ARC Ichimoku Signals

- Indicadores

- Shahabeddin Baset

- Versión: 1.0

- Activaciones: 15

Combination of Ichimoku and Super Trend indicators, with Signals and live notifications on Mobile App and Meta Trader Terminal.

Features:

- Display five reliable signals of ARC Ichimoku

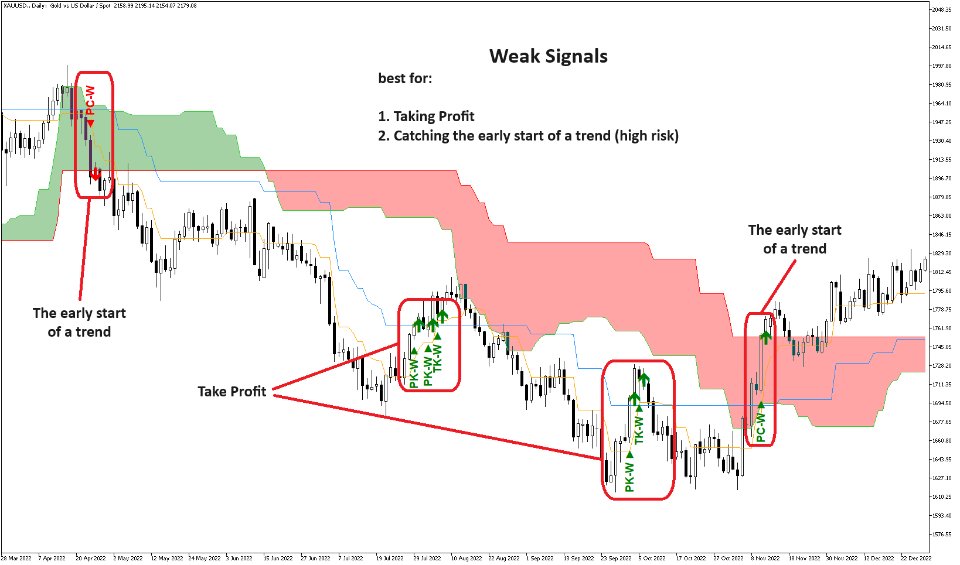

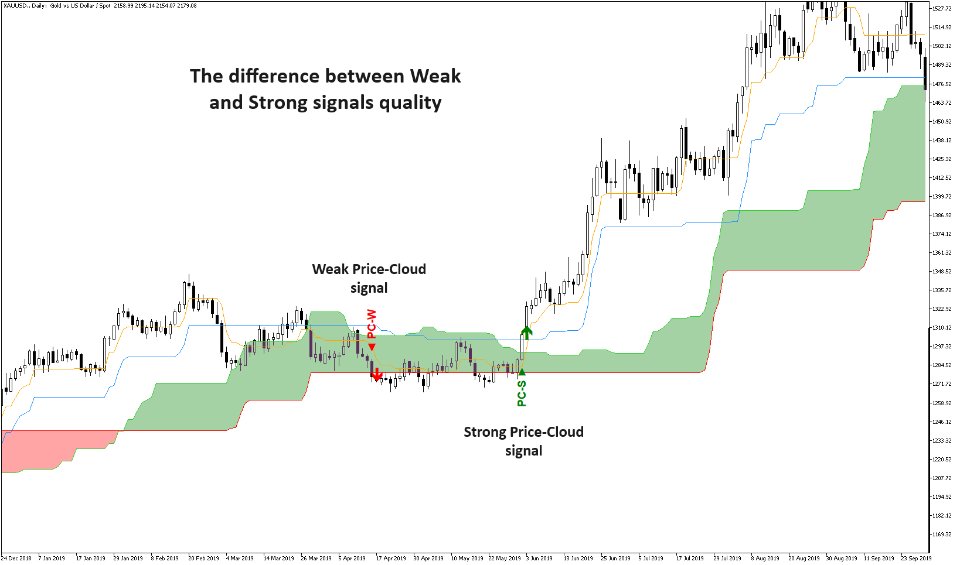

- Filter signals by their strength level (strong, neutral, weak)

- Send live notifications on Mobile App and Meta Trader terminal

- Signals remain consistent without repainting

- Applicable across all time-frames

- Suitable for all markets

- Notifications format: "ARC Ichimoku | XAUUSD | BUY at 1849.79 | Tenken-Kijun cross | Strong | H1 | 2023.10.09 02:00"

