Candlestick pattern EA

- Asesores Expertos

- Menaka Sachin Thorat

- Versión: 1.0

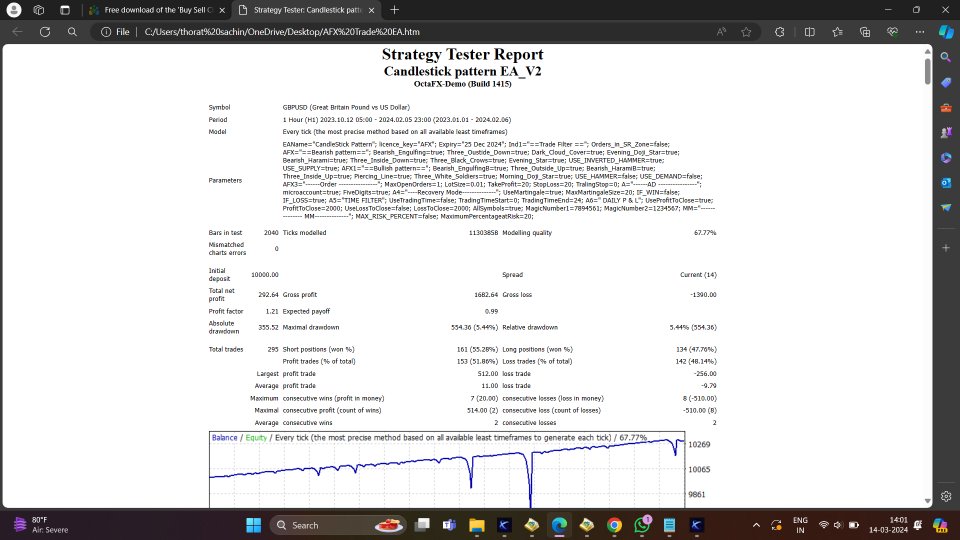

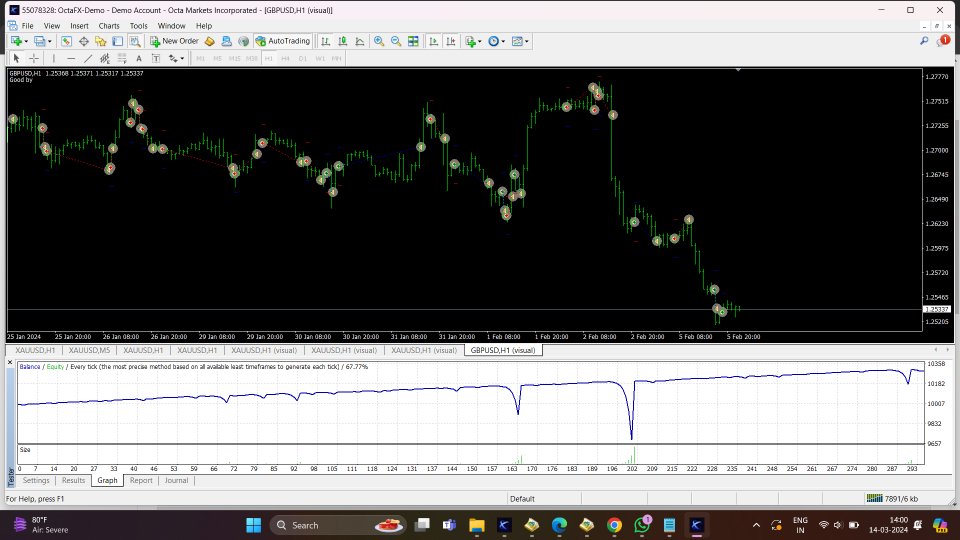

Certainly! A candlestick pattern EA is an Expert Advisor that automates the process of identifying specific candlestick patterns on a price chart and making trading decisions based on those patterns. Candlestick patterns are formed by one or more candles on a chart and are used by traders to analyze price movements and make trading decisions.

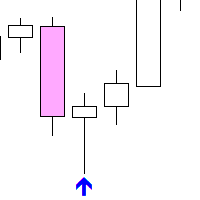

EA likely scans the price chart for predefined candlestick patterns such as the Hammer, Inverted Hammer, Three White Soldiers, and Evening Star. When it identifies one of these patterns, it can generate a signal to either buy or sell, depending on the pattern and its implications for future price movement.

For example, if the EA detects a Hammer pattern, which is a bullish reversal pattern, it might generate a signal to buy, anticipating a potential upward price movement. On the other hand, if it detects an Evening Star pattern, which is a bearish reversal pattern, it might generate a signal to sell, anticipating a potential downward price movement.

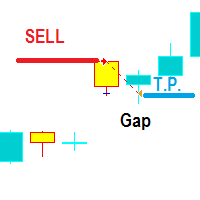

if the EA detects a loss from the previous trade, it should activate a recovery mode for both buy and sell directions. If the previous trade was a win, it should correct. This feature can help manage losses and potentially increase profits. Do you have specific rules or strategies in mind for how the recovery mode should work?

if use recovery mode set trailing stop = 0