Market Cycles Order Flow

- Asesores Expertos

- Thang Chu

- Versión: 2.687

- Actualizado: 19 octubre 2024

- Activaciones: 5

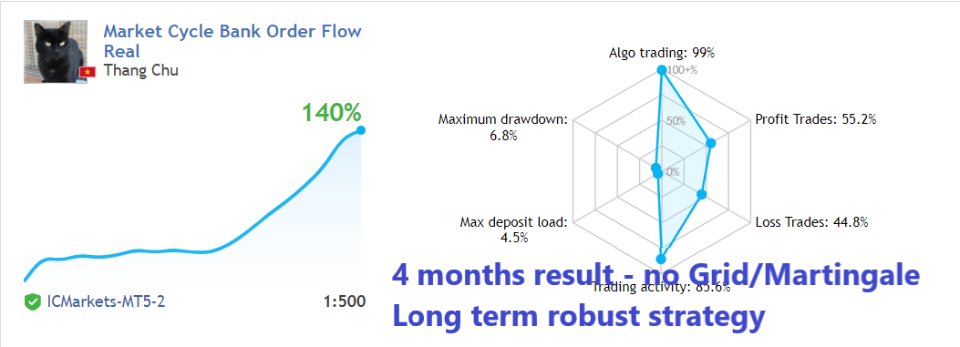

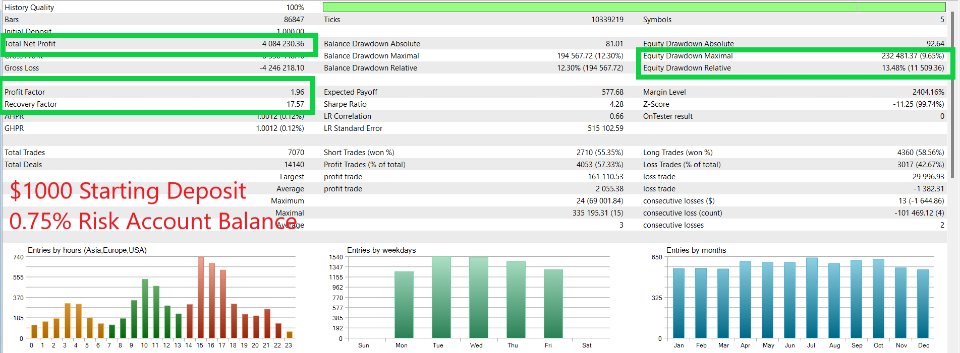

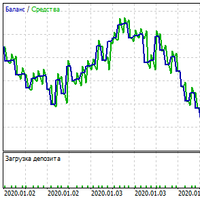

Signal Account (running 0.75% Balance Risk)

If you need MT4 version or can't afford renting/purchasing contact me for alternative solution.

Join Nexus Community Public Chat

This EA is part of Nexus Portfolio - a combination of the best long term EAs I created for my personal trading as well as private fund management.

The best NON martingale, grid or averaging EA in mql5 market. Most other EAs only sell backtest dream. This is the only EA that can perform closely in live trading as in backtest.

