MarketTrader StBol MT4

- Asesores Expertos

- Bohdan Suvorov

- Versión: 1.6

- Activaciones: 15

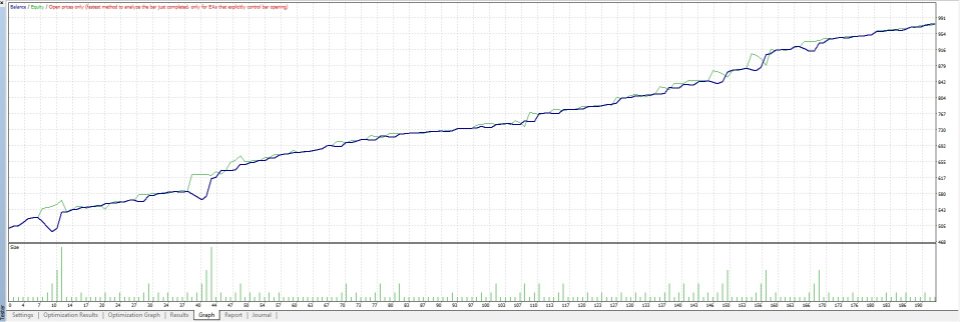

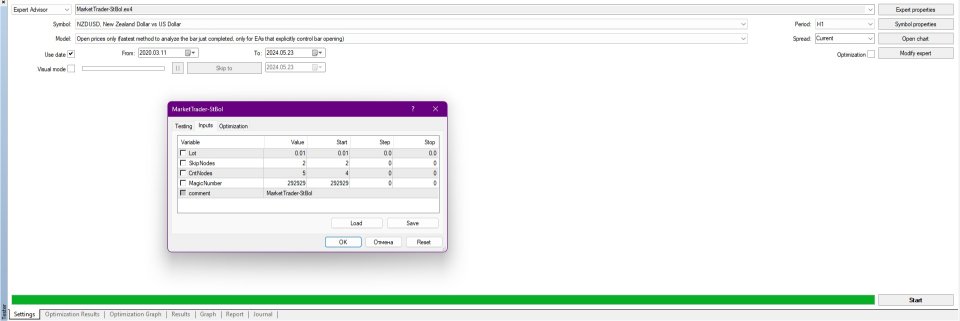

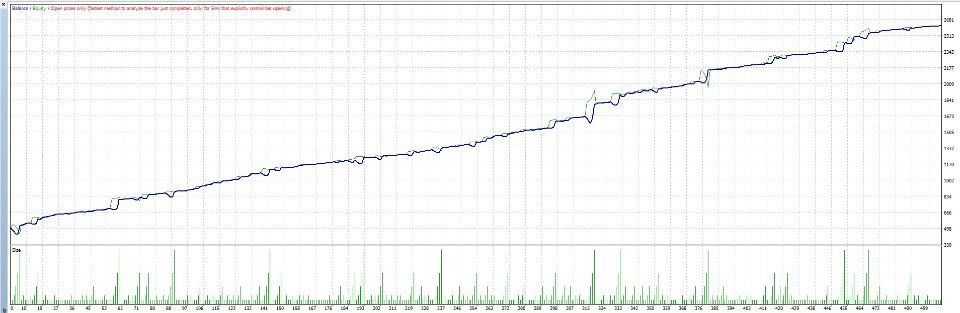

The Expert Advisor works on double stochastic, bollinger bands and trawl. The Expert Advisor trades simultaneously on 18 standard symbols.

- The Expert Advisor is for five-digit accounts.

- Leverage 1:500

- Timeframe for trading H1

- Period 2022.05-2024

Symbol for placing the Expert Advisor any of the standard symbols.

- Statistics on a real account: https://www.mql5.com/en/signals/1964381

- Lot for every 0.01 lot needs $ 500 deposit.

- The first three knees are skipped. Total knees for each symbol no more than five.

Only these symbols are traded from one chart, one symbol at a time, any prefixes and suffixes in currency pairs are allowed:

- NZDCAD

- GBPNZD

- NZDUSD

- NZDJPY

- CADCHF

- EURCAD

- EURNZD

- CHFJPY

- AUDCHF

- AUDCAD

- CADJPY

- EURJPY

- EURAUD

- EURGBP

- AUDUSD

- USDCAD

- EURUSD

- GBPUSD

Algorithm:

- Data Loading: Create a function that loads financial data from a source (such as a database, CSV files, or API) and stores it into data structures, such as arrays or containers, for further processing.

- Data Analysis: Implement functions to analyze financial data, including calculating statistics (e.g., mean, standard deviation, correlation) and plotting to visualize trends.

- Forecasting: Implement forecasting algorithms such as regression analysis, time series, neural networks, or other machine learning techniques. Functions should use historical data to train a model and predict future values.

- Develop trading strategies: Create functions that use predicted values and other financial indicators to develop trading strategies. This may include identifying entry and exit points, calculating stop loss and profit-take levels, and portfolio management.

- Testing and Optimization: Implement functions to test and optimize trading strategies using historical data. This may include backtesting, visualizing results and optimizing strategy parameters for best results.

- Portfolio Management: Develop functions for portfolio management, including asset allocation calculation, risk diversification and portfolio rebalancing based on financial performance and trading strategies.