UnbalanceEurUsdAud2

- Asesores Expertos

- Kai Wei Luo

- Versión: 1.0

- Activaciones: 5

1. The principle of UnbalanceEurUsdAud2 intelligent trading system:

The three currency hedge unbalanced arbitrage is the extension and continuation of the triangle arbitrage. As a common arbitrage method, triangle arbitrage has been used by many investors in foreign exchange trading. Triangle arbitrage is based on cross exchange rates, which is the basis of triangle arbitrage. The so-called cross exchange rate refers to the price of a non-US dollar currency expressed by another non-US dollar currency. For example, AUDUSD =0.65472, EURAUD =1.76735, EURUSD =1.08575 in a certain foreign exchange market, when AUDUSD×EURAUD≠EURUSD, this provides the possibility for triangular arbitrage.

However, strict triangular arbitrage is not profitable due to spreads, slip points, overnight interest, fees and other reasons. If you increase the imbalance coefficient on the above three currency pairs, breaking this symmetry, there is the possibility of profit.

For example: place orders 1, sellA lot eurusd,2, sellB lot usdjpy,3, buy C lot eurjpy, 4, A, B, C coefficients are calculated.

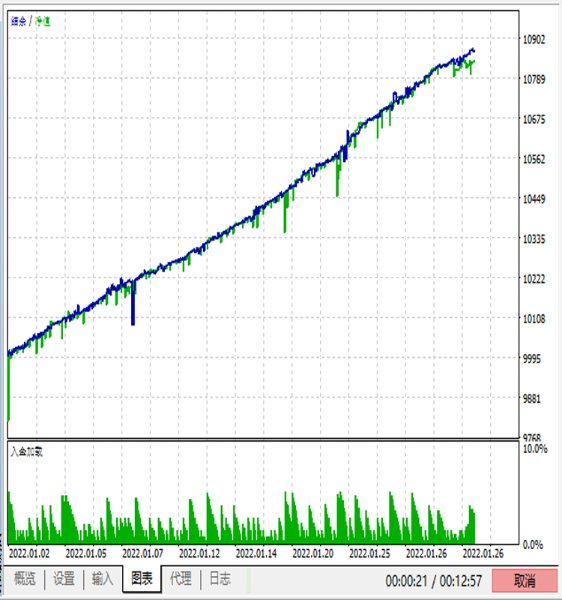

If Ask_AUD_USD * ASK_EUR_AUD-BID_EUR_USD < -400, trade three orders Ask_AUD_USD, Ask_EUR_AUD, Bid_EUR_USD at the same time;

If Bid_AUD_USD * BID_EUR_AUD-ASK_EUR_USD > +400, three orders Bid_AUD_USD, Bid_EUR_AUD, Ask_EUR_USD are traded at the same time;

When the above three orders are profitable, close the position. To make a profit.

2. Risk control and Tips:

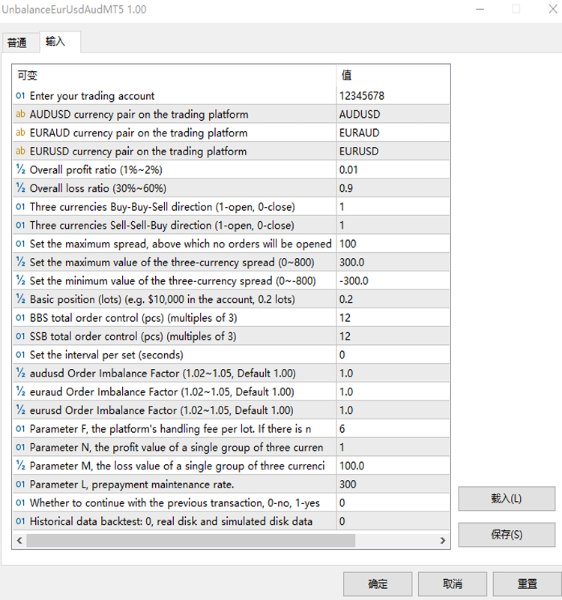

A The overall profit ratio is recommended to be 0.01, and the overall loss ratio is 0.6 or the value acceptable to the customer;

B With a principal of $10,000, it is recommended to set "basic position" as 0.2 lots, "BBS Order Total Control" as 12, and "SSB Order Total control" as 12.

C Any trading system has risks and should be invested with caution.

3. if the following problems, suggestions:

A If there is no trading order for a long time, it is recommended to modify "Set the maximum price difference of three currencies" and "set the minimum price difference of three currencies";

B If the three currency combinations cannot be closed for a long time, it is recommended to modify the "EURUSD order imbalance coefficient", "AUDUSD order imbalance coefficient", "EURAUD order imbalance coefficient", and modify the "Parameter F platform trading fee per lot" and "Parameter N" to make them at a reasonable level;

C After modifying parameters, reload EA.

4.Troubleshooting Common problems

A If "Account error!! You should set up your own trading account in EA;

B If there is no data or no transaction, check the letter subscript of the currency pair in the EA Settings;

C If "Abnormal account is detected during program operation or software expires" occurs, please contact the seller in time.