The Latvian Green Fairy

- Asesores Expertos

- Joy Dupute Moyo

- Versión: 1.0

- Activaciones: 10

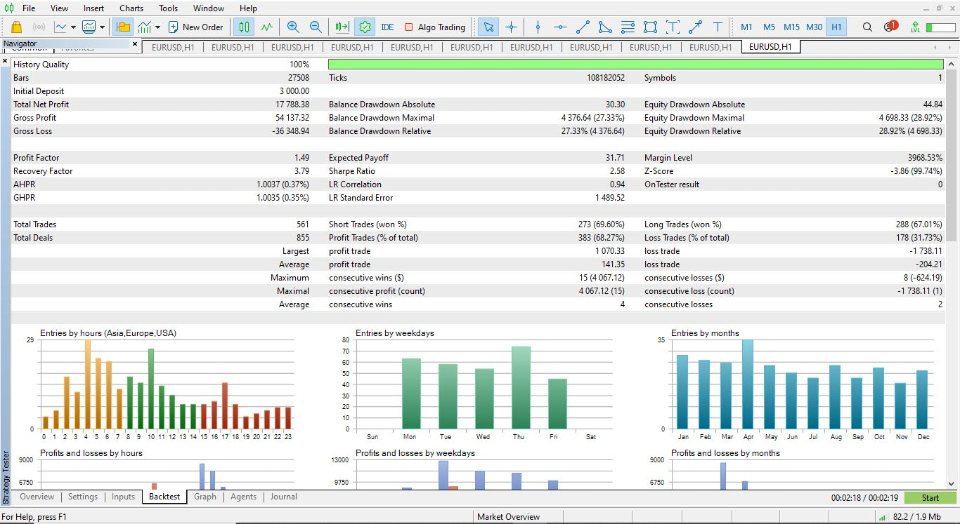

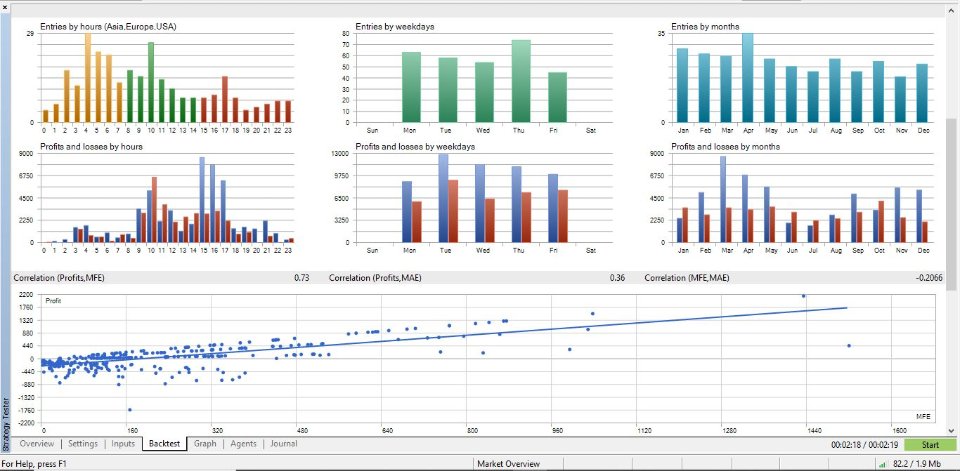

TRADE ENTRY LOGIC

The strategy is Based on Contraction Zone Breakouts caused by Master candlestick formations. If the zone breaks bullish, whereby price closes above the zone within a specific breakout distance, a buy trade is executed. Similarly, if the zone breaks bearish, whereby price closes below the zone within a specific breakout distance, a sell trade is executed.

TRADE MANAGEMENT

The strategy has a take profit level and a stop loss level. If price breaks Bullish, the stop loss is set at the lower level of the zone. If price breaks Bearish, the stop loss is set at the higher level of the zone. The Take profit level is 3 times the size of the stop loss level. However, there are 2 virtual partial take profit levels which have the same size as the stop loss distance which close part of the position and modify the stop loss level to protect winning trades. Hence theoretically, there are 3 Take Profit Levels.

RISK MANAGEMENT

The strategy has an Auto lot function which ensures that the account is compounded as it grows. The Auto lot function ensures that for a specific balance in your account, you use a proportionate lot size. This ensures that as the account grows, the volume used also increases to allow compounding to occur, similarly, as the account enters drawdown, the volume decreases to reduce the risk.

PREFERENCES

Although not part of the core strategy, the strategy allows users to specify trading sessions if they wish to that they would like breakouts to be traded, this might help reduce the risk of lack of volatility during break outs which may lead to targets not being hit. The strategy also allows users to decide to use a News filter or not depending on their own preferences.

WHO IS THIS STRATEGY FOR:

This strategy is for realistic traders who seek an edge in the markets. As seen from the strategy description above, This is not a mystical black box. There is no AI or machine learning algorithm within this EA. There is no Hedging logic within this strategy. There is no Cost Averaging Grid or Loss Recovery Technique employed to capture an edge in this strategy. There is no martingale used to recover losses. This strategy was not optimized in any way and neither is there any need to optimize it. The strength of the EA lies in how it manages trades. Everything is laid out clearly and honestly. Everyone is welcome to download the demo and test it.