Trading Camp MT5

- Asesores Expertos

- Goh Kato

- Versión: 2.2

- Actualizado: 1 abril 2025

- Activaciones: 10

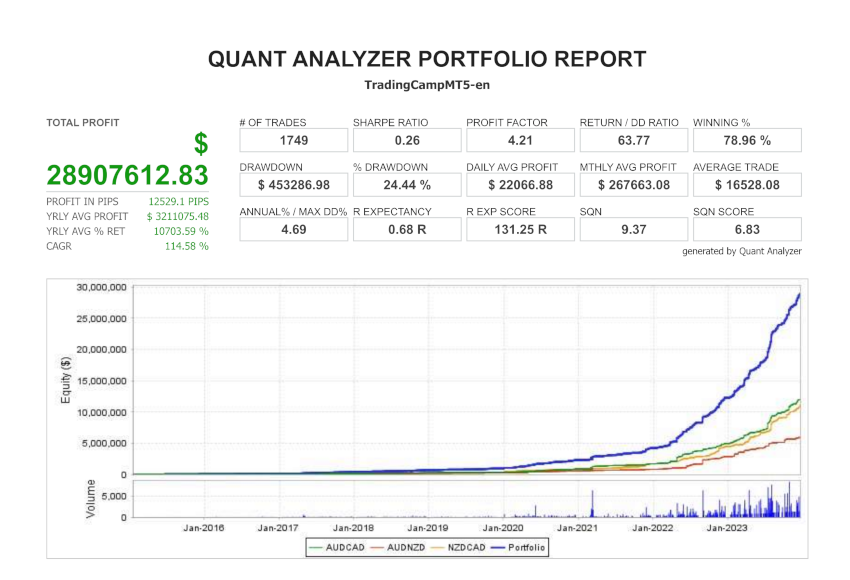

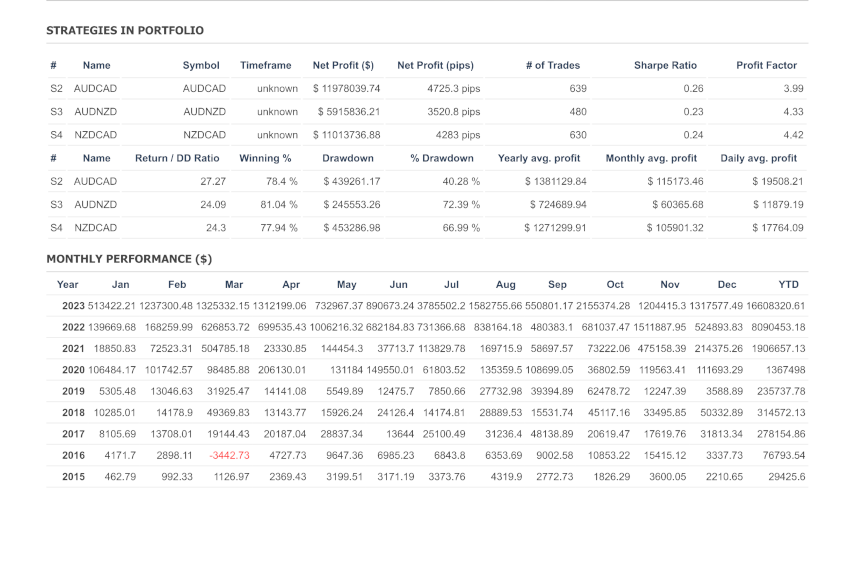

Mean reversion EA with AUD,CAD,NZD

Trading Camp MT5

Trading Camp is an EA that focuses on three currencies (AUD, CAD, and NZD) with strong mean reversion tendencies and performs a contrarian strategy. Although a grid is used as the trading technique, it is designed with a security feature with straddling of the trade, making it difficult to get stopped out. Various filters are also available to carefully select entries (therefore, the entry frequency is not high). In addition, various input parameters are available, allowing you to change the EA's behavior according to your preference. Trading Camp will support you on your journey to the fullest!