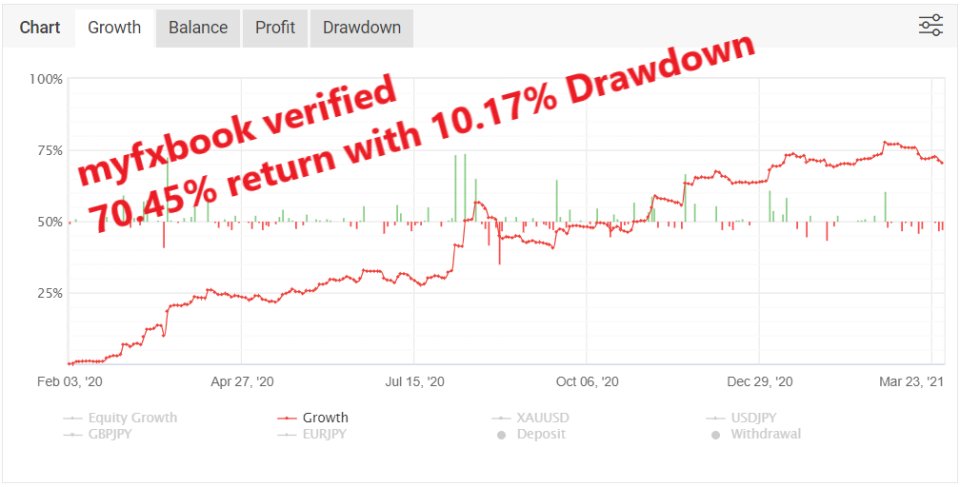

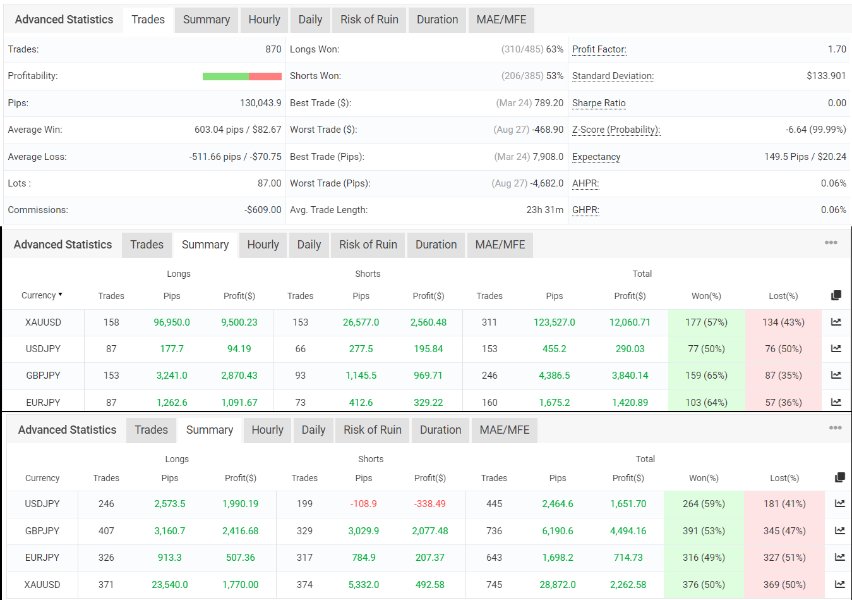

This algorithm has been running live for private accounts for over 3.5+ years since 2020, returning over 26,000 pips with exceptional risk stability. Now upgraded to MT5 platform with additional enhancements to market regime recognition and additional indicator filtering.

The algorithm utilizes a proprietary AI model based on retail trader sentiment and 9 different indicators to identify and predict relevant market cycles of up and down trends, including MACD, Smoothed Moving Average, RSI, TDI, ADX and some others less common indicators to find the best entry during a trend.

Retail sentiment data has been collected for many years and feeding to the AI engine to learn the patterns of retail traders and consistently trade against them.

Why choose my EAs ?

- Excellent long term stable backtest, no grid martingale or manipulation

- Real trades match backtest in execution (90% EAs fail at this!)

- Live performance is similar to backtest (another 90% EAs fail at this - the moment they trade in real life, they perform poorly nothing like backtest)

- This algo includes 20+ trading strategies, 5 assets for diversification

- Higher return and less risky than any other martingale/grid/increasing lot size after loss EAs

Backtest & Setup Guide (Check setup pictures below):

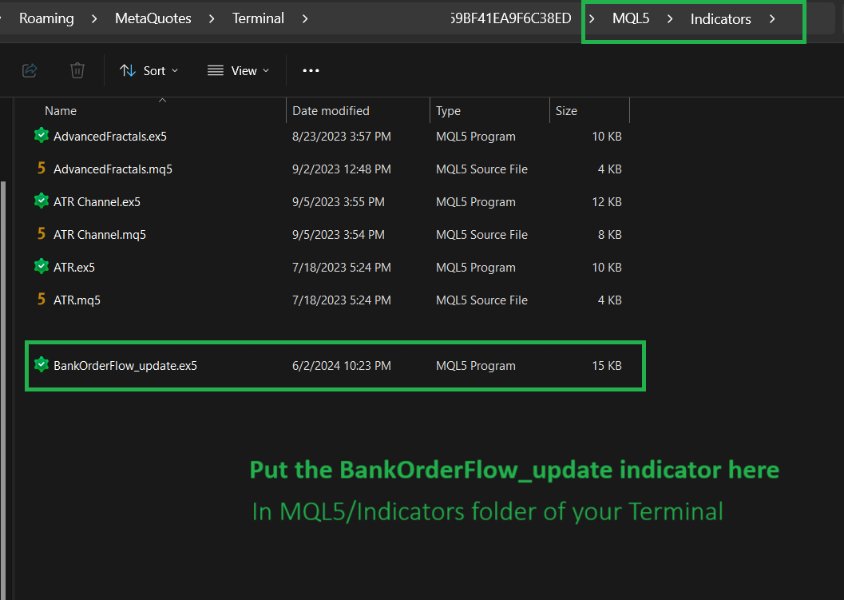

- To backtest and run the EA correctly you'll need the BankOrderFlow_update indicator. PM me to receive the indicator and put it in MQL5\Indicators folder.