How to Use

-

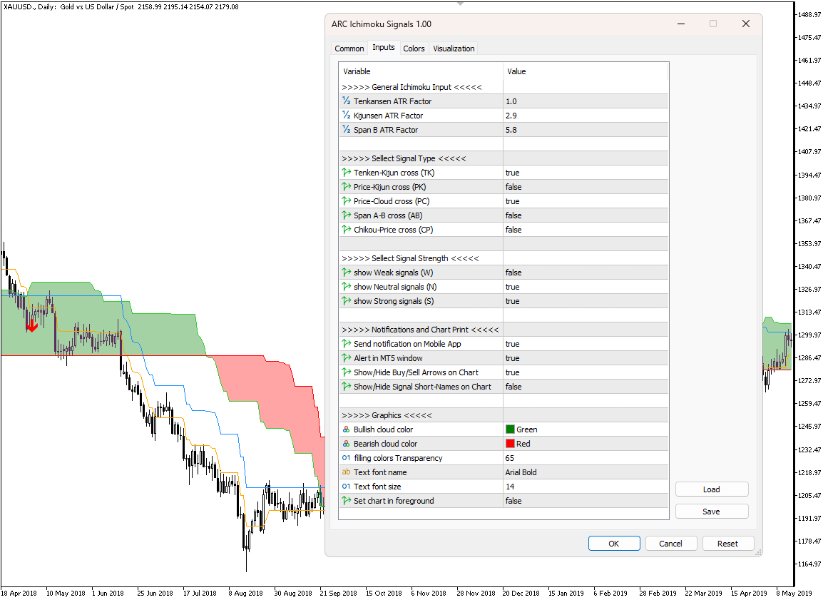

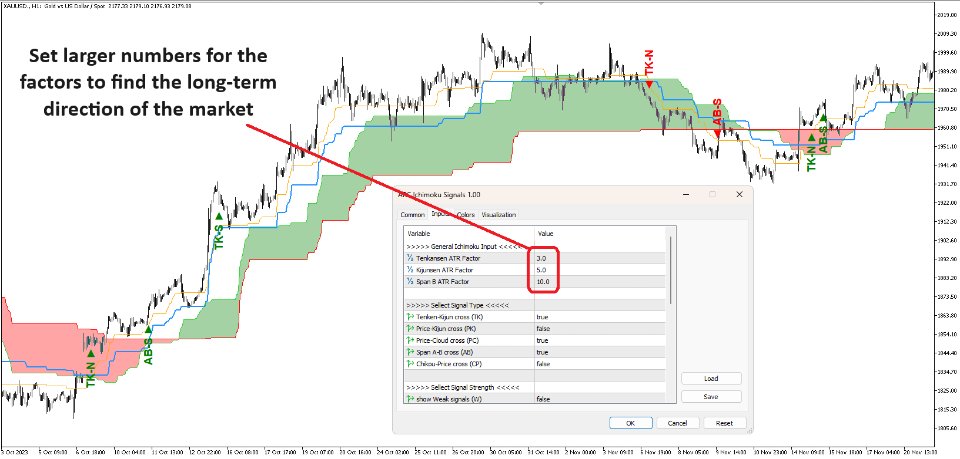

Set the factors for Tenkensen, Kijunsen, and Span B (default: 1.0, 2.9, 5.8).

-

Choose your desired signal types.

-

Select the preferred signal strength (strong, neutral, weak).

-

Enable or disable notification alerts and Meta Trader alert.