- Having high winning percentage with mean reversion and grids

- Security features by straddling

- Selected entries by various filtering

- Easy setup for trading multiple stocks by simply setting up on one chart

- Wide range of operations with extensive input parameters

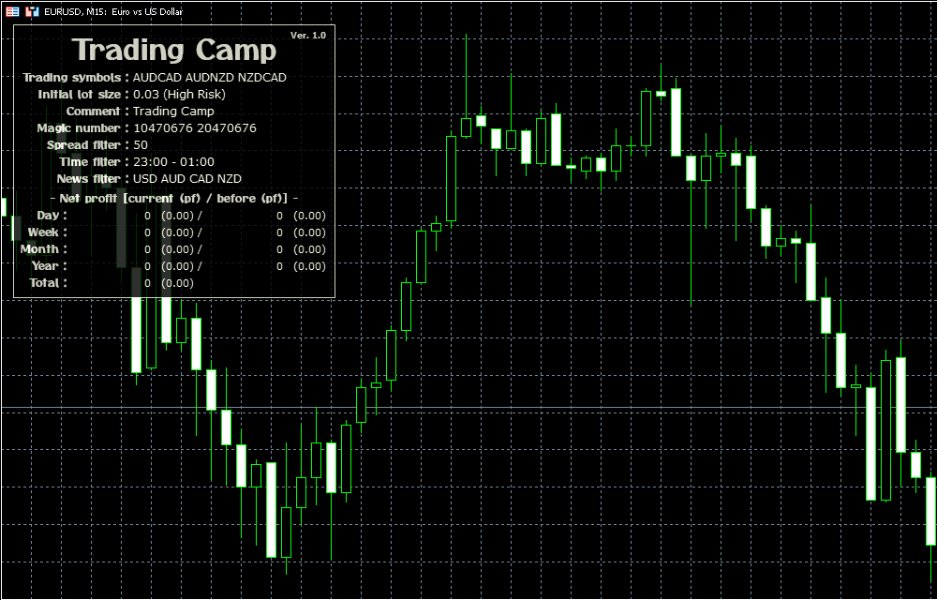

- Display of operational status by information panel

- Economic calendar is here : 2010-2019, 2020-2025

- MT4 version is here : Trading Camp MT4

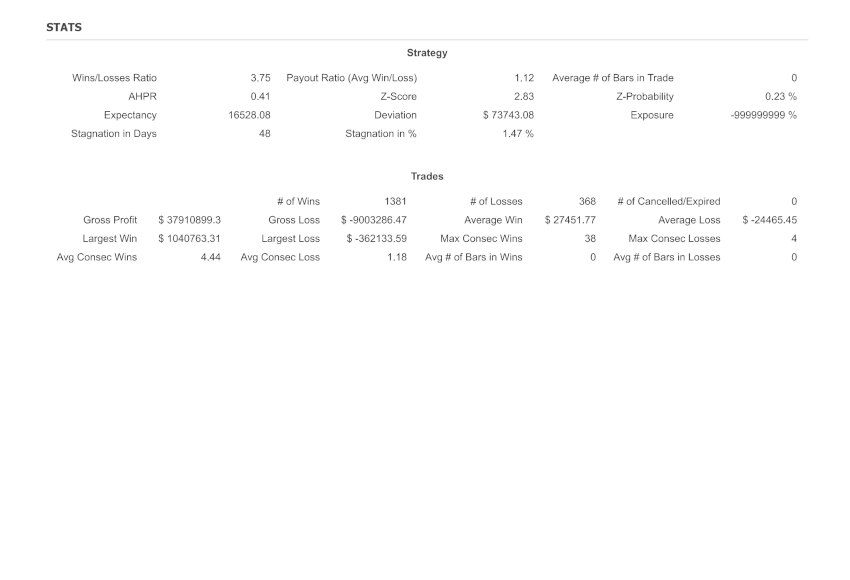

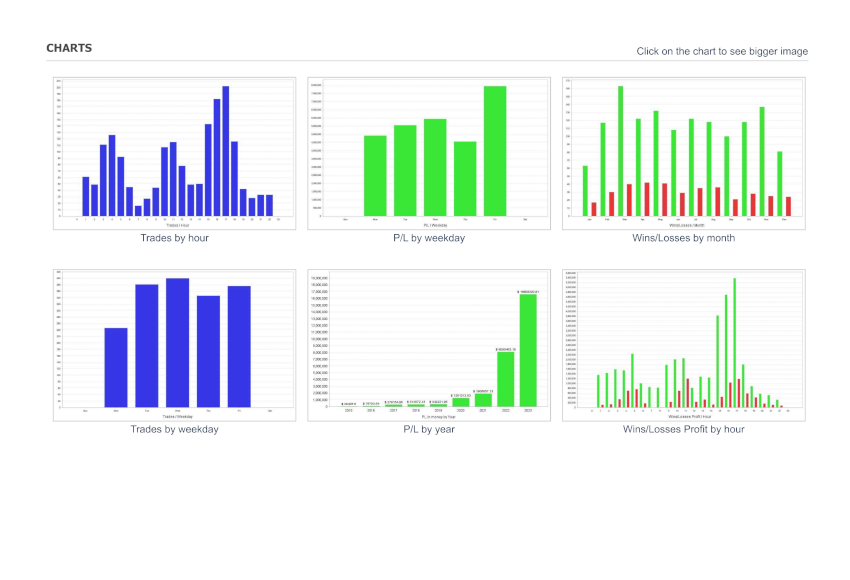

Trade Strategy Overview

When the price becomes overbought or oversold, we will aim for a mean reversion and enter with a reverse take profit of approximately 10 pips per position (automatically adjusted according to the mean spread). If the price does not return immediately, an additional entry is made in the grid strategy and the take profit is re-set. The lot and profit for grid entries can be changed using the input parameters. The default stop loss (4 grids) is 175 pips, which is also automatically changed according to the grid settings. Entries are carefully selected using internal logic and various filters, and are designed to ensure stable profits.

Spread filterThis filter deters entry when the spread exceeds a specified value. It is also possible to temporarily disable stop loss to deter unintended settlements due to widening spreads.

Illiquidity filterThis filter deters entry during illiquid hours (when the New York market is closed). As with the spread filter, it also disables stop loss.

News filterThis filter deters entry when there is an economic event of high importance. This filter reduces risk by avoiding sudden market fluctuations caused by events.

Input Parameter Description

General

CommentComments on entry.

Magic number (maximum 6 digits)EA's magic number. Specify up to 6 digits, and 8 digits with 10 (buy direction) or 20 (sell direction) added at the beginning are used. Specify a value that does not overlap with other EAs.

Show information panelInformation panel display availability.

Show information panel by backtestingWhether or not the information panel is displayed in the back test. It is recommended not to display the information panel for long-term testing, because it slows down the backtest and consumes a large amount of memory.

Information panel languageThe language of the information panel can be selected from English and Japanese.

Lot Sizing

Lot sizing methodLot size calculation method. The following can be specified.

| Fixed lot | Fixed lot specified |

| Auto lot (equity) | Auto variable lot (based on equity) |

| Auto lot (balance) | Auto variable lot (based on balance) |

| Low risk | Low-risk automatic variable lot |

| Medium risk | Medium-risk automatic variable lot |

| High risk | High-risk automatic variable lot |

Lot when 'Fixed lot' is specified in 'Lot sizing method'.

