QuanticX Multi Indices

- Asesores Expertos

- QuanticX

- Versión: 1.0

Quantic MultiIndices

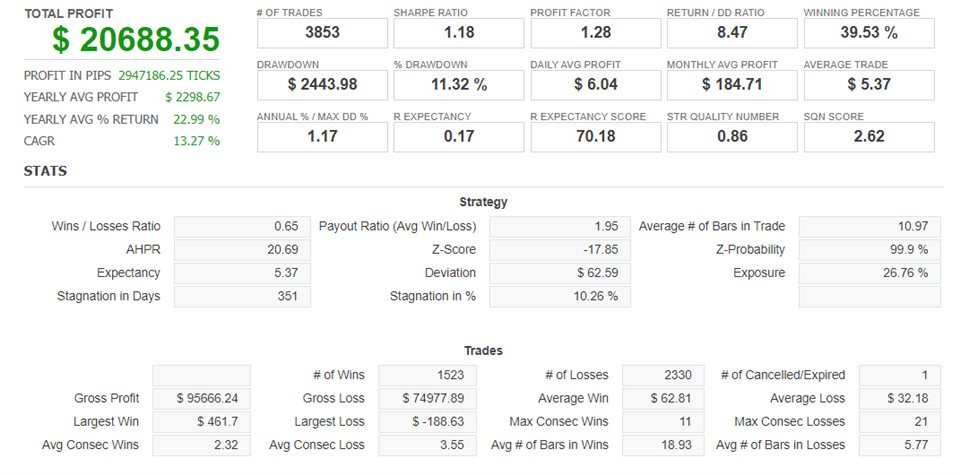

Introducing Quantic MultiIndices, meticulously engineered to operate on four assets: US500, US30, Nasdaq, and DE30.

Built upon the renowned concepts of breakout strategies, it is crafted to ensure precision and long term reliability

.

Key Features and Operational Insights:

- Timeframe: 1-hour (1H) timeframe.

- Robust Risk Management: risks a user-specified amount of money per trade. (Default: $50).

- Strategic Use of Trailing Stop and Stop Loss: Employs a volatility-based trailing stop and guarantees the application of a stop loss for every trade to safeguard your investment.

Development and Testing:

- High-Quality OHLC Data Utilization: Developed using high-quality Open, High, Low, Close (OHLC) data to ensure accurate historical analysis.

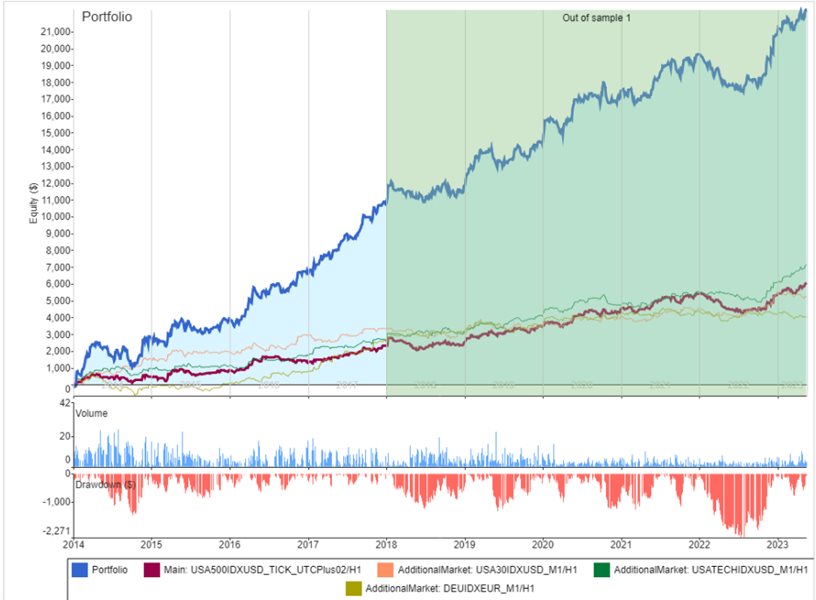

- Dataset: The development dataset was adeptly segmented into in-sample (IS) or out-of-sample (OS) periods, but the strength of this development model doesn't end here.

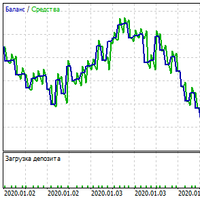

- Five-Year Holdout Validation: A prudent reserve of 5 years (2019-2023) was used for holdout validation. The strategy exhibited constistent performance across these 5 years of unseen data during the design phase and robustness tests, ascertaining its reliability and validity in live trading scenarios.