- Make sure supported trading pairs ( XAUUSD, USDJPY, GBPJPY, EURJPY, XAUJPY ) are in Market Watch. Set TradeXAUJPY = false if your broker doesn't have this pair.

- Load data for all timeframes for the supported pairs ( Ctrl+U --> Symbols --> Bars --> Request data from M1 to Daily)

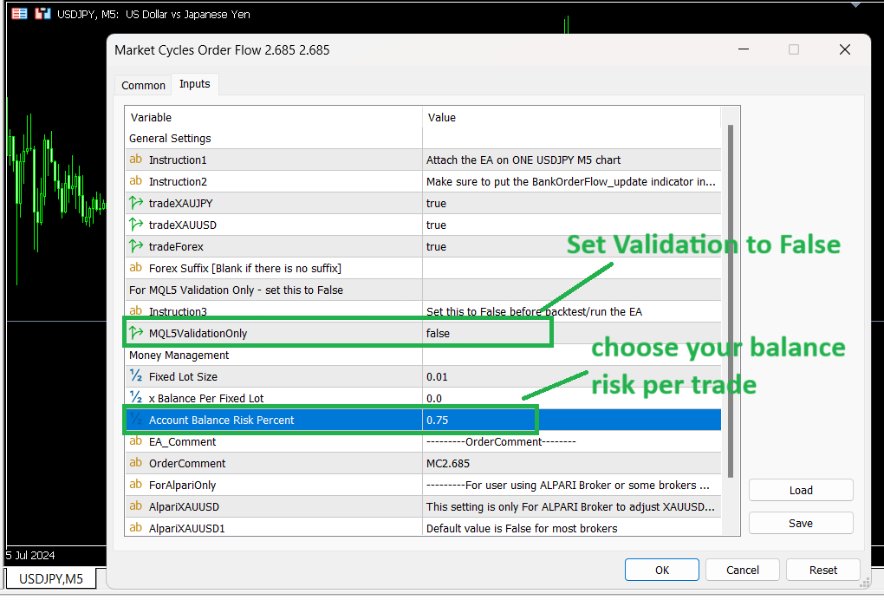

- Attach/backtest the EA on ONE USDJPY M5 chart

- Set ValidationOnly to False

- Choose your Risk ( Live Signal trading with 0.75 Account Balance Risk Percent )