Maximum lot sizeMaximum lot size. Any designation exceeding the broker's maximum lot is invalid.

Auto lot denominatorUsed when 'Auto lot' is specified in 'Lot sizing method'. The lot calculation formula is as follows.

- (equity or balance) / (Auto lot denominator * 100)

Trading

Trading pairs [separated by ','] (empty is chart pair)Specify the issue(s) to be traded. When specifying multiple stocks, separate them with ','. If blank, it is the issue of the chart for which the EA is set. If the issue contains a prefix or suffix, it will be automatically detected, but if the detection is not successful, specify the suffix and other information as well (e.g. AUDCAD.m).

Trading frequencySpecifies the frequency of orders (negative values are also acceptable). The number of orders will increase or decrease according to the increase or decrease of the value. Note, however, that increasing the number of orders too much will drastically reduce the win rate.

Number of symbols entry allowed at same timeSpecifies the number of stocks that can be traded at the same time. By increasing this value, entry can be made even when there are positions in other issues. However, the probability of large drawdowns increases, so the risk is high.

Cross order allowedAllows cross orders. Allows simultaneous entries for selling and buying within the same issue.

Initial entry allowed (excluding grid entry)Initial entries are allowed. However, it does not affect grid entries. By disallowing this item, additional initial entries can be deterred and the EA can be terminated without difficulty.

Stop loss [point] (0 is auto)Specify stop loss (in points). If 0, it is set automatically.

Take profit [point] (0 is auto)Specifies take profit (in points). If 0, it is set automatically.

Grid Trading

Maximum number of grid lines (0 is no grid)Maximum number of grid entries. If 0, no grid entry will be made.

Grid line distance [point]Distance (in points) from which a grid entry will be made. An additional entry is made if the distance is greater than this distance from the previous entry. However, this is only a guideline, and entries are not always made at this distance.

Lot multiplierLot multiplier in grid entries. Specify if the lot is to be increased according to the number of grid entries.

Profit multiplierMultiplier for profit in grid entries. Specify if you want to increase profit based on the number of grid entries.

Grid security allowedAllows grid security features by straddling. It works when the price exceeds the maximum number of grids specified and reduces the decrease in equity. Note that while this may reduce the likelihood of a stopout, it does not completely prevent it.

Grid security stop loss [point] (0 is auto)Specifies the stop loss for grid security (in points). If 0, it is set automatically.

Grid security take profit [point] (0 is auto)Specifies the take profit of grid security (in points). If 0, it is set automatically.

