QBotAI

- Asesores Expertos

- Yevhen Chystiukhin

- Versión: 1.6

- Actualizado: 11 julio 2024

- Activaciones: 10

QBotAI is a trading robot designed to automate trading in financial markets. It uses a reinforcement learning technique called Q-learning to optimize its trading strategies.

All signals of this advisor in real time and settings for it can be downloaded from my website forexvisible.com - copy and paste into the browser

Q-learning allows the robot to learn from experience through trial and error. The robot constantly interacts with the trading environment, makes trade transactions and receives a reward or penalty depending on the result of the transaction. Over time, QBotAI learns to choose the optimal actions to maximize the reward received.

For example, the classic Atari game Breakout was used to train AI to play the game using Q-learning. At first, the agent acted randomly, but with practice, he learned to optimally move the racket to hit the ball and prevent it from falling. Thus, AI was able to reach and even surpass human levels in this game thanks to reinforcement learning.

This multi-currency expert uses 28 currency pairs. For forecasts, the advisor uses recurrent neural networks of the LSTM type, models trained in the Python language environment, and imported into the advisor using a new function in mql5 for loading ONNX models

In addition to the main model UseModel1_QLearning, the advisor has an auxiliary model UseModel2 which is trained in the usual standard way, and if you use two models simultaneously (these are the default settings), then the result of a decision to sell or buy will be made as the sum of these two models at once, which is much more accurate makes advisor predictions than using models separately.

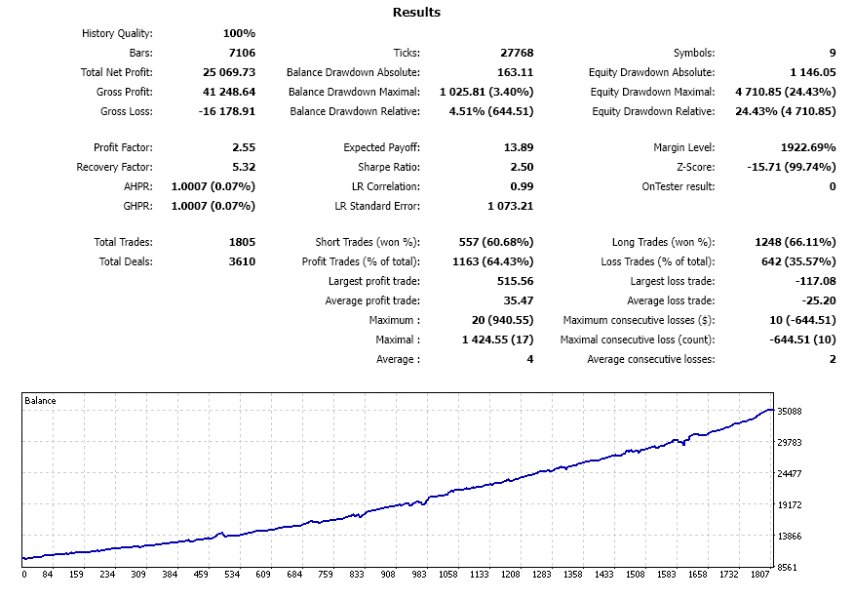

The profitability of currency pairs can be viewed in the strategy tester after the test in the "Journal" tab, and unprofitable pairs can be disabled as needed in the advisor settings, or you can select the most profitable ones using the Active option. Before the test, set Active = True for all pairs and after the test, disable unprofitable pairs Active = False, and you can start trading.

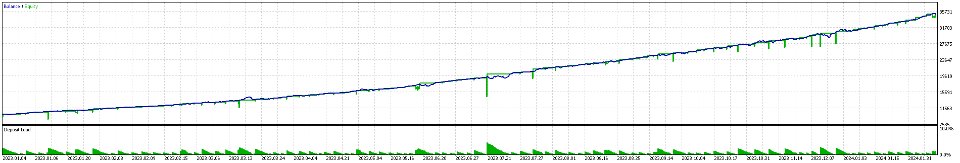

By default, the most profitable 9 pairs out of 28 are selected, but you can choose more currency pairs.

Also an important point: by default, the advisor closes all currency pairs when trading and opens again if it has reached a profit of 1% of the balance, setting UseMaxAllTakeProfitProcent and MaxAllTakeProfitProcent, you need to experiment with this setting in real trading.

The advisor was trained until 2023 year, it is advisable to run the back test from 2023

- Before testing, it is advisable to select the EURUSD currency pair and the H1 hour period

- Also, for quick testing, you can turn off the visualization of the strategy tester.

- At the end of testing, in the log tab, you can view information on the profitability and maximum drawdown of each pair separately

- UseSameLotSizeForAllPairs - the ability to select the lot size for each pair separately, true by default, one lot size for all specified by the parameter above

- UseMaxAllTakeProfitProcent - enables the global take profit as a percentage of the current profit specified in the MaxAllTakeProfitProcent parameter, after its execution all current orders are closed. Test only on all ticks or 1 minute OHLC

- UseMaxStopLossProcent - turns on the global stop loss as a percentage of the current profit specified in the MaxAllStopLossProcent parameter, after its execution, all current orders are closed. Test only on all ticks or 1 minute OHLC

- IsDynamicLot - enable automatic formation of the lot size depending on the balance or free margin

- is_koef_for_each - if true, then the lot size is formed from the balance for each currency pair separately, if false, then from the total balance or free margin

- koef - coefficient for forming the lot size, the larger, the greater the risks

- from - formation of the lot size depending on the balance or free margin

- CountOfGrid - the number of pending orders in the grid

- CountGridBars - the number of last bars in history from which the lowest and highest prices are found to calculate the interval between orders for the grid: MaxPrice and MinPrice

- GridKoef - the distance between pending orders in the grid is calculated using the formula (MaxPrice - MinPrice)/ GridKoef

- GridKoefBegin, GridKoefEnd - distribution of coefficients for multiplying the price of a pending order in the grid

El usuario no ha dejado ningún comentario para su valoración