GainFountain

- Asesores Expertos

- Kotaro Hashimoto

- Versión: 1.0

- Activaciones: 5

summary

It is a hybrid strategy EA that aims for swap points and long-term unrealized profit by holding a portion of positions for a long period of time, based on the royal road of buying when the price is low and selling when the price is high. Users can set the long-term holding ratio, the time frame used for entry/closing, and the entry interval, etc., and it can be customized to accommodate a variety of styles from short-term scalping to long-term trading.Basic Strategy

Entry/Closing Conditions

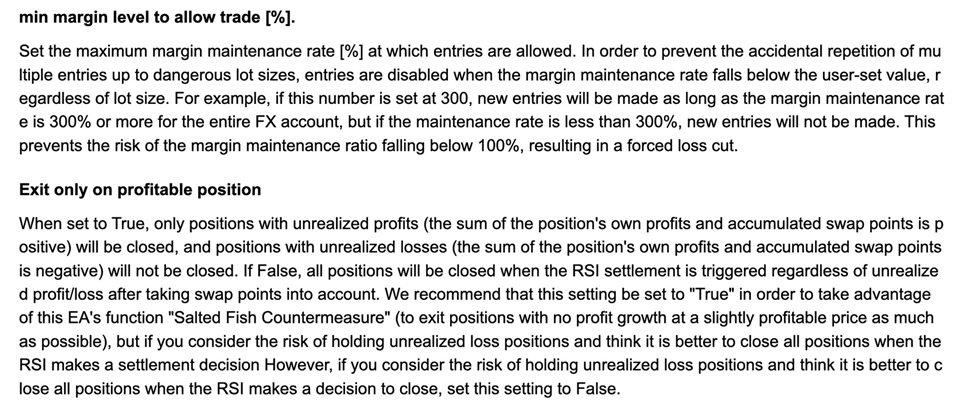

Entry/closing is based on the RSI, which is measured in real-time and interpreted as low when the RSI is less than 30 and high when the RSI is greater than 70, triggering a buy when (RSI < 30) or sell when (70 < RSI). A position can be set to buy or sell in one direction only. When set to buy, entry is made at (RSI < 30) / close at (70 < RSI), and when set to sell, entry is made at (70 < RSI) / close at (RSI < 30). The threshold for the buy/sell decision (30,70) and the time frame for calculating RSI can be customized. The average price of the position is kept as close to thefalling/rising

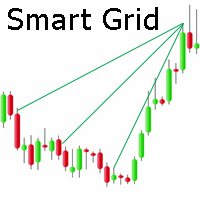

price as possible by strategically entering a series of small lots by so-called "nan-pinning" instead of entering a large lot at a time. The lot size of one entry and the interval between entries can be customized. If the selected currency pair is expected to continue rising or falling in one direction for along

period of time, and if the position in that trend direction has positive swaps, it may be more profitable to hold a portion of the position than to close it based on RSI. A user-specified percentage (0~100%) of the entered positions can be held for a longer period of time by disabling RSI auto-settlement. Such positions will continue to be held unless the price reaches the StopLoss or TakeProfit set at the time of entry or manual closing is performed.Salt Pickling

: This function allows you to exit a position with no profit growth at a slightly profitable price as much as possible. Since the entry strategy is based on a "nan-pin" strategy, some positions will inevitably have unrealized losses. In order to close such salted positions at the most advantageous price possible, the best settlement timing is automatically determined as follows.- When the settlement condition is met

- , only positions with unrealized profits are closed at once, and settlement of positions with unrealized losses is put on hold

- When the settlement condition is met again at the next or subsequent timing, the positions that were on hold for settlement last time are settled if they are in an unrealized profit position.

- When the settlement condition is met, if the sum of the swap point total up to that point and the unrealized loss is positive, the position pending settlement is closed. Although the unrealized loss alone is a loss, it is offset by the swap points, and the position is effectively withdrawn at a small profit.

This allows you to maintain peace of mind because there is a large possibility that you can withdraw from a salted position at a small profit someday with time on your side, even if it is a salted position if the swap is in the positive direction. The user can customize whether or not to hold the settlement of unrealized loss positions.