Gmgs SG

- Asesores Expertos

- Usama Yasir

- Versión: 1.0

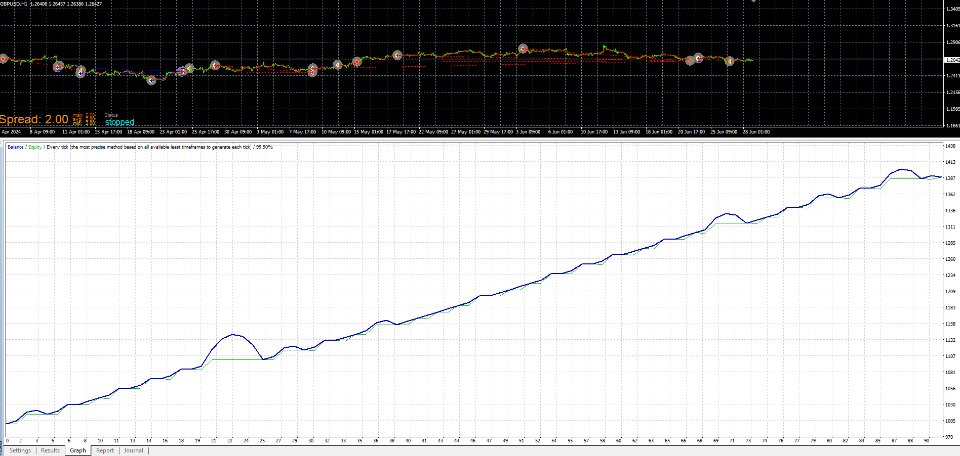

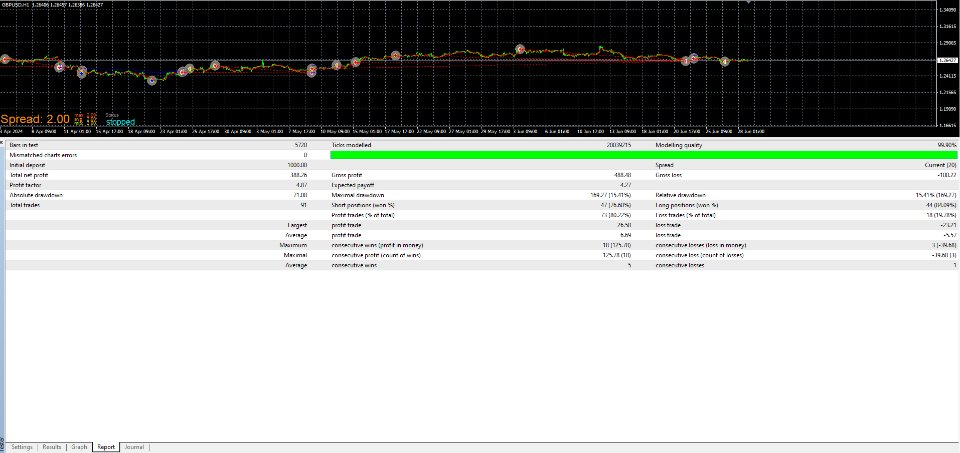

GMGS Smart Grid – Adaptive Grid EA for Long-Term, Low-Risk Forex Trading

GMGS Smart Grid (GMGS SG) is a professional-grade Expert Advisor for MetaTrader 4, designed to implement a calculated grid-based trading strategy with a focus on capital preservation, low drawdown, and long-term profitability. Built for traders who prefer structured logic over high-risk approaches, GMGS SG uses dynamic recovery algorithms and price-action-based decision-making to respond to market movement intelligently.

Rather than using classic martingale techniques with aggressive multipliers, GMGS SG applies a more conservative and adaptive approach, managing trades through spaced grid levels and strategic exits. This results in smoother equity curves and minimized exposure to high-volatility spikes.

Whether you're trading one pair or multiple, this EA offers a plug-and-play solution with a long-term perspective, offering flexible risk control and account protection.

🧠 Strategy Logic & Core Principles

-

Smart Grid Algorithm: GMGS SG opens additional trades based on market structure and price deviations, using fixed or dynamic grid spacing. It does not over-leverage the account and avoids sudden equity drawdowns by controlling the number and size of positions.

-

Trend Sensitivity: The EA includes filters to determine minor trend shifts, allowing it to optimize entry placement and avoid trades in choppy or high-risk zones.

-

Volatility Adaptive: The EA adjusts to changing market volatility by modifying its trade behavior, optimizing entry spacing and lot scaling where applicable.

-

No Martingale or Scalping Tricks: While it uses grid logic, GMGS SG does not use high-risk doubling strategies. It maintains a fixed lot approach (or modest scaling) and focuses on stable cycles over short-term profit bursts.

🏆 Recommended Currency Pairs

GMGS SG is designed to perform across major and minor pairs with medium volatility and low spread:

-

GBPUSD

-

EURUSD

-

USDCAD

-

AUDUSD

-

AUDCAD

-

EURCAD

-

EURCHF

-

GBPJPY

You can run it on multiple symbols simultaneously if your equity allows, but be sure to allocate enough capital for each pair to handle drawdowns gracefully.

⚙️ Setup Instructions

-

Timeframe: H1 to H4

(For lowest risk and smoother performance, H4 is recommended.) -

Minimum Recommended Equity:

-

$1,000 per pair (or higher if using multiple pairs simultaneously)

-

-

Lot Size: Default settings are optimized; can be customized as per risk appetite

-

Leverage: Works well with 1:100 and above

-

Broker Type: ECN accounts preferred for lower slippage

No additional DLLs, indicators, or configurations are needed. The EA works out-of-the-box with default settings. However, advanced users may fine-tune parameters based on specific risk tolerance or pair behavior.

📈 Growth & Risk Management

-

Expected Monthly Growth: 10% to 30% (historically observed in backtests and live environments with optimal settings)

-

Drawdown Control: The EA uses internal safety limits to manage exposure and avoid excessive drawdown spikes.

-

Smart Recovery: In cases of floating loss, the EA uses calculated exit points instead of force-closing positions, protecting both equity and mental peace.

-

Compounding Plan Suggestion: Add $50 equity monthly and monitor long-term performance. Avoid over-risking in early months.

🔒 Security & Protection

-

No use of DLL calls or external files

-

Does not collect user data

-

No hidden licensing checks or deactivation triggers

-

No broker affiliation or third-party links

🔄 Updates & Future Enhancements

-

Continuous maintenance and upgrade based on MT4 updates and community feedback

-

All users receive free lifetime updates through the MQL5 Market

-

The EA is compatible with new MetaTrader builds and tested for stability on major brokers

📌 Support & Feedback

-

Product support is available via the MQL5 comments section

-

Questions and setup inquiries are typically responded to within 24–48 hours

-

No external support links or Telegram groups are used – all communication stays within the MQL5 ecosystem

✅ Final Notes

GMGS Smart Grid is not a get-rich-quick system. It is designed for traders who understand long-term, compounding growth and proper capital allocation. It performs best with realistic expectations, adequate funding, and minimal interference.

We encourage you to test it in demo or rent before committing to full live deployment. Default settings offer a safe starting point, and additional pair configurations are available upon request through the product comments.

Developed by: GROW MORE GROW SAFE LTD

#GMGS #SmartGrid #ForexEA #LowRiskGrid