Usdjpy OSMA Impulse MT4

- Asesores Expertos

- Tomas Vanek

- Versión: 1.0

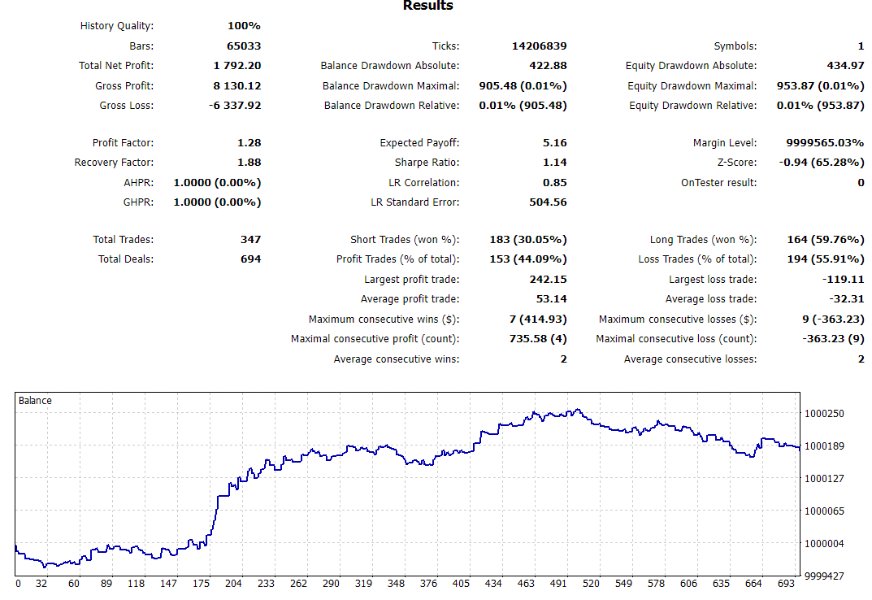

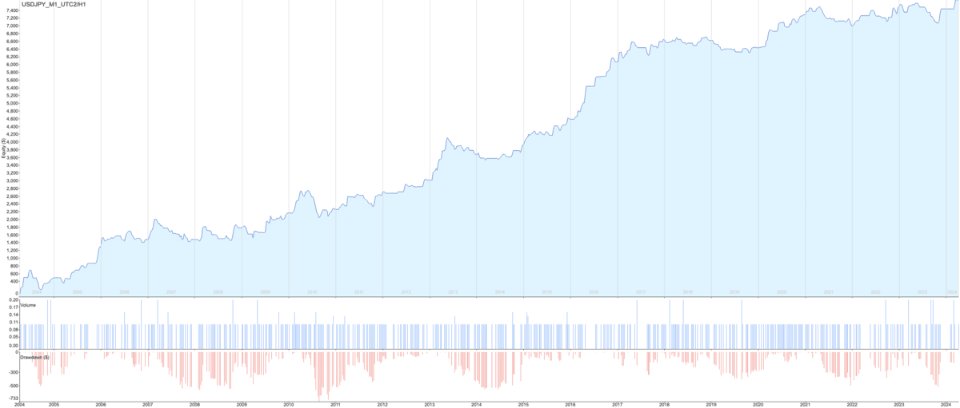

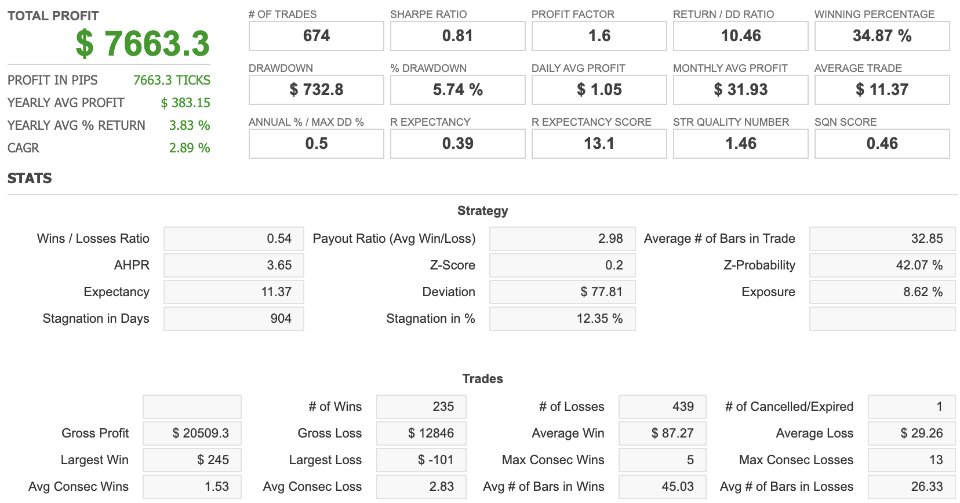

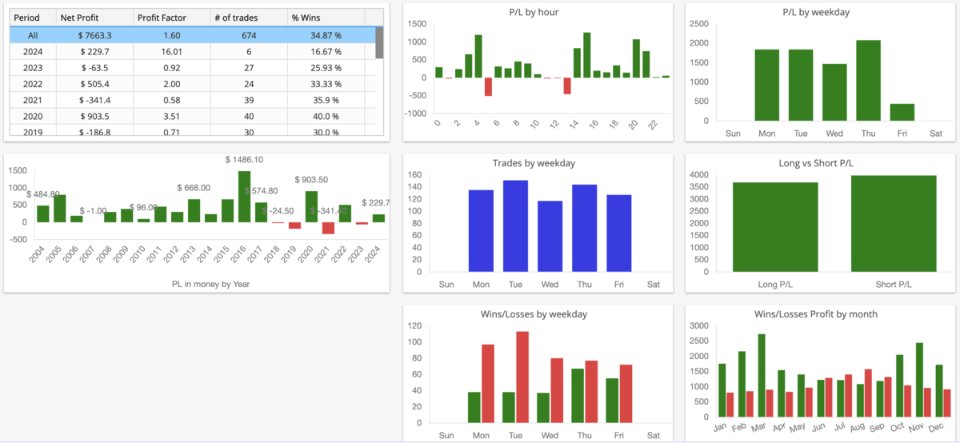

The UJ_H1_170100007_S_OD_CF_SQX is an algorithmic trading strategy for MetaTrader, tested on USDJPY using the H1 timeframe from April 1, 2004, to April 24, 2024. There is no need to set up parameters, all settings are already optimized and fine-tuned.

Recommended broker RoboForex because of EET timezone.

You can find the strategy source code for StrategyQuant at the link: http://quantmonitor.net/listing/usdjpy-osma-impulse/

Key details are:

Parameters

MagicNumber: 170100007

Main Chart: Current symbol and timeframe

Trading Options

Weekend Trading: Allowed

Daily Exit: Disabled

Friday Exit: Enabled at 20:00

Max Trades/Day: No limit

Stop Loss (SL) and Profit Target (PT): Min SL: 15, Max SL: 100, Min PT: 30, Max PT: 500 ticks/pips

Entry Signals

Long Entry: Triggered when the OSMA changes direction downwards and the close is below the upper Bollinger Band (10, 2.1).

Short Entry: Triggered when the OSMA changes direction upwards and the close is above the lower Bollinger Band (10, 2.1).

Entry Rules

Long Entry: Opens long orders at the daily open price with a SL of 6.3 * ATR(17) and a profit target of 245 pips, moving SL to break-even at 25 pips, valid for 12 bars.

Short Entry: Opens short orders at the daily open price with a SL of 6.3 * ATR(17) and a profit target of 245 pips, moving SL to break-even at 25 pips, valid for 12 bars.

Exit Rules

Long Exit: Closes full position if market is long and no LongEntrySignal is active.

Short Exit: Closes full position if market is short and no ShortEntrySignal is active.

Features

- Each deal is protected by stop orders (Stop Loss and Take Profit).

- AI based strategy

- Both a fixed lot and a free margin percentage are used.

- No martingale, no grid, no scalp.

- No excessive consumption of CPU resources.

- User-friendly settings.

- All settings optimized, ready for real trading.

- Long-term strategy. - you need patinet, startegy makes a few trades per month and picks up only the best opportunities on the market