Grid security trailing step [point] (0 is no trailing)Specifies the frequency of stop loss trailing in grid security (in points). 0 means no trailing. The smaller the value, the more frequently trailing is performed, but some brokers warn against frequent stop loss changes, in which case a larger value should be set.

Filter

High spread with no entry and stop loss [point] (0 to disable)Specifies the spread (in points) at which entry is to be stopped. 0 means disabled. If the spread is greater than the specified spread, stop loss is also temporarily disabled.

Illiquidity filter allowedEntry is inhibited during periods of market illiquidity (one hour before and after the close of the New York market). Stop loss is also temporarily disabled.

Volatility filter lower levels (0 to disable)Suppresses entry when volatility is low. invalid if 0. Suppresses entry when volatility is less than or equal to the specified volatility.

Volatility filter Upper levels (0 to disable)Suppresses entry when volatility is high. invalid if 0. Suppresses entry when volatility is above the specified volatility.

Holiday filter allowedDeter entry on holidays. No entries for the corresponding country throughout the day.

Currencies for apply holiday filter to all [separated by ',']Specify the target currency of the holiday to be applied to all issues. When specifying multiple currencies, separate them with ','. Normally, the margin currency and profit currency of each issue are targeted, but holidays in countries corresponding to the currencies specified here can be additionally applied.

Minimum importance for apply news filterMinimum importance to which the news filter should be applied. News events of the specified importance or higher will be applied.

Time before for apply news filter [minutes]Time (in minutes) to suppress entries before a news event occurs.

Time after for apply news filter [minutes]Time (in minutes) to suppress entries after a news event occurs.

Currencies for apply news filter to all [separated by ',']Specify the target currency for news events that apply to all issues. When specifying more than one currency, separate them with ','. Normally, the margin currency and profit currency of each issue are targeted, but news events for the currency specified here can be additionally applied.

Time

Automatic UTC detection (production only)Enables/disables automatic detection of UTC (Universal Time Coordinated). Valid only during production and invalid during backtesting.

Broker time difference to UTC [hours]Specifies the time difference in winter time for broker time when UTC is not automatically detected. Also used during backtesting.

Broker DST areaSpecifies the broker's DST (Daylight Saving Time) region when UTC is not automatically detected. Also used during backtesting.

Backtest

Show information panel by backtestWhether or not the information panel is displayed in the back test. It is recommended not to display the information panel for long-term testing, because it slows down the backtest and consumes a large amount of memory.

Economic calendar file name for filterSpecify the name of the economic calendar file to be used in the filter. Used during backtesting.

Precautions

How to Install

Click here for installation instructions.(How to install). This product can be set up on one chart to trade multiple issues of AUDCAD, AUDNZD, and NZDCAD. For normal operation, it is recommended to set the product to the M15 chart with a large number of ticks, such as EURUSD. However, if you are trading a single stock, leave the 'Trading pairs' parameter blank and set it to the M15 chart of the relevant stock. In addition, this product requires viewing of an external site in order to automatically determine the time. Therefore, the URL must be set in MetaTrader. In the 'Tools -> Options -> Expert Advisers Tab', check the 'Allow WebRequest for listed URL' checkbox and set the following URL in the input field.

Production Operation

When operating, simply change the 'Lot sizing method' input parameter to 'Low risk', 'Medium risk', or 'High risk'. However, please note that high risk increases the probability of stopouts, so be aware of the risks involved. Other input parameters usually do not need to be changed (time filter time may need to be changed for some brokers). Since many of the input parameters are directly related to changes in risk, please refer to the manual to fully understand the parameters before use. I recommend a minimum balance of $500. I recommend that you first check the operation of the demo account before starting the actual operation.

Economic Calendar

An economic calendar is required to run the holiday and news filters during backtesting. For this reason, I have prepared a csv file of the economic calendar (economic calendar). Before running, please save the file 'TradingCamp-ec.csv' in the following location without changing the file name.

- ...\Terminal\Common\Files\

This folder can be found one level above the folder opened in MetaTrader by specifying 'File -> Open Data Folder'. The economic calendar is created in UTC (Universal Time Coordinated), so the broker's time difference and DST area must also be set in the parameters.

Brokers

This product operates three pairs, AUDCAD, AUDNZD, and NZDCAD. Since these are minor currencies, some brokers may not offer them and they cannot be used. Also, even if a pair is offered, the spread may be wide, and in this case, you will not be able to use it (if the average spread exceeds 3 pips, your profit will drop drastically). We are not able to specify specific brokers, so please contact each broker for this information before you consider using them.

Disclaimers

Please note that we are not responsible for any problems that may occur by using this product (Trading Camp MT5).

Past results are no guarantee of future performance.