EA Powerful Candle

- Asesores Expertos

- Zafar Iqbal Sheraslam

- Versión: 1.0

- Activaciones: 5

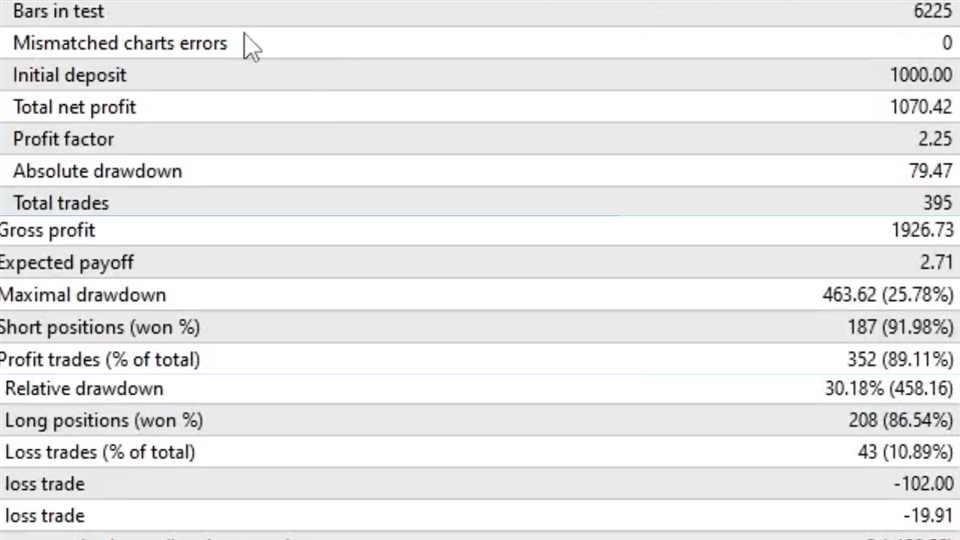

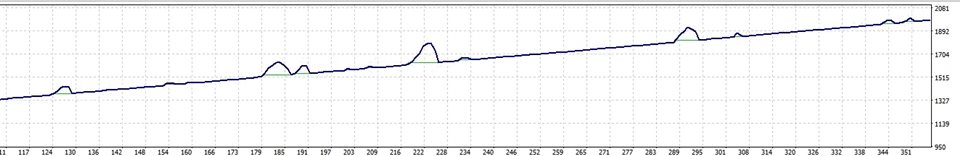

For Live Results with the same EA Powerful Candle click the link below for signal copying and see the live trades as well.

https://www.mql5.com/en/signals/2073310

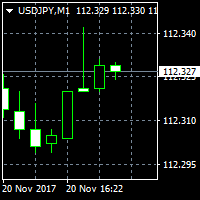

The "Powerful Candle Strategy" is a trading strategy commonly used in financial markets, especially in the realm of technical analysis. This strategy relies on identifying specific candlestick patterns to make trading decisions. Candlestick patterns are graphical representations of price movements in a given time frame, typically on a price chart.

Here's a basic overview of a Powerful Candle Strategy:

-

Understanding Candlestick Patterns: To implement this strategy, you first need to have a good grasp of various candlestick patterns. Some common ones include:

- Doji: This pattern suggests indecision in the market and can signal potential reversals.

- Bullish Engulfing: A bullish reversal pattern where a small bearish candle is followed by a larger bullish candle.

- Bearish Engulfing: A bearish reversal pattern where a small bullish candle is followed by a larger bearish candle.

- Hammer: A bullish reversal pattern with a small body and a long lower shadow.

- Shooting Star: A bearish reversal pattern with a small body and a long upper shadow.

-

Selecting a Timeframe: Choose a specific timeframe for your analysis. Candlestick patterns can vary in significance depending on whether you're looking at a daily chart, hourly chart, or another timeframe.

-

Identifying Patterns: Continuously monitor the price chart for potential candlestick patterns. When you spot a pattern that meets the criteria of your strategy, take note of it.

-

Confirmation: It's crucial not to rely solely on candlestick patterns for trading decisions. Look for confirmation from other technical indicators or analysis methods like trendlines, support and resistance levels, and volume analysis.

-

Entry and Exit Points: Determine your entry and exit points based on the candlestick pattern. For example, if you see a bullish engulfing pattern, you might consider entering a long position. Conversely, a bearish engulfing pattern might signal a short position.

-

Risk Management: Always have a risk management plan in place. Set stop-loss orders to limit potential losses and consider setting profit targets to take profits when the market moves in your favor.

-

Continuous Monitoring: Keep an eye on the market after entering a trade. You may need to adjust your strategy based on how the price evolves.

-

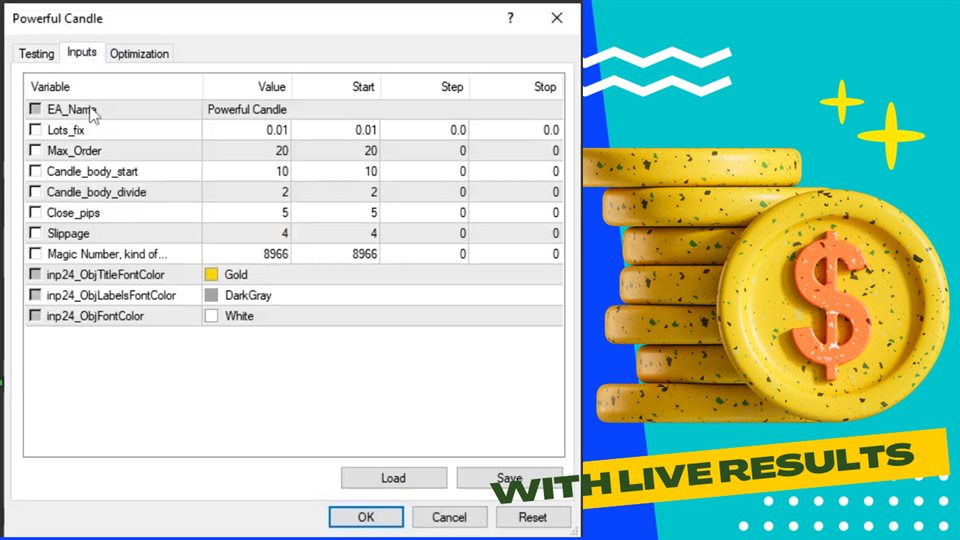

Backtesting: Before using this strategy with real money, it's advisable to backtest it on historical data to assess its effectiveness.

-

Emotional Control: Avoid making impulsive decisions based solely on candlestick patterns. Stick to your trading plan and don't let emotions dictate your actions.

-

Education and Practice: Finally, remember that mastering any trading strategy takes time and practice. Continuously educate yourself about candlestick patterns and refine your skills.

Please note that while candlestick patterns can be a valuable tool in trading, they are not foolproof. Markets can be unpredictable, and it's essential to use this strategy in conjunction with proper risk management and a comprehensive trading plan. Additionally, this strategy may not be suitable for all traders, and it's essential to assess whether it aligns with your risk tolerance and financial goals.