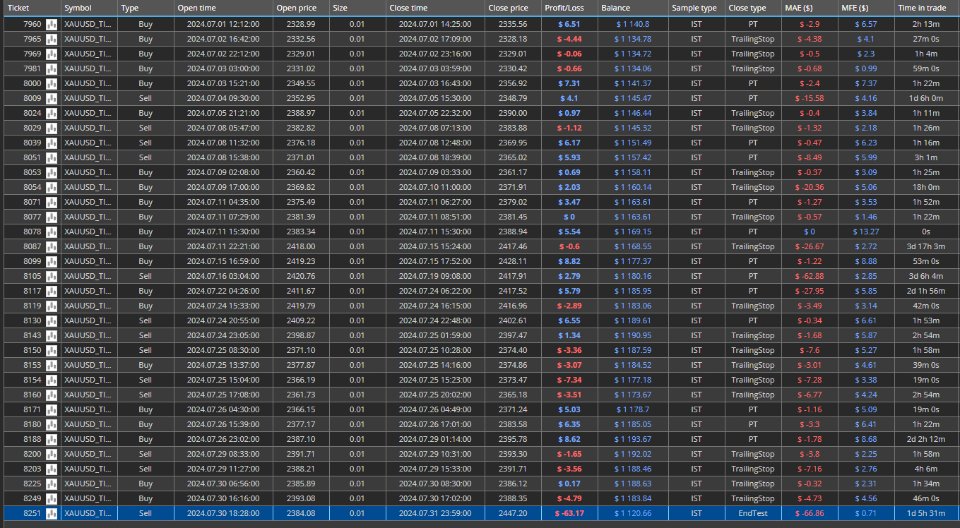

- Optimal Performance: Designed to work best with GOLD on the M5 timeframe.

- Capital Requirements: Minimum starting capital of $1000 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Zephyrlar Expert MT5

- Optimal Performance: Designed to work best with GOLD on the M5 timeframe.

- Capital Requirements: Minimum starting capital of $1000 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

### Relationship Between Indicators

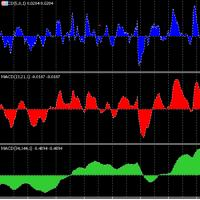

1. **Rate of Change (ROC):**

ROC measures the percentage change in price over a specific period, indicating momentum. It helps identify the strength and speed of price movements, signaling potential trend continuations or reversals.

2. **Fractal:**

Fractals identify potential reversal points in the market by highlighting price patterns with a central high (bearish fractal) or low (bullish fractal). They are often used in conjunction with other indicators to confirm trend changes or continuations.

3. **Average Directional Index (ADX):**

ADX measures the strength of a trend without indicating its direction. It helps determine whether the market is trending or ranging, which is critical for deciding whether to follow a trend or look for a reversal.

4. **Awesome Oscillator:**

The Awesome Oscillator measures market momentum by comparing the difference between two moving averages of different lengths. It provides insight into the market's strength and direction, confirming trends or indicating possible reversals.

5. **Stochastic Oscillator (Stoch):**

Stochastic measures the closing price relative to a range over a certain period. It is used to identify overbought or oversold conditions, signaling potential reversals or corrections within the trend.

### Combined Trade Setup

- **Pending Stop Order with Heiken Ashi:**

Heiken Ashi candlesticks smooth out price data to show trends more clearly. A pending stop order is placed based on the smoothed trend direction, waiting for confirmation of trend continuation or reversal.

- **Stop Loss (SL) %:**

The SL is set as a percentage of the entry price, providing a predefined risk limit based on the market conditions indicated by the combined analysis of ROC, Fractals, ADX, and other indicators.

- **Take Profit (TP) ATR20 Coefficient:**

The TP is calculated using a multiple of the 20-period ATR (Average True Range), allowing the trade to adapt to market volatility. ATR helps determine a realistic profit target based on recent market activity.

- **Trailing Stop by MTKeltner:**

The trailing stop is set using the Keltner Channel, which adjusts the stop-loss level based on price movements within the channel. This method allows the trade to lock in profits while following the trend, as indicated by the combined strength and momentum from the indicators.

### Indicator Interaction

- **ROC, ADX, and Awesome Oscillator:**

These indicators work together to assess trend strength and momentum. ROC and Awesome Oscillator provide momentum insights, while ADX confirms the trend's strength, helping decide whether to enter a trade.

- **Fractal and Stoch:**

Fractals identify potential reversal points, while Stoch helps confirm overbought or oversold conditions. This combination aids in timing entries or exits more precisely, especially when used with pending stop orders.

- **Heiken Ashi with MTKeltner:**

Heiken Ashi smooths price data to identify trends, while MTKeltner uses volatility-adjusted channels to trail stops. Together, they manage trade exits by capturing the trend's full potential while minimizing risk.