Time Based Range Breakout EA

- Asesores Expertos

- Utkarsh Katiyar

- Versión: 1.1

- Actualizado: 14 febrero 2024

- Activaciones: 5

The Time Based Range Breakout Expert Advisor (EA) is a straightforward yet powerful tool designed to automate trading strategy based on intraday price range breakouts. It is suitable for traders who prioritize a disciplined and rule-based approach to trading and capitalizing on market movements within defined time windows. The EA marks the High and Low prices between the given time range and enter a trade when either the high/low of the range is breached. Suitable for trading different Forex sessions where the volatility is high.

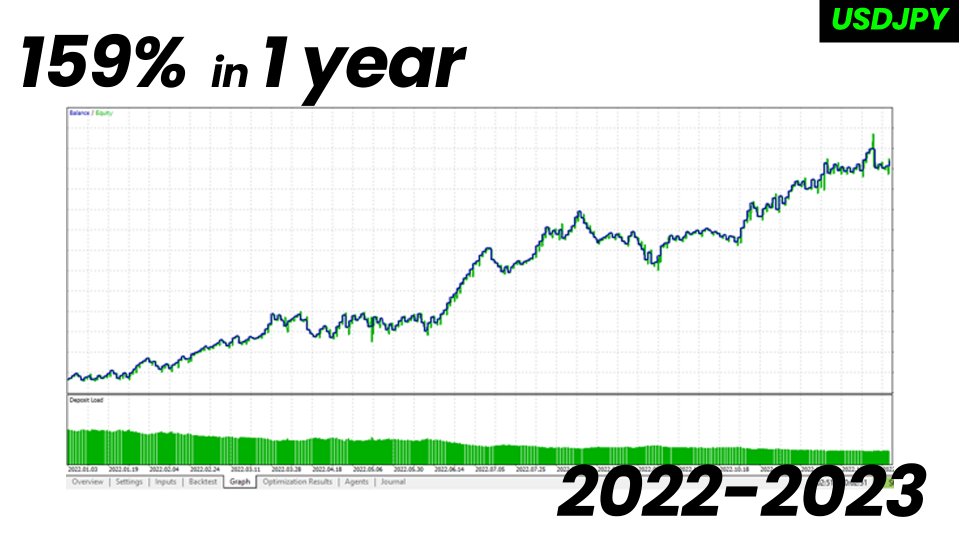

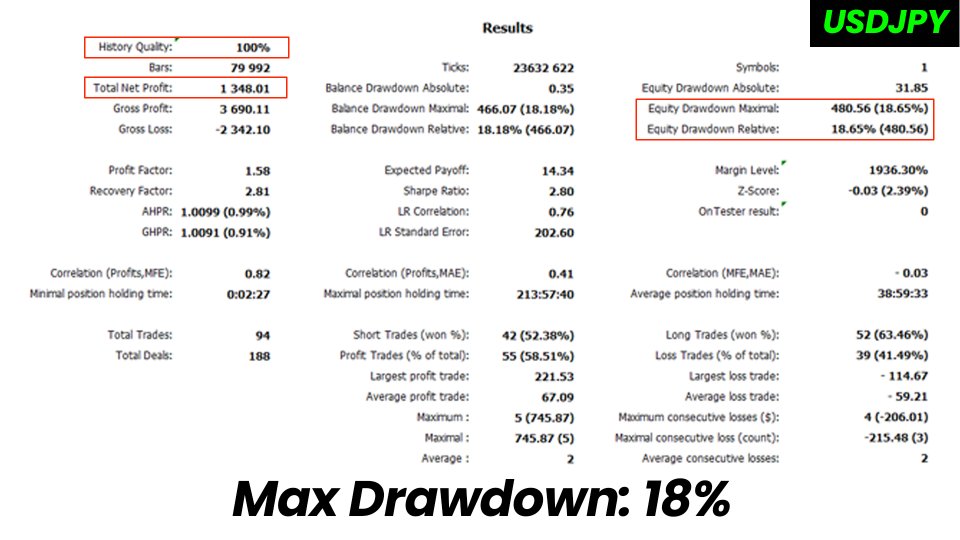

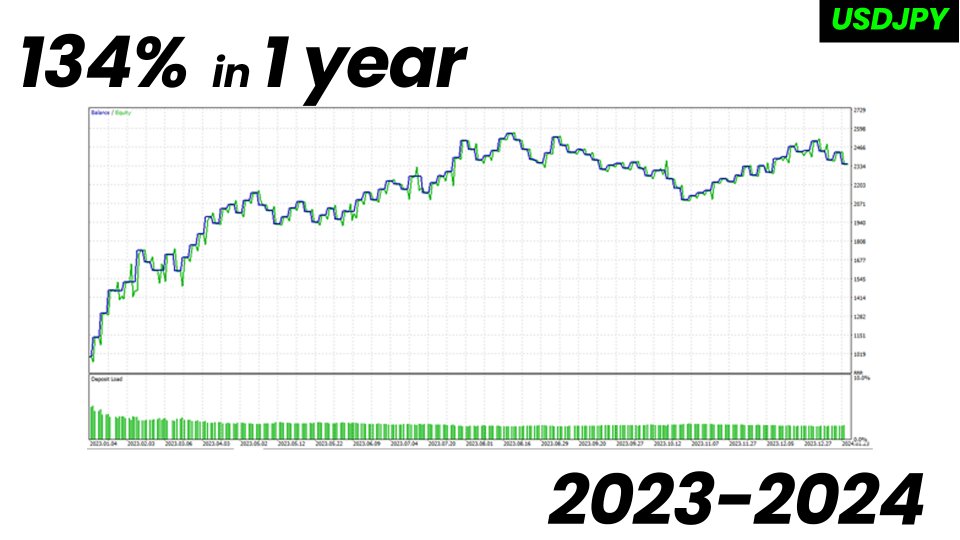

Live Performance

Supported Instruments: Currency/ Index/ Commodities(any instrument with high volatility)

Key Features:

-

Range-Based Trading:

- The EA identifies price ranges by marking the high and low within specified time periods.

