Versión 2.8

2024.08.19

The strategy research to address recent market conditions has been completed, and we recommend all clients to upgrade to the new version. The new strategy has been integrated into the Intelligent Market Filtering System. We suggest keeping it enabled by default.

Versión 2.7

2024.08.06

1. Added “Daily Maximum Drawdown Limit (%)” function, mainly for use by prop firms, not recommended for use as a stop loss.

2. Corrected the impact of the new stop loss strategy on the original strategy.

3. Updated training data.

Versión 2.6

2024.07.10

1. Add "Start trading time" function

2. Support obtaining exchange rates for currency pairs with suffixes

3. Add minimum time interval between orders

4. Add close positions based on profit percentage

5. Fix the issue where configuration changes do not take effect immediately

6. Add new stop loss strategies

7. Update training data

This upgrade has adjusted the algorithm and parameters, and we recommend upgrading.

Versión 2.5

2024.04.26

1. Correct the issue where the comment is mistakenly modified to the same for order identification.

2. Add adjustment for Trailing Stop Modification Interval Time, suitable for platforms that need to limit the frequency of Trailing Stop modifications, with a default of 0 meaning no restrictions.

3. Add automatic conversion rate retrieval for non-USD accounts, using preset rates when retrieval fails.

4. Change the default lot size mode to CustomRiskMode.

Update training data.

This upgrade does not include any algorithm updates, so existing customers can also skip this version.

Skipping version 2.4 to synchronize with the MT4 version number.

Versión 2.3

2024.03.17

1. Based on live trading performance, set Signal 1's configuration as the default setting, which has been validated as excellent in live trading. This makes it more reliable to use.

2. Change the default setting for the order volume mode to MediumRiskMode.

3. The default setting for Intelligent Dynamic Parameters is changed to false.

4. The default setting for Reduce close conditions after long times is changed to true.

5. Optimized the acquisition of market data. There is no longer a need to open additional time frame windows.

6. Updated the training data.

The decrease in backtest profits is due to the reduction in risk values. Changing to RiskMode and Intelligent Dynamic Parameters settings to true will approximately return to the version 2.2 state.

Versión 2.2

2024.01.14

1. The default riskmode setting has been changed to InitialCapitalMode. The primary purpose of this change is to allow clients to better observe the profit curve, reinforcing their confidence and understanding of risk. As the lack of compound interest growth in backtesting can significantly reduce profits, users may adjust back to the old riskmode as needed. The backtesting results will be consistent with version 2.1.

2. Correction interval mode.Added new options for Profit priority and Safety priority, which mainly affect the interval between orders. Profit priority maintains the previous interval value and provides the optimal value for overall profit. Safety priority has been re-optimized based on the profit factor, offering the best value for the maximum profit of each order.Safety priority increases the interval between orders to reduce risk.

3. Automatic checking of the trading environment. Data retrieval will switch automatically when there is a lack of weekly data.

4. The default setting for "Reduce close conditions after long times" is now turned off.

5. Removed the "Trailing Stop Modification Interval" parameter.

6. Removed the percentage mode parameter.

7. Added Low Risk Mode, Medium Risk Mode, High Risk Mode, Highest Risk Mode, corresponding to risk values of 0.005, 0.01, 0.02, 0.03 respectively.

There were no algorithm adjustments in this update. The changes were made based on real trading performance, and by altering the parameters, it is possible to revert to the effects of version 2.1.

Versión 2.1

2023.12.21

1.Fixed the issue where additional position adjustments were stopped when the lot size was too large.

2.Modified the limitation on the maximum total number of iterations orders.

The Intelligent Market Filtering System feature is mainly designed to deal with potential drawdowns from long-term market trends in the future, but will filter out some trading opportunities. Users can decide for themselves whether to turn it off.

Versión 2.0

2023.12.14

Important Update:

1. Fixed some display bugs.

2. Resolved the issue where the moving stop-loss did not trigger after EA restarts or setting changes.

3. Added an option to edit the comment for Correction orders.

4. Introduced a smart filtering system to improve order accuracy and reduce counter-trend orders.(Important)

5. Added intelligent stop-loss, order interval, and moving stop-loss value for GBPUSD, which adjust the parameters based on different market conditions. If this feature is turned off, the previous fixed parameters apply.

6. Added an option for lowering the standard for closing positions during long-term holds.

7. Modified some parameter descriptions.

This algorithm update is significant and may result in different positions compared to the previous version. Please back up the old version yourself if needed.

Currently, the intelligent stop-loss, order intervals, and moving stop-loss values are only adapted for GBPUSD, with other currency pairs to be developed progressively.

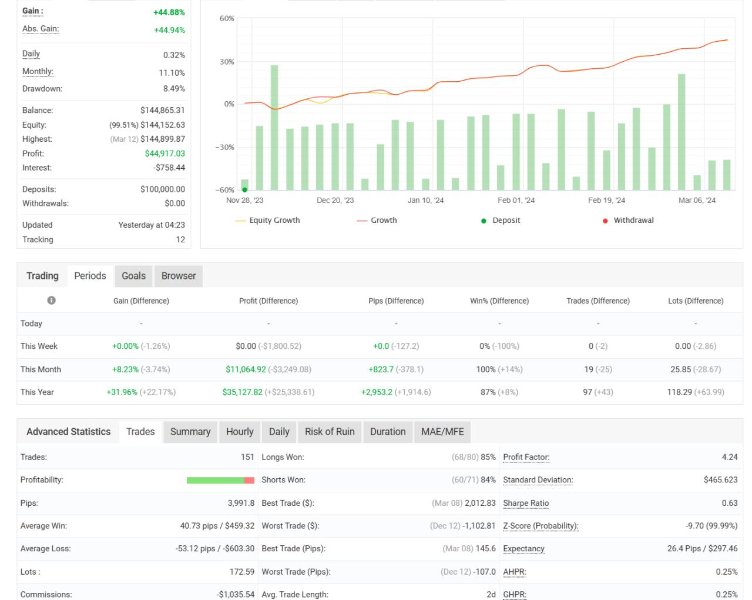

Firstly, I want to thank you and your team for creating such a great EA. Over the last year I coded 30 EA's and tested 50 or more from the market. The best was break even. But AI Trading Vision is an animal! It doubles your account every 2 months! I have hopes to be a millionaire in less than 3 years, by adding funds to my forex when I can and not taking profits until my account is over $300,000, then I can retire on $100,000/month. I bought this EA last month, Started with a $2,000 account on September 9th. As of this writing October 5th now $3,034 it has made $1,034 profit, 14 winning trades in a row. I have it set on 0.03% and risk mode so my lot sizes automatically grow, and even at a 2,400 point draw down I still have 105% equity in Forex, so not blowing the account. In back testing these extreme trades happen 3 to 4 times a year, but with 97% wins and only 3% loss this is more than acceptable in my opinion. Now I must say it does enter trades sometimes "backwards" to the trend, goes into 700 to 1,000 points draw down but just be patient, they all turned out a win in 3 to 5 days. I am very happy with this EA, I hope you stay with this and provide updates as needed.