Unicorn XU

- Asesores Expertos

- Andrii Garkusha

- Versión: 2.1

- Activaciones: 5

Description of the strategy:

A highly professionally developed strategy from a trader with 25 years of experience.

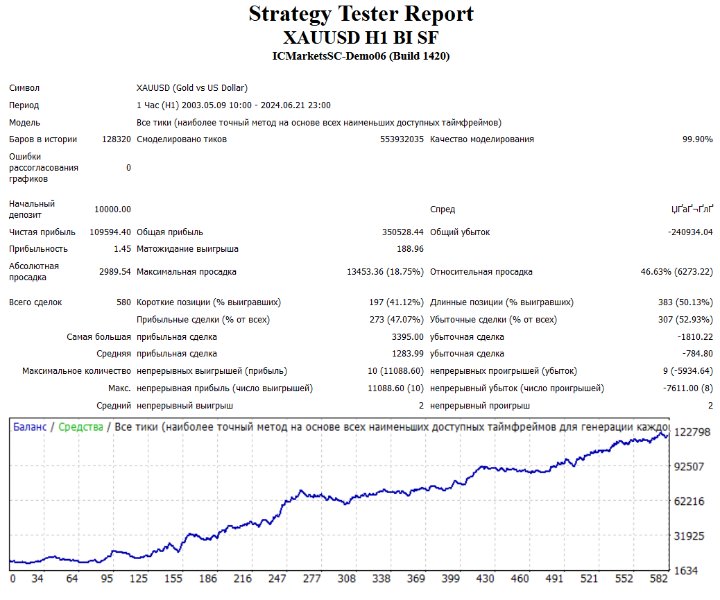

The strategy is based on the breakdown of levels. It has been thoroughly tested over a 20-year history using the entire range of stress tests (spread widening, slippage, application in other markets, changes in parameters, etc.).

Average annual return 362%. Maximum drawdown 41.3%.

In portfolio mode, the average annual return is 225%, drawdown 15.2%.

Work with a single entry with take profit and stop loss (no risky techniques such as martingale, grids, etc.).

Application in portfolio mode:

I strongly recommend using “Unicorn GBPUSD” and “Unicorn EURUSD” in a portfolio with our developments due to the fact that all three strategies were specially developed taking into account joint use in order to reduce drawdowns and increase the uniformity of profit. Strategies have a minimum level of cross-correlation of 2-5% (for open entries per day and for profit). Of course, they can be used separately, but if you want to get as close as possible to the method of using algorithms by large funds, then I recommend using a portfolio approach or, as it is also called, quantitative trading, when 2, 10 or more advisors can work on one account at the same time.

Money management:

Recommended money-management: 1 lot per 10,000 deposit. If used in portfolio mode and a deposit of 10,000, I recommend setting the opened lot to 0.33 lots in each of the three advisors.

Trading conditions:

The strategy is not sensitive to trading conditions (spread, commission, time delay to the broker’s server) and can be used on any (sane, of course) broker.