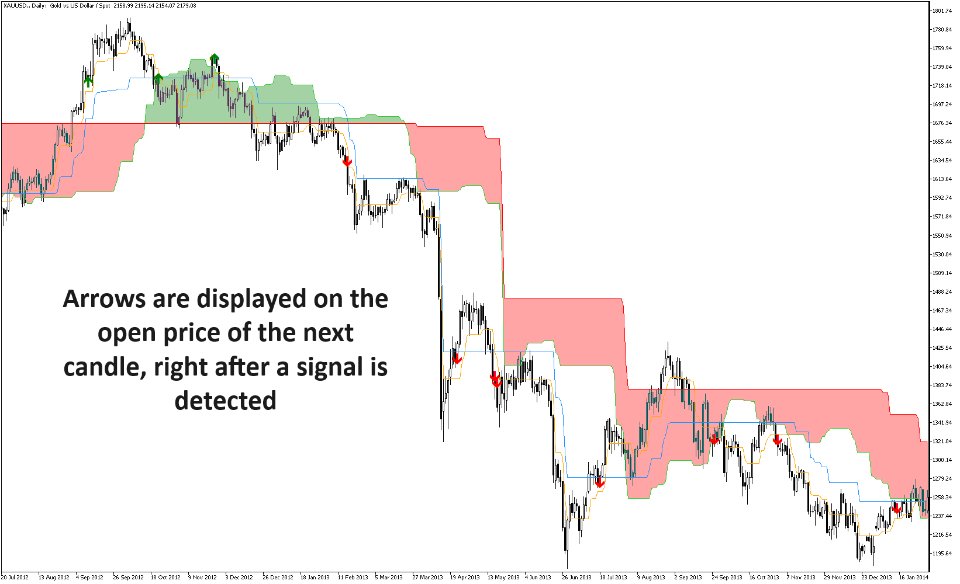

- Select Show/Hide arrows on the chart (arrows will be drawn right at the price that you can enter a position or take any other action, i.e. the open price of the next candle after the signal)

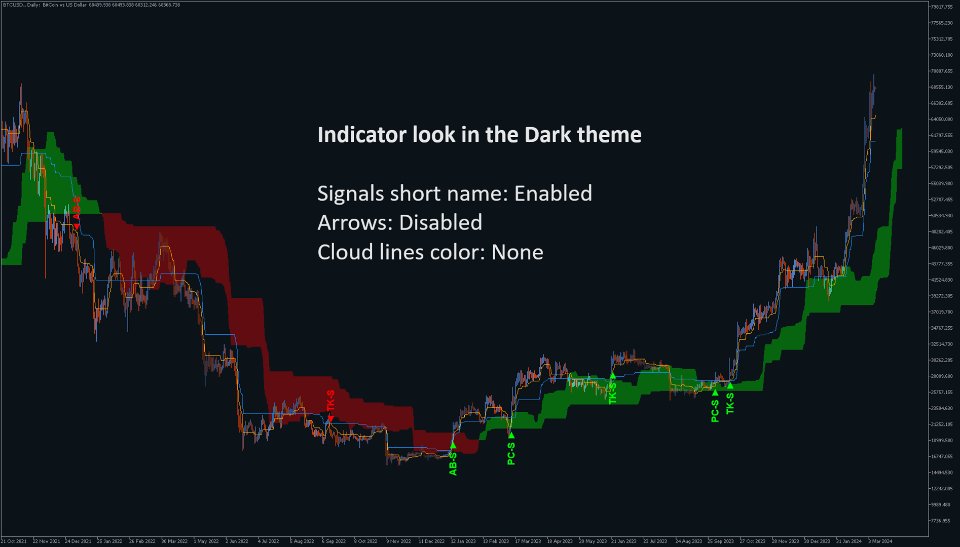

- Select Show/Hide signal short-names on the chart (short-names will be written right at the candle that the signal has been formed)

- Fix the graphical options (cloud colors, short names font and size, ...)

- Take a look at the 'colors tab' and change the lines and arrows colors as you wish.

1. ARC (Average Range times Constant)

ARC is the original concept used in the Super Trend indicator:

• multiply a constant (factor) with the Average True Range (ATR), then, based on trend direction, either subtract or add the resulting value to the last extremum point on the price chart.

• In an uptrend, ignore any support level lower than the previous day’s support level, and during a downtrend, ignore any support level higher than the previous support level.

2. ARC Ichimoku

ARC Ichimoku is a variation of the classic Ichimoku indicator, which instead of using chart Max/Min values over fixed periods (e.g., 9, 26, 52) to find Ichimoku lines, employs the ARC with adjustable factors (constants) for the same periods to find those lines.

- Tenkensen: This line represents an ARC (Super Trend) calculated using an adjustable factor (default, 1.0) based on a 9-period ATR.

- Kijunsen: Kijunsen is also an ARC (Super Trend) calculated using an adjustable factor (default, 2.9), but based on a 26-period ATR.

- Span A (faster cloud edge): It is the average of Tenkensen and Kijunsen, shifted forward by 26 candles.

- Span B (slower cloud edge): It is another ARC (Super Trend) calculated using an adjustable factor (default, 5.8) based on a 52-period ATR. It is then shifted forward by 26 periods.

- Chikou: Chikou represents the close price shifted backward by 26 candles.