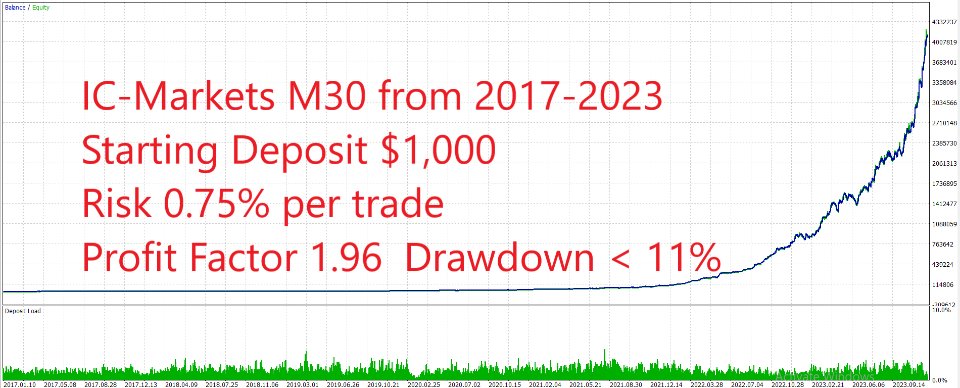

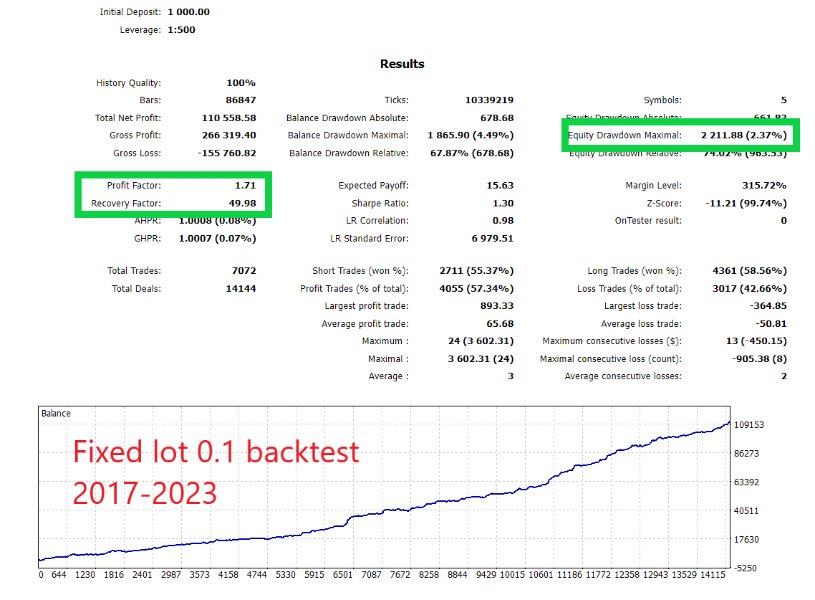

- Best is to use IC Markets platform to test from 2017. You'll get the same backtest result as mine.

- No Martingale, grid or holding on losses to infinity. This algorithm is used for private funds and clients with strict risk management guidelines.

- Supported pairs: XAUUSD, USDJPY, GBPJPY, EURJPY, XAUJPY

- Multi assets - Multi Timeframes - Multi Strategies

- Safe and long term stable

- Proven edge: it has proven edge in both backtest since 2017 and live trading since 2020

- Backtested with 0.1 fixed lot yield $110,000 in profit over the last 6 years with Recovery Factor of 49.98

- Losses can and will happen as with any other normal trading strategies. It will have periods of drawdowns but it is a tradeoff for long term capital safety. Estimated Max Drawdown with 0.75% Balance Risk is 20-25% from backtest

- Requires hedging account and standard New York close brokers time zone( GMT+2 +3)

ICM: The entry is often very good, the profit transfer is not good with cross-trends (zigzag), too much profit is expected, and the timing of the market change is also problematic. I carry out the profit transfer manually, it is a bit time-consuming but I am satisfied.

July 18th started very well, then 1 month from August 20th to September 18th, 2024 with greater losses and higher DD, was certainly not a good time. Since September 18th, very good again, the losses from August 20th to September 18th, slightly more than neutralized.

Rough summary as of July 18th: Of the last 3 months, 2 months neutral, 1 month good profit. If I had only traded for the last two months, I would not have had the reassuring profits from the first of the three months to offset the rather high DD.

EURJPY has been showing a strong negative trend since June 21, 2024 and could be deactivated in the last version, then 4 pairs will remain.

23.11.2024: The last few weeks went well with my manual closing of orders at a certain profit limit. I have now closed all orders on all accounts, so I'll start again on Monday. I have made the EA purchase several times, so now I'm giving it 5 stars.

The automatic profit transfer of the EA is also good in several cases, but still needs to be improved. The profit expectations are too high, I'm happy with less, but more often.

11.12.2024: From November 25th to December 10th, 2024, things weren't going well until yesterday, the cross trend was too high. Yesterday, on December 10th, 2020, at the end of the session at 11:26 p.m. ICM time, I closed all orders manually because the orders were in good profit. This way I made up 2/3 of the losses during that time.

The trend often only lasts one or two sessions, or like now, 1 or 2 days. But a trend doesn't currently last longer than that. The temporary losses can be made up quickly, but currently only with good manual profit transfer.

Let's see how the market trend continues, 1/3 of the last losses are still missing, but I'm still doing well... .

01.01.2025: I'm currently doing quite well with the manual TP at MC, after a small interim low I've reached a new profit high after 5 months !

06.01.2025: This afternoon, the automatic TP transfer from the MC was once again not good. The entry was good.

I had manually transferred a little too late today and not all currency pairs, so these accounts remained only neutral.

The accounts with "basket ea managements" came out with a profit.

In the evening, the live signal of the equity was optimistically good at +107 USD (lot 0.01). The live signal in January is at -4.42%, so this is offset by +107 USD. However, so far today there has been no significant TP, only an increase in loss orders (-4.42%). Therefore, a lot can still change in the live signal and this -4.42% can be reduced.

17.01.2025: I'm in the plus in January, live signal is -1.18%. Therefore still 5 stars.

08.03.2025: It was great before, but the last 1 to 2 weeks have been a very, very tough time, no real strong trend, a lot of sideways movements in an unhealthy SL range. The good profits of the year have been greatly reduced.

The TP would have to be improved for cross trends so that the DD is not as high as the last 2 weeks.

18.03.2025: runs much more relaxed again...