Smart Trend Fisher

- Asesores Expertos

- Svetoslav Ognyano Chilingirov

- Versión: 2.0

- Actualizado: 7 diciembre 2023

- Activaciones: 10

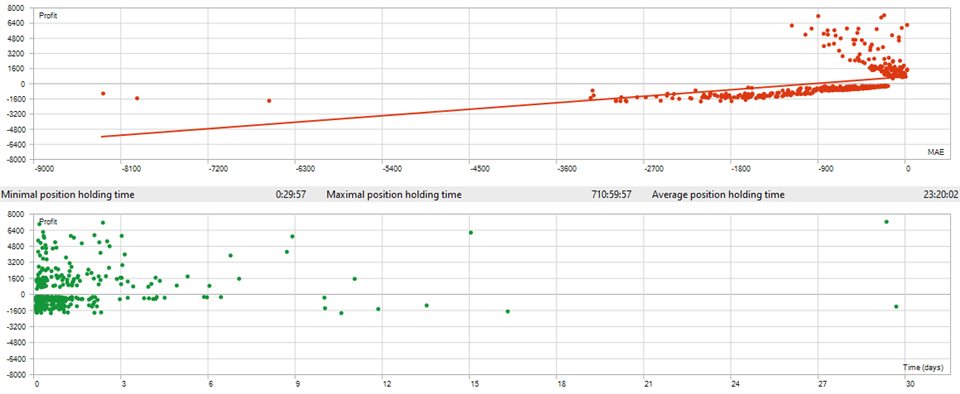

The optimization of the strategy was conducted on 2 years of data, and forward tested on 5, using ICMarkets regular account with 100% real tick data. (Timezone GMT+2)

Change your time filter settings accordingly if you're in a different time zone - for example if you're in the UK GMT+0, instead of 7:30 to 19:00, you should switch to 5:30 and 17:00!!!