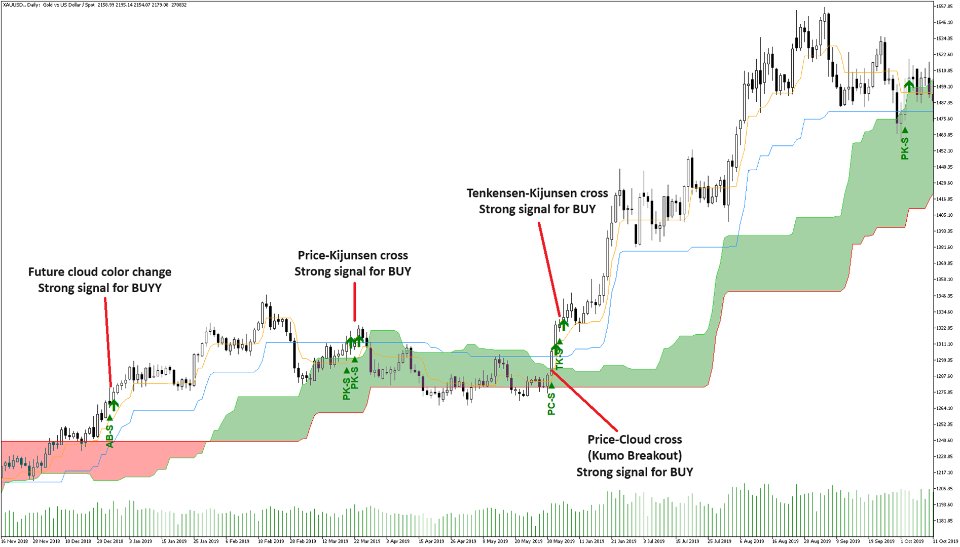

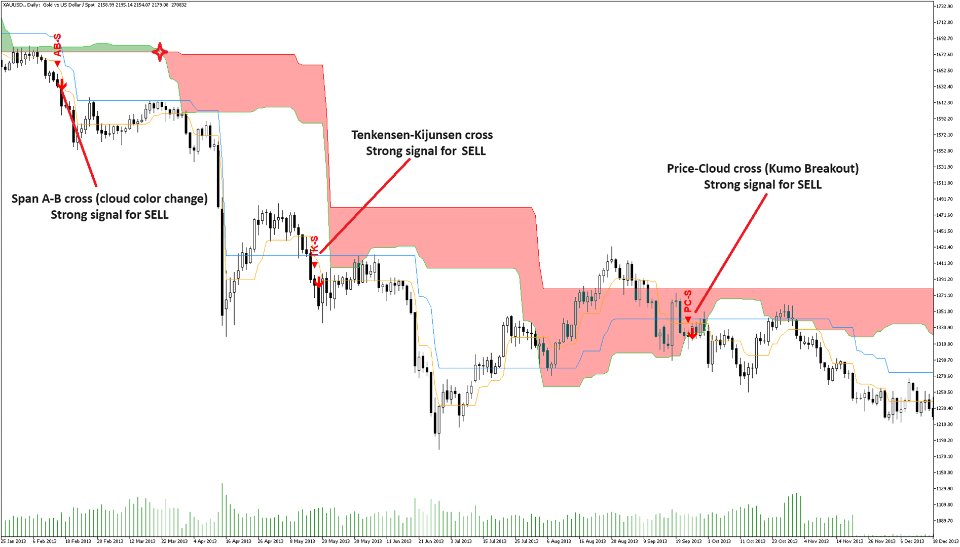

3. Available Signals in the indicator

There are five reliable signals in the classic Ichimoku, which have difference in their strength mostly based on their relationship with the cloud, and you can see all of them in this indicator, too. These include:

- Tenkan-Kijun Cross: When Tenkensen crosses above/below Kijunsen, it signals a potential bullish/bearish trend.

- Price-Kijun Cross: This signal occurs most frequently and when the price crosses above or below the Kijunsen line.

- Kumo Breakout: A breakout above or below the Kumo (cloud) indicates a potential trend reversal.

- Kumo color change: When the cloud color changes from red to green, or vice versa, it signals a potential trend reversal.

- Chikou Span Confirmation: When the Chikou (lagging span) crosses above or below the price, it confirms the prevailing trend direction.

If you believe that there are more reliable signals for Ichimoku trading system, I’m ready to hear and implement them in this indicator for the next updates.

If you find any problems or errors in the indicator, or any complexity that you can not understand, don’t hesitate to tell me (through comment, review, or DM) and I will fix the problem or explain the complexity as soon as possible.

related topics: Trading signal, Ichimoku, Tenkensen, Kijunsen, Kumo, Senkou Span, Chikou Span, Conversion Line, Base Line, Lagging Span, ATR, ARC, Volatility System, Super Trend, trend trading, support and resistance levels