B4S Institutional Round Number Prices

- Indicadores

- Henry Waribu Macharia

- Versión: 2.0

- Actualizado: 4 junio 2024

- Activaciones: 5

Brief Description:

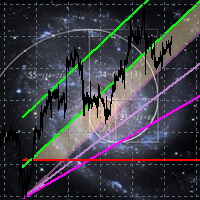

The B4S_Institutional_Round_Number_Prices indicator identifies and marks key price levels, known as round number prices or institutional price levels, renowned for their psychological significance. These levels often influence institutional activity, attracting attention and triggering significant market moves.

Features:

- Round Number Price Identification: The indicator excels at identifying round number prices, providing you with crucial insights into potential market movements.

- Persisting User Settings: Enjoy the convenience of setting your preferences just once! Your chosen settings are automatically saved and persist through future restarts, streamlining your trading experience.

- Flexible Settings Adjustment: Need to make changes? Activate the simple Boolean toggle in the input section to adjust saved settings effortlessly.

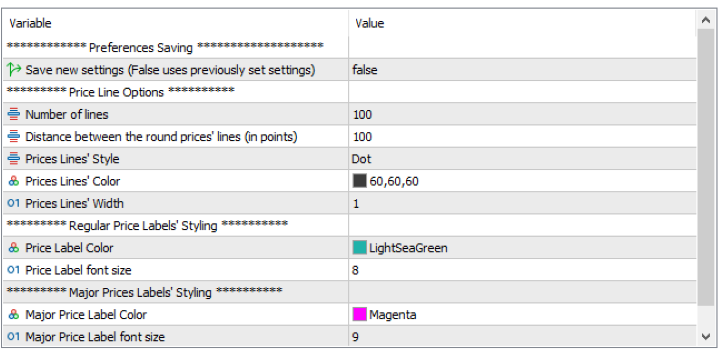

Settings:

- Price Line Options:

- Number of Lines

- Distance Between Lines (in points)

- Price Lines' Style

- Price Lines' Color

- Price Lines' Width

- Price Label Styling Options:

- Price Label Color

- Price Label Font Size

- Major Prices Labels' Options:

- Major Price Label Color

- Major Price Label Font Size

Importance of Institutional Price Levels

1. Strategic Trading Zones:

- Execution Planning: Large institutions often strategically plan their trades around key price levels. Institutional price levels act as reference points where these entities execute significant buy or sell orders.

- Reduced Slippage: Trading around institutional levels allows large institutions to minimize slippage by entering or exiting positions at prices that are considered optimal within the broader market context.

2. Liquidity Concentration:

- Increased Liquidity: Institutional price levels are magnets for liquidity. Large institutions target these levels to tap into concentrated liquidity zones, facilitating the execution of substantial orders without causing excessive market impact.

- Reduced Market Impact: Trading at institutional levels helps large players avoid disrupting the market with their sizable trades. By concentrating their activity at these key levels, institutions can reduce the impact of their trades on price movements.

3. Smart Money Alignment:

- Smart Money Reference: Institutional traders are often considered "smart money" in the market. Recognizing and following their actions around institutional levels can provide retail traders with insights into potential future market directions.

- Alignment of Strategies: Traders may align their strategies with institutional activity, recognizing the importance of institutional price levels as guideposts for smart money movements.

- Trend Confirmation: Institutional price levels can act as confirmation points for trends. Breakouts or bounces from these levels may indicate the initiation or continuation of a trend.

4. Order Flow Analysis:

- Order Accumulation: Large institutions may use institutional levels to accumulate or distribute positions. Monitoring the order flow around these levels provides valuable insights into institutional intentions.

- Algorithmic Trading Strategies: Institutional traders often employ algorithmic strategies that are designed to take advantage of price levels with historical significance. The indicator can aid in identifying and aligning with these algorithmic strategies.

5. Market Influence and Psychology:

- Market Perception: Large institutions have the ability to influence market perception. By transacting around institutional levels, these entities contribute to shaping the overall market sentiment.

- Psychological Impact: Institutional trading at key levels can have a psychological impact on the broader market. Traders often look to institutional activity as a signal for potential market direction.

6. Risk Management:

- Informed Risk Decisions: Institutions use institutional levels to make informed risk management decisions. These levels serve as reference points for setting stop-loss orders, managing position sizes, and assessing overall risk exposure.

- Volatility Assessment: Large institutions may adjust their risk parameters based on the volatility observed around institutional levels. Recognizing these levels aids in anticipating and managing market volatility.

7. Enhanced Timing and Decision Making:

- Precision Timing: The indicator's ability to identify round number prices enhances your timing precision. Traders can align their strategies with these levels, entering or exiting positions at opportune moments.

- Strategic Entry and Exit: By incorporating institutional price levels into your analysis, you can strategically plan your entry and exit points. This leads to more informed trade decisions and improved risk management.

Summary

In summary, the B4S Institutional Round Number Prices Grid becomes a valuable asset for traders by providing insights into the behavior of large institutions. By understanding the importance of institutional price levels as reference points, traders can align their strategies, make informed decisions, and potentially benefit from the movements orchestrated by major market players.

Related Topics

1. B4S

2. #Psychological Levels

3. #Market Sentiment Analysis

4. #Smart Money Trading

5. #Price Action Strategies

6. #Algorithmic Trading Signals

7. #Liquidity Zones Identification

8. #Trading Around Key Levels

9. #Institutional Order Flow Analysis

10. #Institutional Price Levels Analysis

11. #Price Reactions at Key Levels

12. #Trade Entry and Exit Points

13. #Market Manipulation Detection

14. #Market Microstructure Analysis

15. #Behavioral Finance in Trading

16. #Market Psychology Insights

17. #Risk Management at Institutional Levels