Immaculate Expert MT5

- Asesores Expertos

- Ruengrit Loondecha

- Versión: 24.806

- Activaciones: 10

---------------------------------------------------------

---------------------------------------------------------

Immaculate Expert MT5

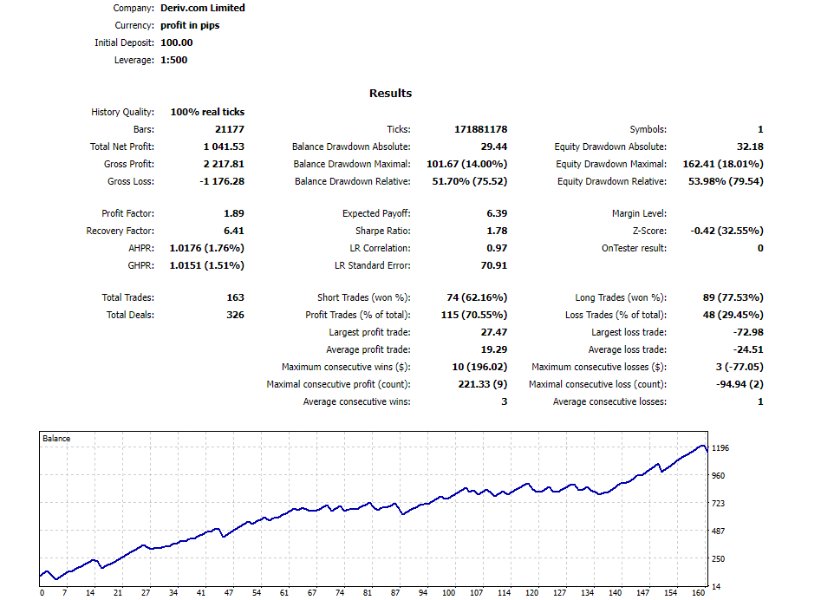

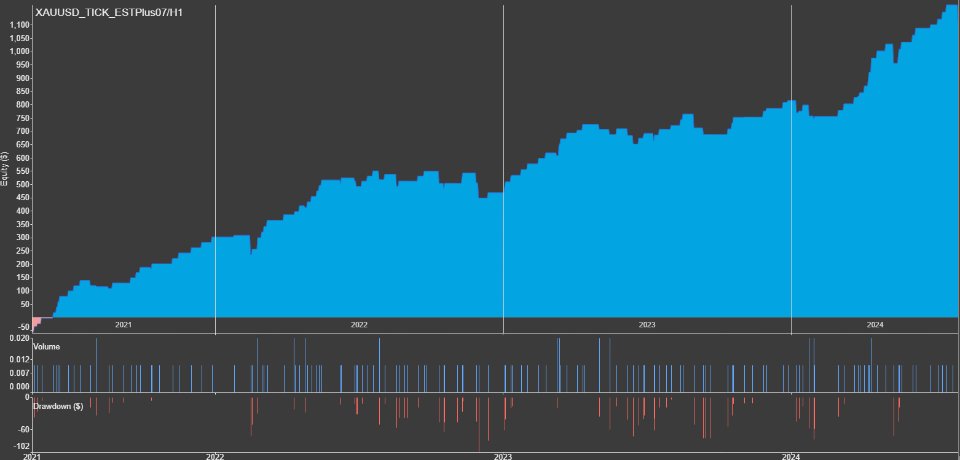

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$200 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Immaculate Expert MT5

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$200 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Ichimoku Kinko Hyo:

- The Ichimoku indicator provides a comprehensive view of market conditions by plotting five lines: Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and Chikou Span (Lagging Span). It helps identify trend direction, support and resistance levels, and potential reversal points.

-

Relative Strength Index (RSI):

- RSI is a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100. Values above 70 indicate overbought conditions, and values below 30 suggest oversold conditions. It helps identify potential market reversals and trend strength.

-

Quantitative Qualitative Estimation (QQE):

- QQE is an enhanced RSI that includes smoothing and volatility filters to provide clearer signals. It helps identify trend strength and potential reversals by refining traditional RSI signals.

-

Stochastic Oscillator (Stoch):

- The Stochastic Oscillator compares the closing price to the range of prices over a specified period. It ranges from 0 to 100, with readings above 80 indicating overbought conditions and below 20 indicating oversold conditions. It helps identify potential market turning points and momentum shifts.

-

Rate of Change (ROC):

- ROC measures the percentage change in price over a specified period, indicating the rate of price change. It helps assess the strength and speed of price movements and can signal potential trend reversals.

Trade Style

-

Move BE2SL with ATR:

- This involves moving the stop-loss to the break-even point (entry price) once the trade has moved in the trader's favor by a distance defined by the ATR (Average True Range). This approach helps lock in the initial capital and reduce risk. The distance added to the break-even point is typically calculated as a multiple of the ATR.

-

Trailing Stop by BB Range + Heiken Ashi:

- The trailing stop is adjusted based on the Bollinger Bands (BB) range and Heiken Ashi candlesticks. Bollinger Bands provide a volatility-based range, while Heiken Ashi smooths out price action to indicate trend direction. The trailing stop follows the price movement within the BB range and adjusts according to the Heiken Ashi high (for long positions) or low (for short positions), allowing for adaptive profit-taking while minimizing risk.

-

Take Profit (TP) and Stop Loss (SL) by Percentage:

- TP and SL levels are set as fixed percentages from the entry price. This method establishes clear exit points based on a predetermined percentage, facilitating consistent risk management and profit-taking strategies.