-

User-Defined Parameters:

- Easily customizable inputs such as start and end times, allowing traders to adapt the strategy to their preferred timeframes.

-

Visual Range Representation:

- Dynamic graphical representation of price ranges on the chart provides a clear visual reference for traders.

-

Trade Management:

- Integrated risk management with automatic placement of stop-loss and take-profit levels for optimal risk-reward ratios.

-

Daily Trade Limit:

- Control over the number of trades executed in a day, promoting disciplined trading.

- Unique Trades:

- In a day, next trade is opened in different direction than the previous one. If TotalTrades = 3, trades will be opened as BUY,SELL,BUY or SELL,BUY,SELL.

How to Use:

- Drag and drop the EA on a M5 chart for any instrument.

- Set your preferred time window for range calculation.

- Define the start and end time for the trading day.

- EA will identify and mark price ranges on the chart.

- Trades are executed when either the range high/low is breached.

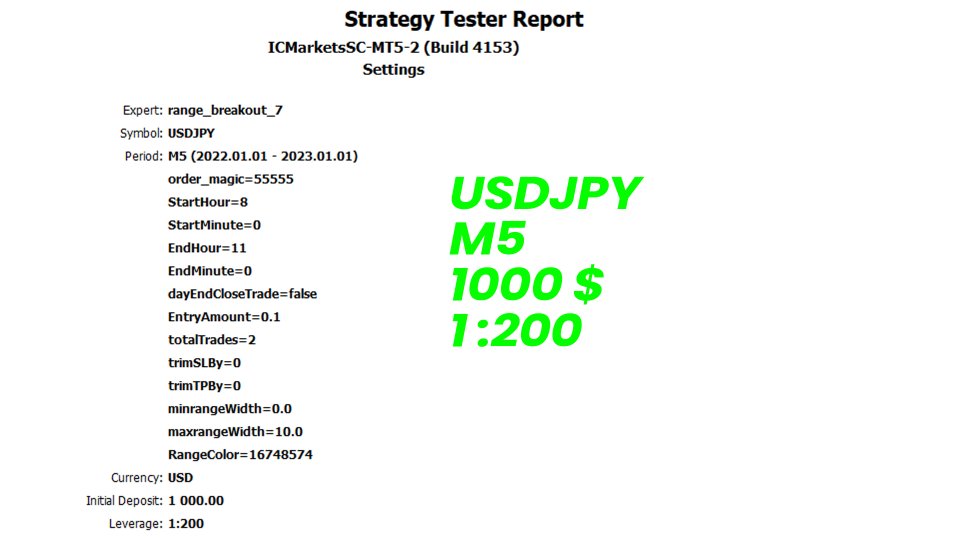

Settings:

1. Magic Number: Set the magic number for the EA. Its a unique number to identify the trades for an instrument.

2. Start hour and Start minute || End hour and End minute : Set the time for the price range to be calculated.

3. Close any open trade at day end: If set to true, no trades are carry forward to next day.

4. Lots for each trade: Sets the lots for each trade.

5. Total trades in a day: Number of trades to be taken in a day.

6. Trim the stop loss by percentage: The stop loss for a trade is set as range low for a BUY trade and range high for a SELL trade if the value for this variable is set to 0. If you want to reduce the SL by some percentage you can change this parameter.

7. Target by percentage of range width: The target for a trade is set as (range high + range width) for a BUY trade and (range low - range width) for a SELL trade if the value for this variable is set to 0. If you want to reduce the TP by some percentage you can change this parameter.

- For Example: If you set this parameter to 0.2(20%), range width is 20 points and you enter a buy trade at range high i.e 100, SL will be kept at 100 - (20 -(20*0.2)) = 84 instead of 80(100 - 20).

- In case of Sell trade if you enter at range low i.e 100, SL will be kept at 100 +(20-(20*0.2)) = 116 instead of 120(100+20).

8. Minimum range width and Maximum range width: The trade will be taken only when the range width is between these values. If you want to disable this parameter, set the minimum value as 0 and max value as some very high number like 100.

- For Example: If you set this parameter to 0.8(80%), range width is 20 points and you enter a buy trade at range high i.e 100, TP will be kept at 100 + (20 -(20*0.8)) = 116 instead of 120(100 + 20).

- In case of Sell trade if you enter at range low i.e 100, TP will be kept at 100 - (20-(20*0.8)) = 84 instead of 80(100-20).

9. Range color: Select the colour with which you want the range to be marked with.

Disclaimer:

- Test the EA thoroughly before deploying it on live account. Also it is better to monitor this EA manually and think of it as a helper in breakout trading.

- One single timeframe will not work all the time, you need to adjust it as per the price action on the charts.