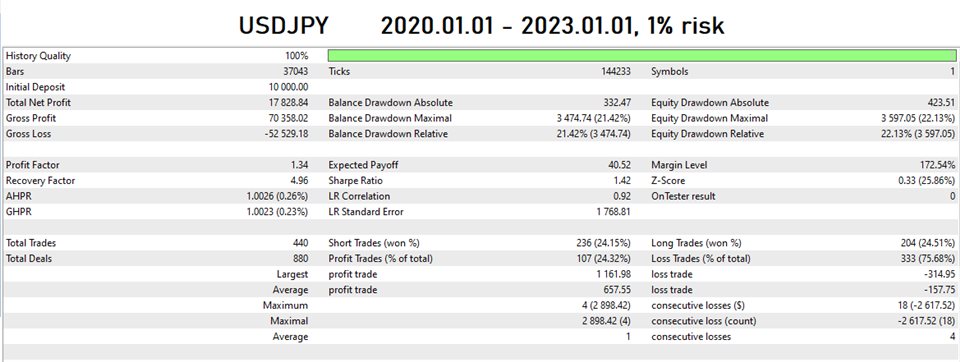

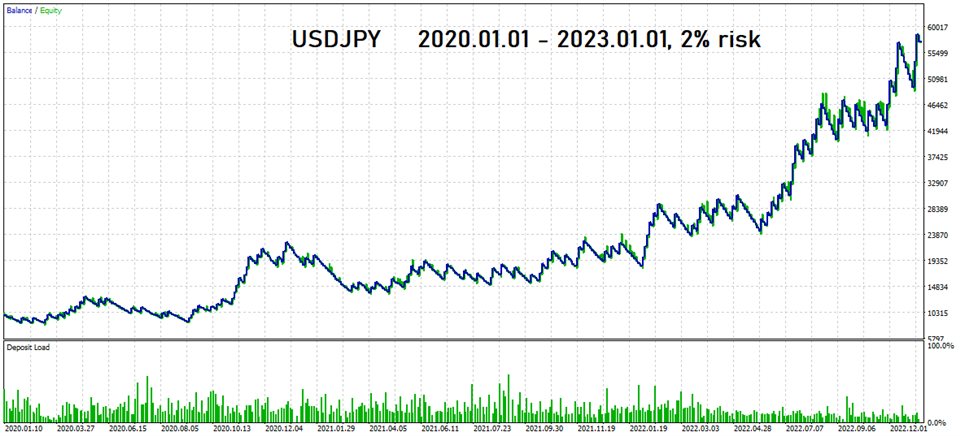

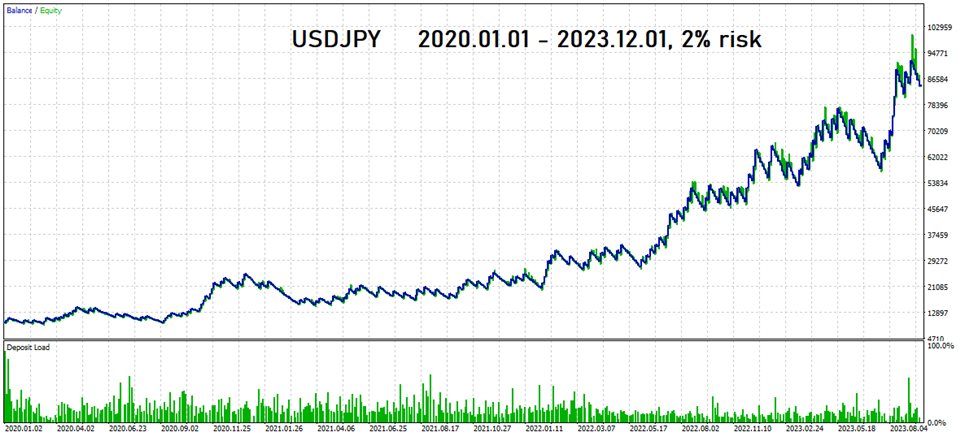

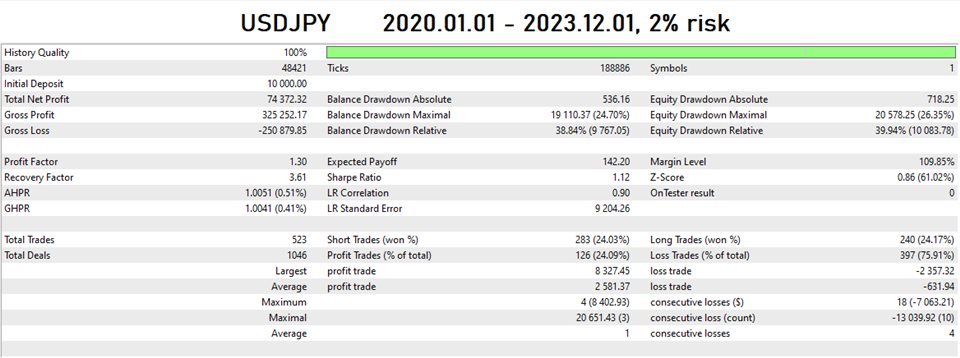

Performance tests in the 3 years from 2020 to 2023, on USDJPY, with 1% risk per trade generate 170% net profit, same 3 years with 2% risk per trade generate 460% net profit. The 4 years from 2020 till now return up to 740% net gain with 2% risk per trade, and so on. This system is very hands off, low stress addition to your algorithmic toolbox, that trades 3-5 times per week (depending on the settings).

The backtest screenshots included and the default settings have been generated with the simplest hard stop loss below the nearest swing low (or above the nearest swing high for short trades). So massaging the results with the "Break Even" and "Trailing Stop" functionalities has not been done. I leave that pleasure to the user.

The Smart Trend EA has a lot of options to play around with, but crucial for it's performance are the 5 main filters:

- One candlestick trend pattern filter;

- One very precise oscilator filter (RSI);

- Two different configurable MA trend filters;

- One time filter.